Stocks climbing to record after record has driven investor sentiment to exuberant levels

Stocks trading around the world have trudged to record or near-record highs this year, leaving them vulnerable to a correction once the sugar high of excessive investor enthusiasm wears off.

But another bear market on par with what occurred in 2020 and 2022 remains unlikely, according to strategists at Ned Davis Research.

“We don’t expect a bear market any time soon. The macro outlook lacks sufficient evidence to expect the return of crippling inflationary pressures or enough economic weakness to make a global recession an increased probability,” said Tim Hayes, chief global markets strategist at Ned Davis, in a recent report shared with MarketWatch.

In addition to the MSCI equity index for the U.S. XX:984000, MSCI equity indexes tracking markets in Japan XX:939200, France XX:925000, Australia XX:903600, India XX:935600 and Taiwan XX:915800, among others, have also risen to record highs this year.

These six markets account for more than 75% of the market capitalization of the MSCI All Countries World Index XX:892400. Many other global markets are on the cusp of joining them: For the first time since 2021, nearly one-third of the 47 markets included in the MSCI ACWI index are trading within 5% of record highs.

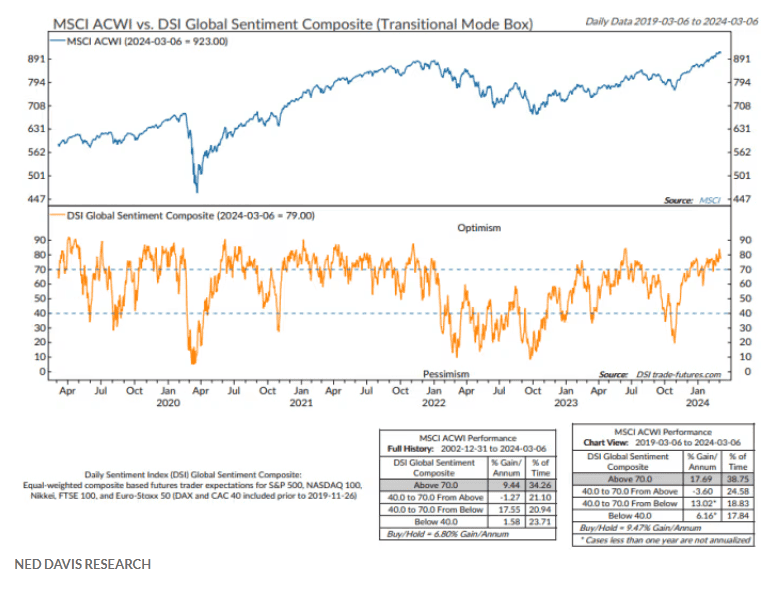

Stocks climbing to record after record has, unsurprisingly, driven investor sentiment to exuberant levels. According to Hayes, the daily sentiment index global sentiment composite finished last week north of 84%, its highest level in nearly a year.

Excessive optimism isn’t necessarily a problem for stocks, Hayes said. Over the past five years, global markets have risen 18% over 12 months after the sentiment gauge topped 70%. But there is plenty of historical precedent to suggest that a pullback could follow once sentiment begins to ebb.

“The longer the period of excessive optimism, the greater the build-up of complacency and the greater the vulnerability to economic or earnings disappointments,” Hayes said.

For now, investors are finding more opportunities to keep pushing markets higher by increasingly buying stocks that have trailed the broader indexes. This has driven the percentage of global stocks trading within 5% of all-time highs to north of 25%, its highest level since early 2022.

After trailing its cap-weighted sibling for most of the past year, the equal-weighted version of the MSCI ACWI has recently been keeping pace, a sign that more stocks have been joining the global market rally.

Expanding breadth could help protect against any losses by the market leaders, market strategists have said. Ned Davis remains overweight stocks, recommending a portfolio allocation of 70% to equities.

Global stocks sank on Tuesday as the MSCI ACWI exchange-traded fund ACWI retreated. Meanwhile, the S&P 500 SPX, Nasdaq Composite COMP and Dow Jones Industrial Average DJIA all shot higher as investors brushed off signs that inflation continued to reaccelerate last month.