Stock Markets

The main stock indexes ended mixed for this week with a slight gain at the end of the week. The Dow Jones Industrial Average (DJIA), comprised of 30 stocks, inched up 0.29% for the week, while the broad Total Stock Market Index moved slightly higher over last week’s close by 0.95%. Comparatively, the broad S&P 500 Index gained 1.32% for the week and the technology-tracking Nasdaq Stock Market Composite rose 2.38%. The NYSE Composite, on the contrary, slipped downward by 0.54%. The CBOE Volatility Index (VIX), the indicator of how risky investors perceive the market, is down by 5.42%.

The market activity showed that investors appeared to weigh contradictory data from the busy economic calendar this week. The S&P 500 Index and technology-heavy Nasdaq Composite reached record intraday highs, however, the smaller-cap indexes pulled back. Growth stocks outperformed value shares by the widest margin since early in the year as falling longer-term interest rates increased the notional value of future earnings. Some market participants felt that some of the market activity seems to emanate from the fast-growing artificial intelligence (AI) sector. News spread that the U.S. officials have slowed the issuing of licenses to chipmakers for AI chip sales to the Middle East and were opening antitrust investigations into Microsoft and NVIDIA over their dominance of AI.

U.S. Economy

The week began with some negative economic news that appeared to reignite worries among some investors about “stagflation,” where slowing growth coincides with high inflation. The gauge of manufacturing activity of the Institute for Supply Management (ISM), released on Monday, came out at 48,7. Since 50.0 is the border between expansion and contraction, the new reading confirmed that manufacturing activity had fallen further into contraction territory. On Tuesday, further bad news came in the form of the Labor Department report that job openings in April had slumped to their lowest levels (8.059 million) since February 2022. On the contrary, the number of Americans voluntarily leaving their jobs (the so-called quit rate), which is considered by many as a more reliable indicator of the strength of the labor market, exceeded expectations on the upside.

By midweek, the economic news releases had turned optimistic. The ISM’s services jumped to 53.9 in May, well above consensus expectations and reaching its highest level in nine months. The payroll processor ADP report, released on the same day, revealed its tally of private sector job gains, which fell to 152,000, the lowest level in four months. The two reports countered the stagflation narrative with a possible “Goldilocks” scenario of economic growth that was neither too hot (as to hike inflation) nor too cold (as to stall growth) in the perception of many investors. On Friday morning, the Labor Department’s official jobs report appeared to derail the narrative, but only temporarily. Employers added 272,000 jobs in May, well above expectations and the most since the year began, according to the Labor Department report’s broader tally of both private sector and government nonfarm jobs. The market’s reaction to the news may have been moderated by an unexpected rise in the unemployment rate to 4.0%, its highest level since January 2022.

Metals and Mining

In the gold market, black boxes traded only on the headlines rather than looking at the details in the broader landscape, resulting to significant hits on the market last Friday. Gold prices dropped more than 3.5% on a single day resulting in the biggest intra-day sellout since 2020. Analysts anticipate that this renewed selling pressure could see gold possibly testing support at $2.200 per ounce. The cause of the sell-down is that data from the People’s Bank of China revealed that the PBOC did not buy any gold last month. This led investors to surmise that China’s central bank will never buy another ounce of gold again, based on the reaction in the gold market. This appears to be ill-based, given that China has been buying gold for the last 18 months and a pause at this point is only to be expected.

Over the just-concluded trading week, the spot prices of precious metals underwent a technical correction. Gold dipped by 1.44%, from its close last week at $2,327.33 to its close this week at $2,293.78 per troy ounce. Silver, which finished last week at $30.41, closed this week at $29.15 per troy ounce to register a loss of 4.14%. Platinum ended this week at $967.81 per troy ounce, 6.80% lower than last week’s closing price of $1,038.45. Palladium, which was last priced one week ago at $916.86, closed this week at $915.01 per troy ounce for a slight loss of 0.20%. The three-month LME prices of industrial metals also ended lower this week. Copper ended at $9,762.50 per metric ton, lower by 2.76% than the previous weekly close $10,040.00. Aluminum closed this week at $2,578.00 per metric ton, down by 2.81% from last week’s close of $2,652.50. Zinc ended this week at $2,767.00 per metric ton, 6.82% lower than last week’s closing price of $2,969.50. Tin closed this week at $31,452.00 per metric ton, down by 4.81% than the metal’s previous weekly close of $33,042.00.

Energy and Oil

After the Monday sell-off that caused WTI to plunge to $73 per barrel, the oil markets got their breach back. Saudi Arabia and Russia insisted that the gradual return of crude to the markets should be regarded as a positive signal rather than a bearish sign. Some macro upside to prices was provided by the interest rate cut of the European Central Bank, which has the effect of raising hopes for a potential Federal Reserve interest rate cut in September. In the U.S. market, the country could expedite the rate of replenishing the Strategic Petroleum Reserve, according to Energy Secretary Jennifer Granholm. This is timely as underground storage sites return from year-long maintenance and WTI remains below $79 per barrel. In the international scene, the energy ministers of Saudi Arabia, the UAE, and Russia defended the extension of OPEC+ production cuts in the third quarter. They lashed out at Goldman Sachs for calling the new deal “bearish” and said that, if needed, they could pause or reverse policy.

Natural Gas

For the report week from Wednesday, May 29, to Wednesday, June 5, 2024, the Henry Hub spot price rose by $0.01 from $2.21 per million British thermal units (MMBtu) to $2.22/MMBtu. Concerning Henry Hub futures, the July 2024 NYMEX contract price increased to $2.757/MMBtu, up by $0.09 through the week. The price of the 12-month strip averaging July 2024 through June 2025 futures contracts also climbed by $0.09 to $3.223/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.02 to a weekly average of $11.98/MMBtu. At the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, the price of natural gas futures for delivery increased by $0.14 to a weekly average of $11.00/MMBtu. In the week last year corresponding to this report week (for the week from May 31 to June 7, 2023), the prices were $9.25 /MMBtu in East Asia and $7.95/MMBtu at the TTF.

World Markets

European stocks moved higher for the week. The gains were achieved on the back of the interest rate cut implemented by the European Central Bank (ECB) on Thursday for the first time in five years. The pan-European STOXX Europe 600 Index closed higher by 1.04% in local currency terms. Major stock indexes recorded gains, with Italy’s FTSE MIB rising by 0.49%, Germany’s DAX gaining by 0.32%, and France’s CAC 40 Index tacking on 0.11%. The UK’s FTSE 100, on the other hand, descended by 0.36%. In line with expectations, the ECB reduced its deposit rate by a quarter point to 3.75%, but it stopped short of signaling that more rate cuts could follow. ECB President Christine Lagarde stated in a press conference that the central bank is not committing “to a particular rate path, despite the progress over recent quarters” and inflation will likely stay above target well into 1925. According to ECB forecasts, inflation will likely average 2.5% in 2024, an upward revision over the previous estimate of 2.3%. The average inflation estimated for 2025 was also revised upward from 2.0% to 2.2%, although the ECB’s average inflation estimate of 1.9% for 2026 remained unchanged.

Japan’s stock market saw generally mixed returns for the week. The Nikkei 225 Index ended 0.5% higher week-over-week, while the broader TOPIX Index fell by 0.6%. A headwind for Japanese exporters was posed by a tentative rally in the yen that strengthened to around JP 155 against the U.S. dollar from the prior week’s JPY 157. However, the country’s services sector continued to expand at a rapid pace in May as shown by the latest purchasing managers’ index data, further bolstering sentiment, Signs were also evident that private consumption could cease being a drag on growth as household spending increased year-on-year in April, the first increase in 14 months. In the fixed-income markets, the yield on the 10-year Japanese Government Bond (JGB) tracked U.S. Treasury yields lower as they fell from 1.07% at the end of the previous week to 0.98% at the end of this week. As a further shift away from its highly stimulative policy stance, the Bank of Japan (BoJ) is speculated to taper its bond buying at its next monetary policy meeting on June 13-14, allowing markets to drive rates more. While the BoJ is expected to keep interest rates unchanged at its June meeting, it could keep taking incremental tightening steps, based on the improving global growth and Japan’s inflation trends.

Chinese stocks retreated during the week despite data showing that the property sector may be improving. The Shanghai Composite Index descended by 1.15%, while the blue-chip CSI 300 Index declined by 0.16%. The Hong Kong benchmark Hang Seng Index climbed by 1.59%. According to China Real Estate Information Corporation, the value of new home sales by China’s top 100 developers rose by 11.5% in May, up from April’s 3.4% increase. In May, new home sales slumped by 33.6% from a year ago but eased from April’s 45% drop. The data lifted hopes that China’s four-hear-long property market downturn may begin to recover. In May, Beijing announced a rescue package to stabilize the struggling sector. Nevertheless, some analysts remain skeptical regarding the effectiveness of the measures, whether they will result in a sustainable housing recovery amid weak domestic demand. The private Caixin/S&P Global survey of manufacturing activity moved up to 51.7 in May from 51.4 in April, its seventh monthly expansion. The Caixin services purchasing managers’ index registered an above-consensus 54 in May, up from April’s 52.5. The private Caixin survey focuses on smaller and export-oriented firms. For this release, the results contrasted with official data the prior week showing that manufacturing activity unexpectedly contracted in May.

The Week Ahead

Among the import economic releases scheduled for the coming week are the CPI and PPI inflation data, import prices, and the FOMC meeting,

Key Topics to Watch

- NFIB optimism index for May

- Consumer price index for May

- CPI year over year

- Core CPI for May

- Core CPI year over year

- FOMC interest-rate decision

- Monthly U.S. federal budget for May

- Fed Chair Jerome Powell press conference (June 12)

- Initial jobless claims for June 8

- Producer price index for May

- PPI year over year

- Core PPI for May

- Core PPI year over year

- Import price index for May

- Import price index minus fuel for May

- Consumer sentiment (prelim) for June

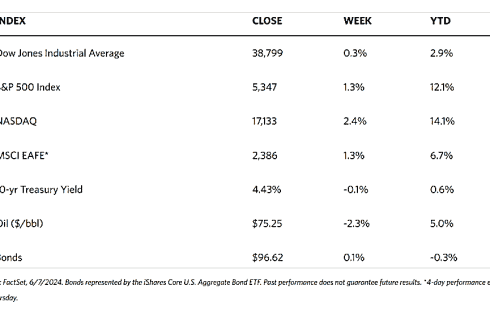

Markets Index Wrap-Up