The software company’s shares have only been outshined by 19 other U.S. stocks — including Nvidia — since 2020

MicroStrategy Inc.’s stock has been one of the best-performing equities in the U.S. since it adopted bitcoin as its primary treasury-reserve asset four years ago, according to bitcoin financial-services firm NYDIG.

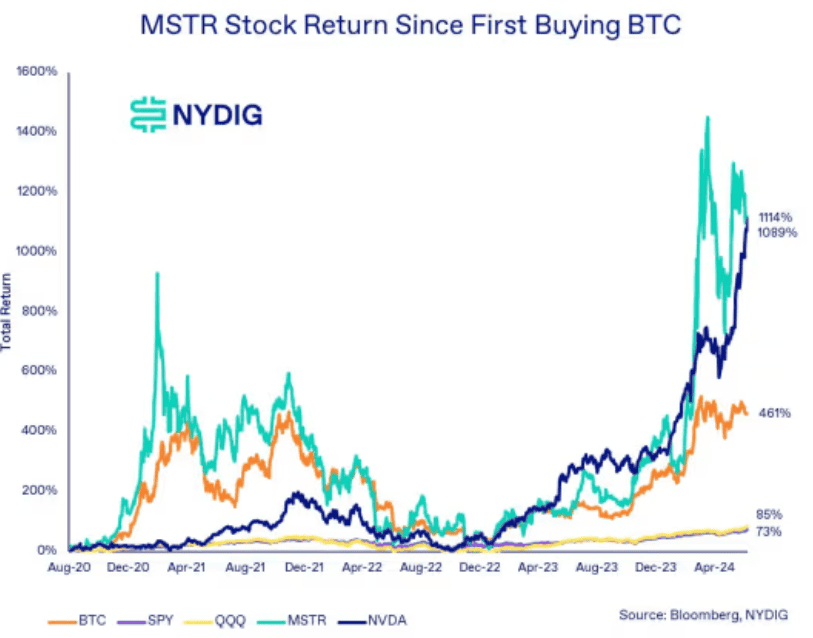

The business-intelligence software company MSTR, +1.25% has recorded a 1,089% cumulative return since Aug. 10, 2020, the day before MicroStrategy announced its first bitcoin purchase, wrote Greg Cipolaro, global head of research at NYDIG, in a Friday note.

On Thursday, MicroStrategy disclosed that it had purchased an additional $786 million worth of bitcoin, taking its total holdings of the asset to nearly $15 billion.

Since pursuing its bitcoin strategy, the company’s stock has only been outshined by 19 other equities in the FT Wilshire 5000 index XX:W5000, which tracks the performance of all stocks that are actively traded in the U.S., according to Cipolaro. MicroStrategy shares have trailed only slightly behind those of artificial-intelligence chip maker Nvidia Corp. NVDA, -3.22%, which saw a 1,114% rise over the same period.

Still, MicroStrategy has outperformed major indexes including the large-cap benchmark S&P 500 SPX and the tech-heavy Nasdaq 100 NDX, Cipolaro noted. The company’s stock has also outperformed bitcoin BTCUSD, 0.15%, which has seen a 461% increase since 2020 and a 52% increase so far this year, according to NYDIG and Dow Jones Market Data.

“The secret behind MSTR’s stock performance has undoubtedly been its bitcoin acquisition (treasury reserve) strategy,” Cipolaro wrote, citing how the revenue of the company’s core software business has been mostly unchanged since 2020.

MicroStrategy could be seen as a leveraged bitcoin vehicle, as it has issued $4.4 billion in debt since 2020 and purchased 226,331 bitcoins, valued at about $14.7 billion. Those moves have made MicroStrategy the largest corporate holder of bitcoin.

The company’s stock has continued to show strength even after spot bitcoin exchange-traded funds were launched in the U.S. in January, which has reduced the value of owning stock in public companies with substantial bitcoin holdings, noted Cipolaro.

MicroStrategy’s shares ended the week 0.8% lower at $1,483.76, according to Dow Jones Market Data.