Gold’s rise to record highs coincides with all-time highs for the S&P 500

Gold and the S&P 500 have both rallied to record highs in March, but an analysis provided by Jefferies suggests that the precious metal may perform a bit better than the index in the next month.

Gold futures have rallied to fresh record levels, contributing to a gain of more than 6% month to date, with strength in the precious metal also coinciding with a rise to an all-time high for the S&P 500 index.

Most-active gold futures GC00, -0.08% GCJ24, -0.08% traded at $2,188.30 an ounce on Comex Monday, poised to settle at a fresh record, while the S&P 500 index SPX last closed at a record on March 7, at 5,157.36.

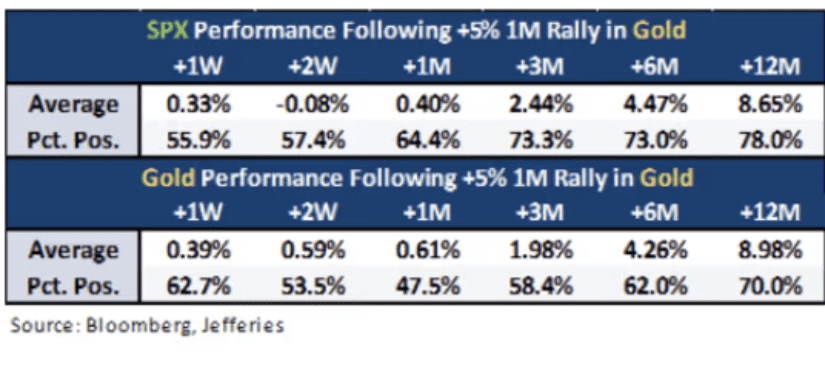

Analysts at Jefferies wrote in a recent note that while easing by the Federal Reserve should benefit both stocks and gold, “it seemed a bit peculiar to us that both would act well together,” so they set out to look at how the index and gold trade following instances when gold is up 5% or more in a month of trading.

“We wanted to see if, easing or not, a rally for each asset could coexist peacefully,” wrote Andrew Greenebaum, senior vice president, equity product management at Jefferies.

He pointed out that gold is “not just making new highs, but really breaking out,” with Fed easing expected to be a “nice catalyst for the yield-free asset,” he wrote. Friday’s “soft” monthly U.S. employment report didn’t do anything to dent those perceived prospects, he said.

Scanning for similar gold rallies going back to 1990, Jefferies found that 5% gold rallies tend to coincide with ”rockier” SPX performance, with one-week to one-month performance “negative to flattish” and while less consistent, gold “tends to see better price performance than SPX in the 12 months after the “initial rip,” averaging 9%-plus, he said.

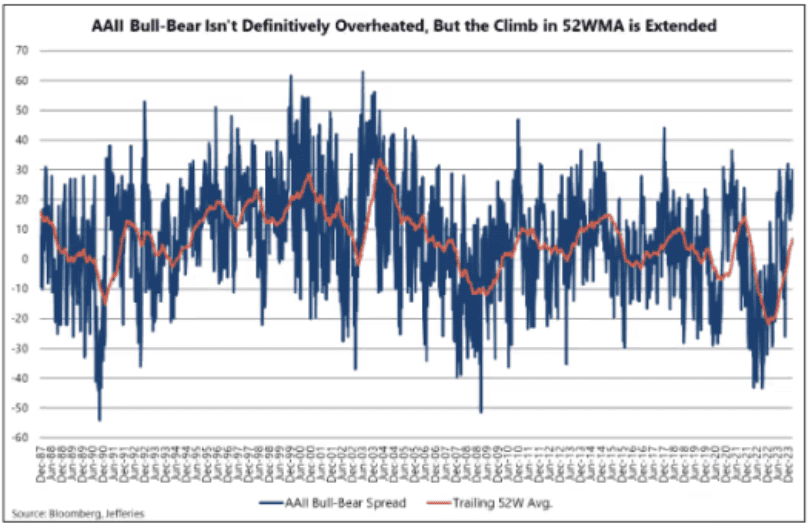

As for the SPX, it may be hovering near all-time highs but for now, it “doesn’t appear to be hampered by overexuberance,” analysts at Jefferies said, adding that looking at the “buy side and sell side sentiment proxies,” they found that both appear to ”have room to move higher.”

The AAII bull-bear spread hit more than 30 this week, the analysts said, referring to the American Association of Individual Investors’ sentiment survey that measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term. It said the spread is high but not historically extended.

What does seem “rather unusual,” however, is that the 52-week moving average has moved higher in 47 of the past 48 weeks — it’s best run since the data began in 1987, they said.

”There has been a clear benefit to markets: if you don’t race to overbought conditions, the higher you may get to rally,” they said.

Still, at some point, “you still wind up at the same result: running out of incremental buyers,” the Jefferies analysts said.