Israeli seizure of Gaza side of Rafah border crossing fails to generate haven demand

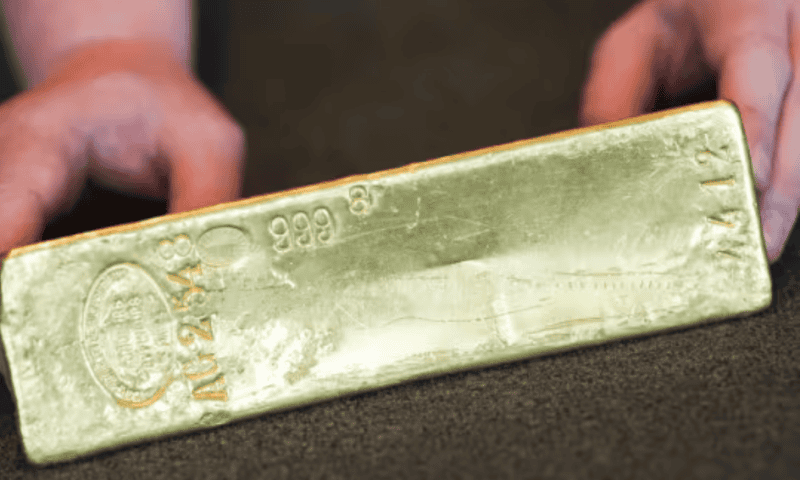

Gold prices settled with a loss on Tuesday, a day after posting their highest finish in a week, though prospects for a rally remain as traders continue to monitor developments in the Middle East.

“Gold is holding within the recent range as Israel continues to threaten a full-scale assault on Rafah, while ceasefire negotiations continue,” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

The Israeli military seized control of the Gaza Strip side of the Rafah border crossing with Egypt, the Associated Press reported Tuesday.

On Tuesday, gold for June delivery GC00, -0.31% GCM24, -0.31% fell by $7, or 0.3%, to settle at $2,324.20 an ounce on Comex. Prices for the most-active contract on Monday gained about 1% to settle at $2,331.20, the highest since April 19, according to FactSet data.

If there’s a full-scale Israeli assault on Rafah, gold will likely challenge short-term resistance around $2,340, Grant told MarketWatch.

A “convincing penetration of this level would signal a breakout of a bullish flag pattern and favor a move to $2,400 initially,” he said, with potential for a retest of record highs above $2,340.

Gold futures, based on the most-active contract, settled at an all-time record high of $2,413.80 on April 19, according to FactSet data.

On the other hand, if Israel holds off, and participates in ceasefire negotiations, Grant said he sees “scope for a retest of last week’s low at $2,277.34, with potential to challenge the 50-day moving average at $2,240.37.

For now, gold remains in a “corrective/consolidative stance”, having set a four-week low on Friday, he said. Gold futures traded as low as $2,285.20 on Friday, the lowest since intraday level since April 1.