Stock Markets

Most stock indexes have fallen over the week, just ahead of the protracted Memorial Day weekend. The 30-stock Dow Jones Industrial Average (DJIA) came down by 2.33% while the Total Stock Market Index slipped by 0.15%. The NYSE Composite is also down by 1.51%. The broader major indexes have managed to chalk up a positive performance. The S&P 500 Index managed a modest gain of 0.03% despite the Mid Cap 400, Small Cap 600, and Super Composite 1500 components of the S&P 500 all ending down. The technology tracking Nasdaq Stock Market Composite also climbed, by 1.41%. The measure of investor risk perception, the CBOE Volatility Index (VIX), is only slightly down by 0.50%.

The different indexes exhibited widely divergent results for the week. This is the DJIA’s biggest weekly loss (-2.33%) since early April; on the other hand, the Nasdaq Composite continued to hit new record highs, while the S&P 500 Index was relatively flat. The Nasdaq’s stellar performance was due to the gain in shares of artificial intelligence chipmaker NVIDIA which is now the third-largest company in the S&P 500 by market capitalization, after Apple and Microsoft. Almost 90% of the S&P 500 counters closed lower on Thursday seemingly due to data suggesting a rebound in growth in May that, in turn, led to speculation that the Federal Reserve would move interest rate cuts further back. The uncertainties in the market appeared to have caused investors to exit their positions to avoid added risks that may materialize over the long holiday weekend.

U.S. Economy

According to the S&P Global report, its composite index of business activity jumped by a higher-than-expected 54.4 in May, its highest level in just over two years. This gave rise to concerns that the economy may be heating up, causing inflation to once more take off and force the Federal Reserve to postpone its planned interest rate cuts. The acceleration was more notable in the much larger services sector. Investors appeared to be especially concerned by the inflation data in the report. The notable increase in selling price inflation continues to signal modestly above target inflation, and the main impetus comes from manufacturing rather than services.

The rates of inflation for costs and selling prices are observably elevated, suggesting that the final stretch down to the 2% target will remain elusive. Friday’s release provides further evidence that the pace of economic growth might pick up in the second quarter. The Commerce Department noted that the indicator of business capital investment, namely the orders for durable goods excluding the volatile aircraft and defense orders, rose faster than expected at 0.3% in April after remaining almost unchanged over the first quarter. On the other hand, the sales of both existing and new homes in April, which were released on Wednesday and Thursday, respectively, failed to meet expectations.

Metals and Mining

A generational shift is taking over the marketplace, where central bank purchases are replacing investment demand as one of the most significant price drivers. Simultaneously, market influence from the East is overtaking the West as demand arises more from Asian buyers, in particular Chinese retail investors, who have a newfound appetite for gold. The shifting dynamics were highlighted in Incrementum AG’s annual comprehensive “In Gold We Trust” report. The report findings underscore the end of the Great Moderation (a period characterized by low inflation) and the onset of persistent inflation volatility. The new economic milieu strengthens gold’s role as a hedge against inflation and economic instability. The report reveals that central banks and emerging market economies are embracing new strategies that include gold as an important monetary asset, in contrast to the strategies of the West which focuses on monetary policy and opportunity costs of holding gold.

The spot prices of precious metals ended down for the week in what could be seen as a technical correction, given their recent stellar performance. Gold came down by 3.37% from its close last week at $2,415.22 to its close this week at $2,333.83 per troy ounce. Silver descended by 3.91% from its last trade one week ago at $31.49 to its last trade this week at $30.26 per troy ounce. Platinum declined by 5.28% from its closing price last week of $1,085.41 to its closing price this week at $1,028.15 per troy ounce. Palladium ended 4.30% lower from its price last week at $1,012.00 to its closing price this week of $968.44. The three-month LME prices of the industrial metals ended mixed for the week. Copper, which ended last week at $10,424.00, closed this week 0.96% lower to end at $10,324.00 per metric ton. Aluminum rose by 2.92% from its close last week at $2,586.50 to end this week at $2,662.00 per metric ton. Zinc rose by 3.28% from last week’s closing price of $2,960.00 to end this week at $3,057.00 per metric ton. Tin descended by 1.48% from its previous weekly close of $33,729.00 to this week’s close of $33,229.00 per metric ton.

Energy and Oil

For four consecutive days, oil prices have been declining as they were driven lower by the Federal Reserve’s reservation in committing to interest rate cuts this year, together with weak physical sentiment in the markets. Backwardation in both WTI and ICE Brent dropped to the lowest level seen this year. Some upside may be provided next week by notably improving U.S. gasoline demand and the OPEC+ meeting. However, Brent is unlikely to break out from its current trading range of $80-85 per barrel. In the meantime, in an effort by the White House to ease gasoline concerns, the U.S. Department of Energy is expected to release almost one million barrels of gasoline from the Northeast Gasoline Supply Reserve. The latter was created after Superstorm Sandy in 2014 and will soon be shut as part of President Biden’s March government funding package.

Natural Gas

For the report week from Wednesday, May 15 to Wednesday, May 22, 2024, the Henry Hub spot price advanced by $0.36 from $2.15 per million British thermal units (MMBtu) at the start of the report week to $2.51/MMBtu at the week’s end. This is the highest price at the Henry Hub since January of the current year and two cents lower than the 2023 annual average. Concerning the Henry Hub futures, the price of the June 2024 NYMEX contract increased by $0.426, from $2.416/MMBtu at the start of the week to $2.842/MMBtu at the week’s end. The price of the 12-month strip averaging June 2024 through May 2025 futures contracts rose by $0.277 to $3.326/MMBtu.

International natural gas futures prices rose this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia climbed by $1.04/MMBtu to a weekly average of $11.50/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.69 to a weekly average of $10.20/MMBtu. In the week last year corresponding to this report week (from May 17 to May 24, 2023), the prices were $9.73/MMBtu in East Asia and $9.27/MMBtu at the TTF.

World Markets

European stocks ended lower for the week, with the pan-European STOXX Europe 600 Index ending lower by 0.45%. Investors have expressed uncertainty about the pace of potential interest rate cuts this year. The major stock indexes in the region ended the week mixed. Germany’s DAX moved sideways, France’s CAC 40 Index slid by 0,89%, and Italy’s FTSE MIB declined by 3.57%. The UK’s FTSE 100 Index lost by 1.22%. The President of the European Central Bank (ECB) Christine Lagarde mentioned in an interview that there was a “strong likelihood” that the central bank would reduce interest rates in June, although she followed this up with “No predicament, no prescription, no commitment.” The decision to reduce rates depends upon whether the data reinforces the confidence that the 2% inflation rate target may be achieved in the medium term. On the economy, the first estimate of the eurozone composite purchasing managers’ index (PMI) for May registered a 12-month high of 52.3, up from 51.7 in April and therefore indicating expanding activity. While services remained firmly expansionary, manufacturing PMI remained in contractionary levels albeit improving slightly. Negotiated wages in the first quarter increased by 4.7% year-over-year, up from 4.5% in the last quarter of 2023.

Japanese equities descended for the week. The Nikkei 225 Index fell by 0.36% while the broader TOPIX Index declined modestly. Earlier in the week, stocks were lifted by positive economic data releases and a glowing earnings update from giant U.S. chip manufacturer NVIDIA which helped support Japanese tech stocks. All gains were lost on Friday, however, due to Japanese indexes tracking Wall Street’s plunge after U.S. data shot down hopes for a U.S. interest rate cut anytime soon. For the Japanese bond markets, it was a notable week as 10-year government bond yields reached 1.0% for the first time in 11 years. Economic data released during the week indicated that Japanese manufacturing activity recovered in May and expanded for the first time in more than a year. The manufacturing PMI climbed up from 49.6 in April to 50.5 this month, crossing the 50.0 borderline from contraction to expansion. Conversely, the services PMI remained in expansion territory despite easing slightly from 54.3 in April to 53.6 in May. Regarding currencies, the Bank of Japan adopted a more hawkish tone in recent weeks to help jolt the yen from its prolonged slump. The yen is currently trading around 24-y/741ar lows and investors fear that this will undermine emerging Japanese inflation and the prospect of any wage increases. The yen closed softer for the week at around JPY 157 versus the USD.

Chinese stocks fell as optimism about Beijing’s latest measures to support its ailing property sector was offset by concerns that rates would remain elevated in the U.S. The Shanghai Composite Index came down by 2.07% while the blue-chip CSI 300 declined by 2.08%. The Hong Kong benchmark Hang Seng Index lost by 4.83%. A week ago, the People’s Bank of China (PBOC) announced an unprecedented rescue package for the languishing property sector as data showed no improvement in China’s housing crisis. One of the measures was a re-lending program that would extend RMB 300 billion in low-cost funds to a select group of state-owned banks to lend to local state-owned entities for buying unsold homes. The measure removes the nationwide floor level of mortgage rates and lowers the minimum down payment ratio for home purchasers. Most investors welcomed the plan, but some remained doubtful as to whether the measure will arrest the property slump which continues to remain a major factor weighing down on China’s economy. Regarding monetary policy, the central bank is expected to continue to loosen policy this year and possibly reduce its reserve requirement again following the surprise cut in January aimed at spurring demand.

The Week Ahead

Among the important economic releases scheduled for this week are the PCE inflation report, the retail and wholesale inventories release, and an assessment of consumer confidence for May.

Key Topics to Watch

- Cleveland Fed President Loretta Mester and Fed Gov. Michelle Bowman speak in Japan (May 28)

- S&P Case-Shiller home price index (20 cities) for March

- Minneapolis Fed President Neel Kashkari speaks (May 28)

- Consumer confidence for May

- Fed Gov. Lisa Cook and San Francisco Fed President Mary Daly speak (Mau 28)

- New York Fed President John Williams speaks (May 29)

- Fed Beige Book

- Atlanta Fed President Raphael Bostic speaks (May 29)

- Initial jobless claims for May 25

- GDP (first revision) for the First Quarter

- Advanced U.S. trade balance in goods for April

- Advanced retail inventories for April

- Advanced wholesale inventories for April

- Pending home sales for April

- New York Fed President John Williams speaks (May 30)

- Dallas Fed President Lorie Logan speaks (May 30)

- Personal income for April

- Personal spending for April

- PCE index for April

- PCE (year-over-year)

- Core PCE index for April

- Core PCE (year-over-year)

- Chicago Business Barometer (PMI) for May

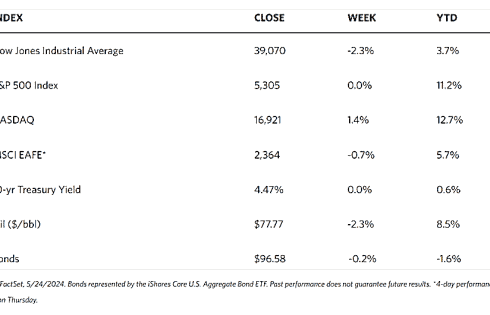

Markets Index Wrap-Up