Tech was a ‘big drag’ on the U.S. stock market last week, says Bespoke

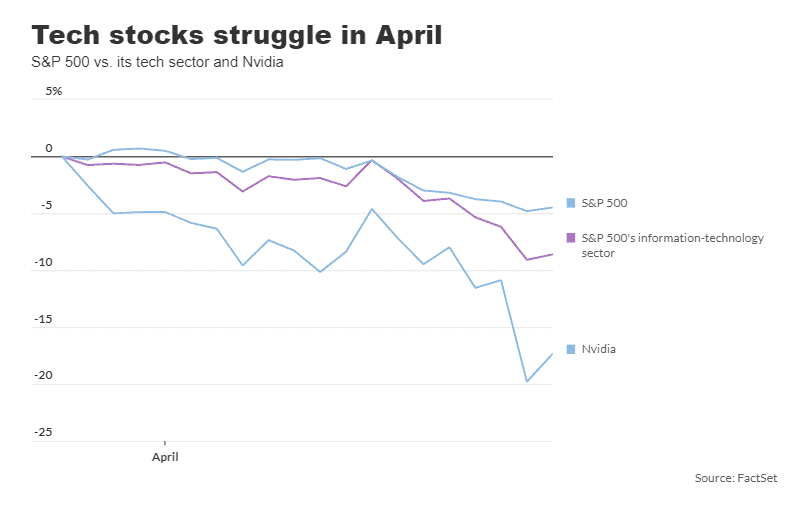

Technology stocks were broadly showing signs of “breaking down,” as the sector struggles in a slump this month that has deepened significantly, according to Bespoke Investment Group.

The S&P 500’s information-technology sector tumbled 7.3% last week, its biggest weekly drop since the stretch ending March 20, 2020, according to Dow Jones Market Data. Tech is the biggest sector in the S&P 500, which slid 3% last week.

“The big drag was technology,” Bespoke said in a research note emailed Monday.

Megacap tech stock Nvidia Corp. NVDA, +4.35% was rebounding Monday morning from a steep 10% slide on Friday that left the company down 13.6% last week. Friday marked the giant chip maker’s biggest daily drop since March 2020 and its worst week since September 2022, according to Dow Jones Market Data.

Bespoke pointed to an exchange-traded fund, the Technology Select Sector SPDR Fund XLK, to highlight woes in that area of the U.S. stock market. The ETF, with about $62 billion of assets under management, ended Friday with its shares about flat for the year.

The chart above has “clearly started to show signs of breaking down,” said Bespoke. Since the ETF dropped below its 50-day moving average on April 15, “the sector hasn’t been able to come up for air,” the chart shows. “It’s now trading closer to its” 200-day moving average, than its 50-day moving average, Bespoke said.

Big Tech earnings this week

Meanwhile, “there are major tech earnings this week,” said Tom Essaye, founder and president of Sevens Report Research, in a note Monday.

He cited upcoming earnings results from Tesla Inc. TSLA, -3.40%, Facebook parent Meta Platforms Inc. META, +0.14%, Google parent Alphabet Inc. GOOGL, +1.42% and Microsoft Corp. MSFT, +0.46%, which often are referred to as Big Tech stocks. Such stocks include megacap companies in the technology, communication-services and consumer-discretionary sectors, with a collective outsized weighting in the S&P 500.

Tesla will report its first-quarter earnings on April 23 after the U.S. stock market closes, while Meta will release its results after the market’s close on April 24. Quarterly earnings from Alphabet and Microsoft are due out on April 25, also after the market ends its trading session.

U.S. stocks were trading modestly higher around midday Monday, with the S&P 500 SPX up 0.5%, the tech-heavy Nasdaq Composite COMP advancing 0.6% and the Dow Jones Industrial Average DJIA gaining 0.4%.

The S&P 500 was attempting to snap six straight days of declines, its longest losing streak since October 2022, according to Dow Jones Market Data. The S&P 500’s tech sector XX:SP500.45 was up 0.7% in midday trading Monday.