AST SpaceMobile, Inc. (NASDAQ:ASTS – Get Free Report) was the target of a large growth in short interest during the month of April. As of April 15th, there was short interest totalling 31,530,000 shares, a growth of 14.2% from the March 31st total of 27,620,000 shares. Currently, 27.9% of the shares of the company are short sold. Based on an average daily volume of 3,820,000 shares, the short-interest ratio is currently 8.3 days.

Analyst Ratings Changes

Several research firms have commented on ASTS. Deutsche Bank Aktiengesellschaft reduced their price objective on AST SpaceMobile from $23.00 to $19.00 and set a “buy” rating for the company in a research note on Wednesday, April 3rd. Scotiabank reduced their price objective on AST SpaceMobile from $7.50 to $7.40 and set a “sector outperform” rating for the company in a research note on Tuesday, April 2nd. Finally, UBS Group began coverage on AST SpaceMobile in a research note on Friday, March 8th. They set a “buy” rating and a $7.00 price objective for the company.

Institutional Investors Weigh In On AST SpaceMobile

A number of institutional investors and hedge funds have recently modified their holdings of ASTS. Summit Trail Advisors LLC purchased a new stake in AST SpaceMobile in the 1st quarter valued at approximately $47,000. Accordant Advisory Group Inc purchased a new stake in AST SpaceMobile in the 1st quarter valued at approximately $463,000. PNC Financial Services Group Inc. lifted its stake in AST SpaceMobile by 319.0% in the 4th quarter. PNC Financial Services Group Inc. now owns 163,296 shares of the company’s stock valued at $985,000 after buying an additional 124,322 shares in the last quarter. Virtu Financial LLC purchased a new stake in AST SpaceMobile in the 4th quarter valued at approximately $259,000. Finally, Broad Run Investment Management LLC lifted its stake in AST SpaceMobile by 74.8% in the 4th quarter. Broad Run Investment Management LLC now owns 3,962,853 shares of the company’s stock valued at $23,896,000 after buying an additional 1,695,805 shares in the last quarter. Institutional investors and hedge funds own 60.95% of the company’s stock.

AST SpaceMobile Stock Performance

NASDAQ ASTS traded up $0.10 on Monday, hitting $2.33. 1,832,464 shares of the company’s stock were exchanged, compared to its average volume of 4,224,042. The company has a debt-to-equity ratio of 0.28, a current ratio of 2.31 and a quick ratio of 2.31. The firm’s 50-day moving average price is $2.70 and its two-hundred day moving average price is $3.66. AST SpaceMobile has a fifty-two week low of $1.97 and a fifty-two week high of $7.10. The firm has a market cap of $596.57 million, a price-to-earnings ratio of -2.12 and a beta of 0.87.

AST SpaceMobile (NASDAQ:ASTS – Get Free Report) last released its earnings results on Monday, April 1st. The company reported ($0.35) earnings per share (EPS) for the quarter. On average, research analysts expect that AST SpaceMobile will post -0.62 EPS for the current year.

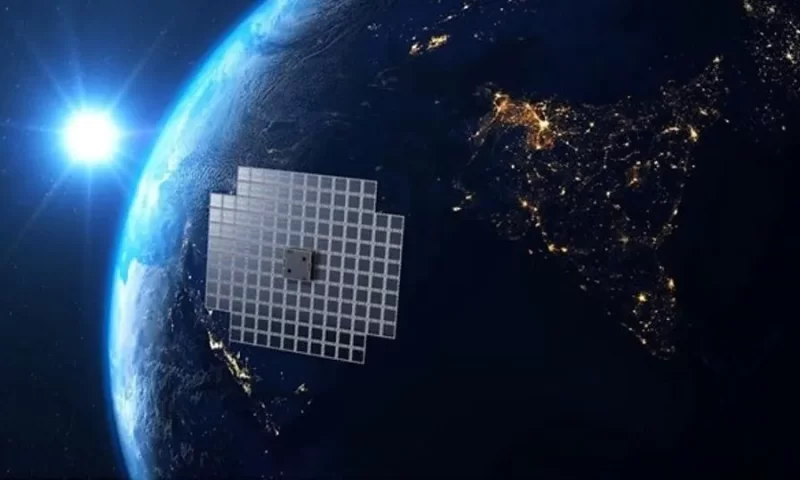

AST SpaceMobile Company Profile

AST SpaceMobile, Inc, together with its subsidiaries, develops and provides access to a space-based cellular broadband network for smartphones in the United States. Its SpaceMobile service provides cellular broadband services to end-users who are out of terrestrial cellular coverage. The company was founded in 2017 and is headquartered in Midland, Texas.