‘There has been a lot of uncertainty about the future of the consumer since COVID,’ says Piper Sandler

The S&P 500’s consumer-discretionary sector is one of the worst-performing areas of the U.S stock-market index this year, struggling to keep up with its growthy peers, according to Piper Sandler.

“After a fantastic 2023,” the S&P 500’s technology and communication-services sectors “continue to handedly outperform again in 2024,” Piper Sandler analysts said in a note Monday. But the consumer-discretionary sector has been “left behind” so far this year, they said.

Consumer-discretionary stocks in the S&P 500 are up around 2% this year based on Monday afternoon trading, trailing tech’s more than 11% gain and the communication-services sector’s more than 14% surge year to date, according to FactSet data, at last check.

Consumer discretionary, “one of the most top heavy sectors,” is being weighed down in 2024 by Tesla Inc. TSLA, +6.25% and buoyed by Amazon.com Inc. AMZN, +0.03%, the Piper Sandler note shows. Electric-vehicle maker Tesla and online-shopping giant Amazon are among the megacap stocks that fueled the S&P 500’s strong gains in 2023.

“There has been a lot of uncertainty about the future of the consumer since COVID,” said the Piper Sandler analysts. Within the consumer-discretionary sector, “quality” is leading while “cyclicality” is trailing, with Amazon and Tesla “having very different starts to the year,” they said.

Shares of Amazon are up around 15% in 2024 based on early afternoon trading Monday, while Tesla’s stock has tumbled around 30% over the same stretch, FactSet data show, at last check.

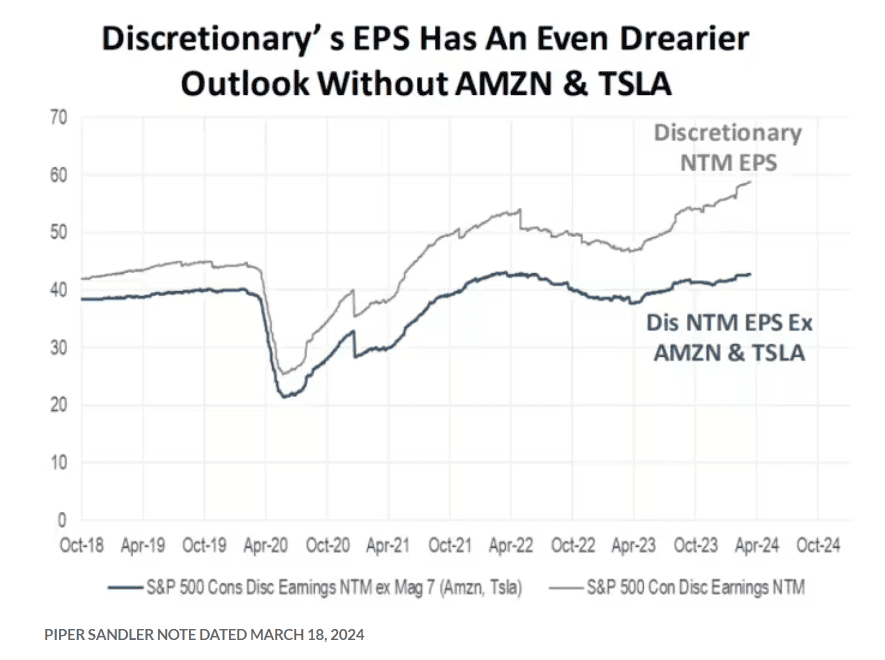

Growth in earnings per share, or EPS, was “extremely strong” in the consumer-discretionary sector in 2024, “but its estimated growth for 2024 is not as impressive to investors,” said the analysts.

A chart in their note showed the sector’s relative uncertainty in EPS, highlighting the dispersion of analysts’ estimates versus the overall market. “It has remained at elevated levels,” they said.

The COVID-19 pandemic and ensuing lockdowns, fiscal stimulus, inflation and work-from-home trend are all “factors that have had an unprecedented impact on consumer patterns and behaviors,” according to the Piper Sandler note.

“Even as we sit here four years past the March 2020 shutdown, there remains a lot of uncertainty about what lies ahead for the consumer,” said the analysts.

They found that the consumer-discretionary sector’s EPS over the next 12 months has an “even drearier outlook” without Amazon and Tesla.

Heavyweight problem for sector ETFs

Looking at exchange-traded funds tracking sectors in the U.S. stock market, the analysts said that “as the market’s heavyweights have gotten even larger in the S&P 500, it has become problematic for sector SPDRs to replicate the sector indices.”

As sector SPDR ETFs cap the weight of individual stocks, “in a sector like discretionary, where Amazon has a weight of 36.5%,” the Consumer Discretionary Select Sector SPDR Fund XLY has “very different weights than the sector itself,” according to Piper Sandler.

Amazon has a more than 26% weight in the ETF’s index, while Tesla has “a slightly larger weight” compared with the S&P 500’s consumer-discretionary index, the analysts said.

Tesla is the second largest stock by weight in the sector, with electric car maker’s year-to-date drop “detracting over 6%” from the Consumer Discretionary Select Sector SPDR Fund’s returns, according to their note.

Communication-services sector jumps Monday

The U.S. stock market was rising in early afternoon trading on Monday, with the Dow Jones Industrial Average DJIA up 0.3% while the S&P 500 SPX gained 0.8% and the tech-heavy Nasdaq Composite COMP climbed 0.9%, FactSet data show, at last check.

The S&P 500’s consumer-discretionary sector XX:SP500.25 was up 0.7% in early afternoon trading, as shares of Tesla jumped around 6% and Amazon rose 0.3%, according to FactSet data, at last check.

The index’s best-performing sector on Monday afternoon was communication-services, an area in which shares of Google parent Alphabet Inc. GOOGL, +4.60% were jumping more than 5% after Apple Inc. AAPL, +0.64% reportedly is considering using Google AI technology in the iPhone.

The S&P 500 communication-services sector XX:SP500.50 was up 2.8% early afternoon Monday, while its tech sector XX:SP500.45 advanced 0.5%, according to FactSet data, at last check.

“The mixed backdrop for consumers supports our preference to remain in high quality stocks at a reasonable price,” said the Piper Sandler analysts.