A growing ‘wall of worry’ that U.S. stocks are entering a period of irrational exuberance

To those with short memories, Reddit’s successful initial public offering kindles worries that the U.S. stock market is entering a period of irrational exuberance like it did in 2021.

Seeing signs of exuberance is understandable. Reddit RDDT, -11.30% priced its IPO at the top of the $31-to-$34 range that it had set just one week prior. The stock began trading at $47 per share, and closed its first day as a public company even higher, at $50.44 — 48% above its IPO price.

It’s also understandable why excessive optimism is a source of concern. The stock market historically has produced below-average returns when investors are exuberant, according to a seminal study conducted by Harvard Business School professor Malcolm Baker and New York University finance professor Jeffrey Wurgler.

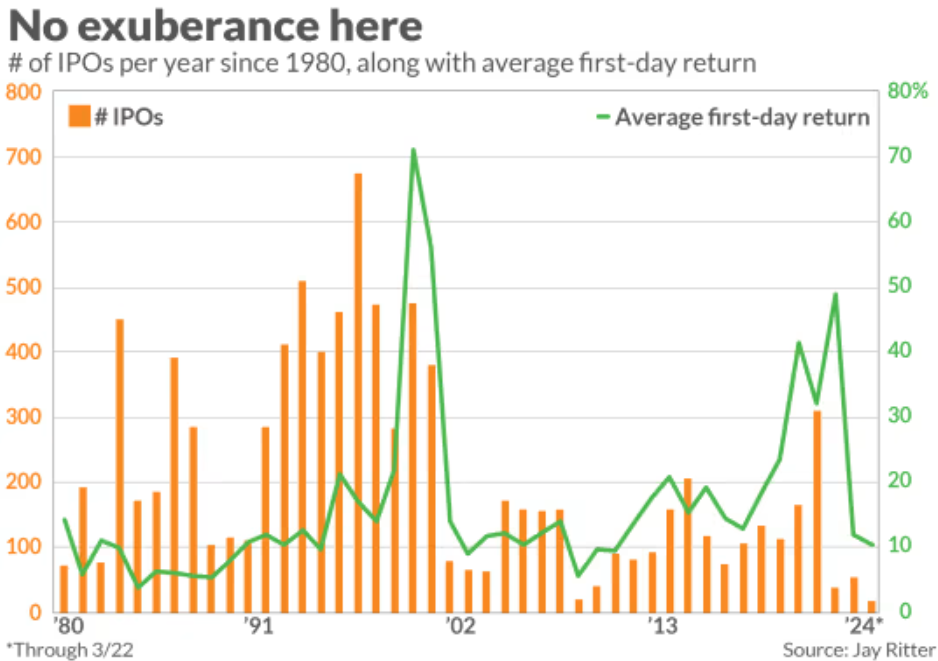

Two sentiment indicators they use to measure exuberance are based on the IPO market: The number of IPOs coming to market (NIPO, in the professors’ shorthand) and the IPOs’ average first-day return (RIPO).

By those measures, recent IPO excitement hardly registers as more than a blip. Neither NIPO nor RIPO are high enough to cause even a mild bout of anxiety.

The chart below provides a 40-year context for the latest NIPO and RIPO numbers, courtesy of data from University of Florida professor Jay Ritter. Take NIPO, for example: Though the number of IPOs shown in the chart for this year so far, even at an annualized rate it would be in 39th place in a ranking of the past 44 years.

The same goes for this year’s RIPO, at 10.4%. If this turns out to be the average for all of 2024, it would be the lowest of any calendar year since 2010, when the market was still struggling to recover from the global financial crisis. In a ranking of calendar years’ RIPOs since 1980, this year would come in at 32nd.

None of this discussion means there aren’t other reasons to worry about stocks, of course. But as far as the potential warning signals from an allegedly overheated IPO market, you can relax.