Celestica Inc. (NYSE:CLS – Get Free Report) TSE: CLS’s stock price traded up 1.3% during mid-day trading on Thursday . The company traded as high as $56.90 and last traded at $55.59. 683,521 shares were traded during mid-day trading, a decline of 70% from the average session volume of 2,287,040 shares. The stock had previously closed at $54.89.

Wall Street Analyst Weigh In

CLS has been the topic of several recent research reports. Fox Advisors began coverage on Celestica in a report on Wednesday, May 15th. They set an “overweight” rating and a $60.00 target price on the stock. StockNews.com lowered Celestica from a “buy” rating to a “hold” rating in a report on Friday, May 24th. BMO Capital Markets lifted their price target on shares of Celestica from $37.00 to $48.00 and gave the company an “outperform” rating in a research report on Monday, April 22nd. Canaccord Genuity Group boosted their price objective on shares of Celestica from $48.00 to $53.00 and gave the stock a “buy” rating in a research note on Friday, April 26th. Finally, CIBC raised their target price on shares of Celestica from $49.00 to $58.00 and gave the company a “neutral” rating in a research note on Monday, May 27th. Three investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of “Moderate Buy” and a consensus price target of $45.56.

Celestica Stock Performance

The company has a current ratio of 1.42, a quick ratio of 0.78 and a debt-to-equity ratio of 0.45. The firm’s fifty day moving average price is $49.50 and its 200-day moving average price is $40.43. The company has a market cap of $6.74 billion, a P/E ratio of 20.74 and a beta of 2.28.

Celestica (NYSE:CLS – Get Free Report) TSE: CLS last issued its quarterly earnings results on Wednesday, April 24th. The technology company reported $0.66 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.64 by $0.02. Celestica had a return on equity of 18.25% and a net margin of 3.86%. The firm had revenue of $2.21 billion for the quarter, compared to analyst estimates of $2.10 billion. As a group, research analysts forecast that Celestica Inc. will post 2.87 EPS for the current fiscal year.

Institutional Investors Weigh In On Celestica

A number of institutional investors have recently bought and sold shares of CLS. Byrne Asset Management LLC lifted its holdings in shares of Celestica by 78.6% during the 1st quarter. Byrne Asset Management LLC now owns 1,250 shares of the technology company’s stock worth $56,000 after acquiring an additional 550 shares during the period. Clearstead Advisors LLC bought a new position in Celestica during the third quarter worth about $32,000. UMB Bank n.a. bought a new position in Celestica during the first quarter worth about $64,000. Principal Securities Inc. acquired a new stake in Celestica during the fourth quarter valued at approximately $42,000. Finally, DekaBank Deutsche Girozentrale bought a new stake in shares of Celestica in the 1st quarter valued at approximately $110,000. Institutional investors and hedge funds own 67.38% of the company’s stock.

Celestica Company Profile

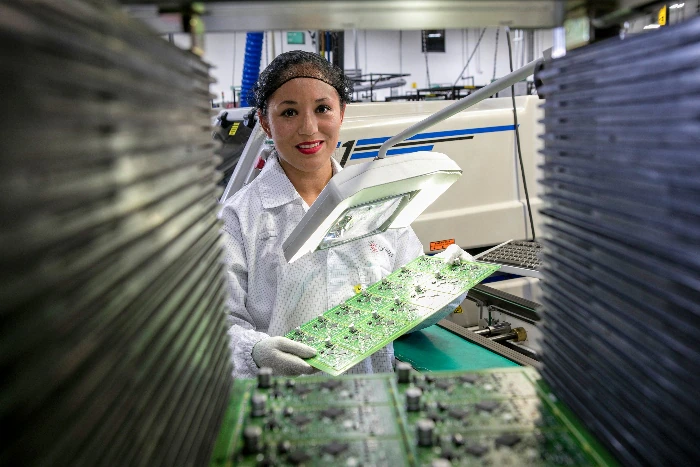

Celestica Inc provides supply chain solutions in North America, Europe, and Asia. It operates through two segments: Advanced Technology Solutions, and Connectivity & Cloud Solutions. The company offers a range of product manufacturing and related supply chain services, including design and development, new product introduction, engineering services, component sourcing, electronics manufacturing and assembly, testing, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, asset management, product licensing, and after-market repair and return services.