Data from Nomura indicates investors slightly more worried about potential S&P 500 selloff

Options traders are growing more cautious — but only slightly — as the rally in U.S. stocks recently hit a speed bump.

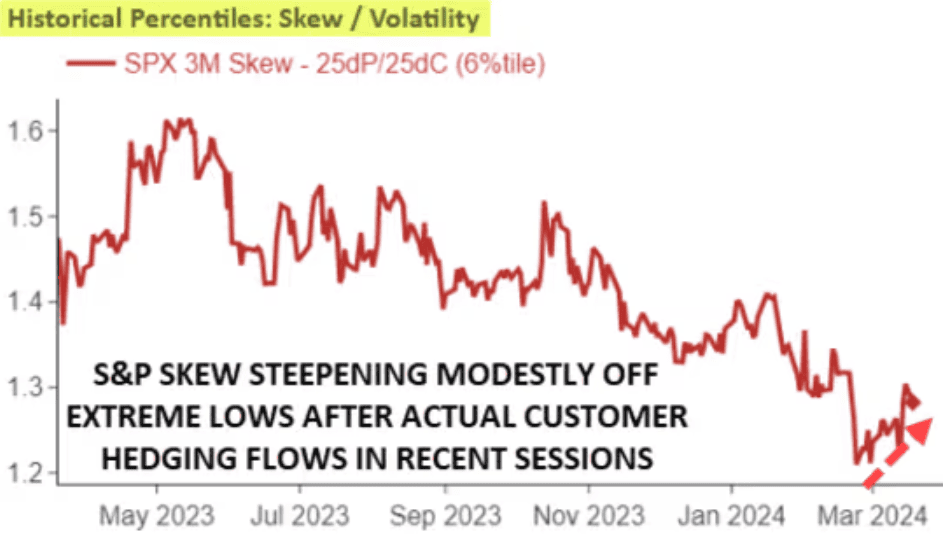

Data from Charlie McElligott, a derivatives strategist at Nomura, highlighted that demand for bearish put options relative to bullish calls tied to the S&P 500 index has risen over the past few weeks, causing a metric called “skew” to shift higher off historically flat levels. It is a sign that traders have grown slightly more apprehensive about the prospect of a selloff in stocks.

But only modestly so, as the shift has caused skew on S&P 500 index options to rise from around its flattest level on record to the 6th percentile relative to history, McElligott said in a note shared with MarketWatch on Tuesday.

In options-market parlance, skew measures demand for put options relative to call options, or demand for out-of-the-money calls or puts vs. contracts that are trading at the money, or closer to it. An options contract is said to be “in the money” if it can be exercised for a profit. When skew is flat or flattening, it means demand for calls is rising relative to demand for puts.

The concept is rooted in the notion that puts typically trade at a premium to calls, since volatility tends to rise more rapidly when stocks fall than when they rise. Puts give the holder the right but not the obligation to sell the underlying asset at a set “strike price” by a certain date. Calls give the holder the right but not the obligation to buy.

Traders, however, have challenged the conventional wisdom this year as stocks have been more volatile on up days than on down days, according to data from Cboe Global Markets, one of the biggest U.S. options exchange operators.

“… [W]e actually saw index hedges being [bought] in recent sessions on this increasing ‘un-ease’ in the market,” McElligott said in written commentary shared with MarketWatch on Tuesday.

A similar pattern has played out in options tied to single stocks and popular index-tracking exchange-traded funds, according to data from Spotgamma, a firm that provides data and analytics on the market for U.S. equity options.

“A month ago there were heavy call skews broadly across tech, including major ETFs (SPY, QQQ, IWM), Mag 7, software, semis, crypto, etc.,” said Brent Kochuba, founder of Spotgamma, in comments emailed to MarketWatch.

The tickers mentioned by Kochuba refer to the SPDR S&P 500 Trust ETF SPY, which tracks the S&P 500, the Invesco QQQ Trust Series 1 QQQ, which tracks the Nasdaq-100, and the iShares Russell 2000 ETF IWM, which tracks the small-cap Russell 2000. The Magnificent Seven, meanwhile, refers to a group of megacap technology stocks that drove the bulk of the S&P 500’s advance last year.

It includes shares of Nvidia Corp. NVDA, +1.07%, Microsoft Corp. MSFT, +0.98%, Apple Inc. AAPL, +1.36%, Meta Platforms Inc. META, -0.15%, Amazon.com Inc. AMZN, +0.81%, Tesla Inc. and Alphabet Inc. GOOGL, -0.44%

More recently, options tied to popular semiconductor stocks and ETFs have started to normalize following Monday evening’s Nvidia event, where the artificial-intelligence darling unveiled its new Blackwell chip.

“Semi stocks were the last sector to maintain a high call skews, and that call skew is now flattening,” Kochuba said.

The options market appears to be having a greater impact on the so-called cash market for shares of stocks as options trading volume has pushed further into record territory this year, according to data from Options Clearing Corp.

Recently, data from derivatives strategists at Goldman Sachs Group showed that volume in options tied to individual shares was set to surpass cash trading volume for the first time since 2021 in March.

U.S. stocks have slowed their ascent recently, with the S&P 500 SPX and Nasdaq Composite COMP logging back-to-back weekly losses on Friday for the first time in nearly five months, FactSet data show. Both indexes have since bounced back, and were trading higher on Tuesday, as was the Dow Jones Industrial Average DJIA.

Investors are waiting to hear from Federal Reserve Chairman Jerome Powell on Wednesday, as the recent rebound in inflationary pressures has stoked suspicions that the Fed might dial back its plans for interest-rate cuts later this year.