Angi Inc. (NASDAQ:ANGI – Get Free Report)’s share price shot up 4.3% during mid-day trading on Monday . The stock traded as high as $2.68 and last traded at $2.66. 322,519 shares traded hands during mid-day trading, a decline of 56% from the average session volume of 739,565 shares. The stock had previously closed at $2.55.

Analysts Set New Price Targets

Several equities research analysts recently commented on ANGI shares. Royal Bank of Canada boosted their price target on shares of Angi from $2.25 to $3.25 and gave the company a “sector perform” rating in a research report on Thursday, February 15th. The Goldman Sachs Group lifted their price target on Angi from $3.00 to $3.50 and gave the stock a “buy” rating in a research report on Friday, February 16th. StockNews.com raised shares of Angi from a “hold” rating to a “buy” rating in a report on Thursday, February 15th. Finally, UBS Group lifted their price objective on shares of Angi from $2.60 to $3.00 and gave the company a “neutral” rating in a research note on Thursday, February 15th. Two research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of “Moderate Buy” and a consensus target price of $4.23.

Angi Stock Up 4.3 %

The firm has a fifty day moving average price of $2.58 and a 200 day moving average price of $2.27. The company has a quick ratio of 1.88, a current ratio of 1.88 and a debt-to-equity ratio of 0.47.

Angi (NASDAQ:ANGI – Get Free Report) last announced its quarterly earnings results on Tuesday, February 13th. The technology company reported $0.01 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of ($0.02) by $0.03. Angi had a negative net margin of 2.84% and a negative return on equity of 3.15%. The business had revenue of $300.43 million during the quarter, compared to the consensus estimate of $306.73 million. As a group, research analysts forecast that Angi Inc. will post -0.01 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CTO Kulesh Shanmugasundaram sold 12,000 shares of Angi stock in a transaction that occurred on Thursday, February 1st. The stock was sold at an average price of $2.41, for a total transaction of $28,920.00. Following the completion of the transaction, the chief technology officer now directly owns 39,242 shares in the company, valued at approximately $94,573.22. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 1.90% of the company’s stock.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the company. Mirae Asset Global Investments Co. Ltd. raised its holdings in Angi by 30.6% in the 2nd quarter. Mirae Asset Global Investments Co. Ltd. now owns 235,367 shares of the technology company’s stock valued at $777,000 after acquiring an additional 55,143 shares during the last quarter. FMR LLC increased its stake in Angi by 44.6% in the third quarter. FMR LLC now owns 6,430,138 shares of the technology company’s stock valued at $12,732,000 after purchasing an additional 1,983,031 shares during the last quarter. DAVENPORT & Co LLC purchased a new position in Angi during the third quarter worth about $27,000. Wolverine Asset Management LLC boosted its stake in Angi by 61.8% in the 3rd quarter. Wolverine Asset Management LLC now owns 268,860 shares of the technology company’s stock worth $532,000 after buying an additional 102,653 shares during the last quarter. Finally, Mitsubishi UFJ Trust & Banking Corp grew its holdings in Angi by 76.1% in the 3rd quarter. Mitsubishi UFJ Trust & Banking Corp now owns 136,546 shares of the technology company’s stock valued at $270,000 after buying an additional 59,029 shares during the period. Institutional investors and hedge funds own 12.84% of the company’s stock.

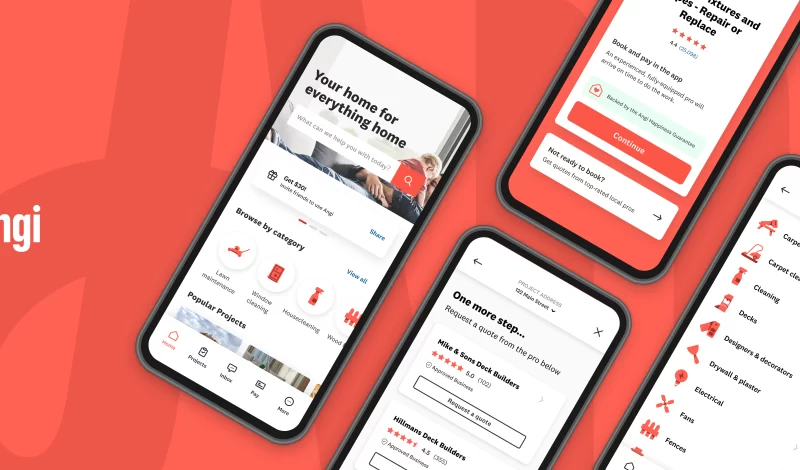

Angi Company Profile

Angi Inc connects home service professionals with consumers in the United States and internationally. The company operates through three segments: Ads and Leads, Services, and International. It provides consumers with tools and resources to help them find local, pre-screened and customer-rated service professionals, matches consumers with independently established home services professionals.