Tuesday’s CPI report represents a ‘potentially pivotal moment’ for interest-rate expectations: BMO Capital Markets

A month after the U.S. stock market suffered its worst consumer-price index release day in over a year, investors are worrying about a reprise when the latest inflation data arrives on Tuesday morning — data that could shake up the Federal Reserve’s monetary-policy expectations and test stocks’ 2024 bull run.

The consumer-price index (CPI) report for February is expected to show inflation edging up again, thanks to an uptick in prices for gasoline, housing and car insurance. The headline CPI is forecast to have risen by 0.4% last month, a faster pace than January’s 0.3%, while the annual rate is projected to remain at 3.1%, according to economists polled by the Wall Street Journal.

The core measure — which strips out volatile food-and-energy components, and is often seen as a better indicator of the underlying pace of price changes — is forecast to have risen 0.3% in February, a tick lower than the prior month. Year-over-year core inflation is projected to dip to 3.7%, from 3.9% in January.

Tuesday’s CPI report represents a “potentially pivotal moment” for monetary-policy expectations, which have remained in flux since the Feb. 13 release of January’s data, said BMO Capital Markets rates strategists Ian Lyngen and Vail Hartman. They noted the inflation update will also play a crucial role in refining the Fed’s own outlook for interest rates in its Summary of Economic Projections, released at the end of its policy meeting next week.

As long as core inflation comes in below the levels seen in January, the market will most likely be comfortable moving forward under the assumption that the Fed’s efforts to fight inflation have largely been successful, Lyngen and Hartman wrote in a client note on Monday.

“This leaves the biggest risk as another report demonstrating the stickiness of realized inflation,” which is not BMO’s call but is “certainly a risk that should be on the radar as investors ponder the effectiveness of Fed policy in the face of consistent global inflationary pressures,” they said.

With traders pricing in a more than 50% likelihood that the first Fed rate cut will arrive by June, “a sweeping shift in policy expectations is certainly on the table,” the BMO strategists wrote.

Markets have priced in a 97% probability that the Fed will leave interest rates unchanged at a range of 5.25% to 5.5% after its next meeting on March 20, while the chance of at least a 25-basis-point rate cut by the subsequent meeting in May was seen at only 21.9%, down from 52.2% just a month ago. However, a similar move by June was priced at a 55.2% likelihood, according to the CME FedWatch Tool.

“Embedded within investors’ concerns regarding the effectiveness of monetary policy in addressing the type and magnitude of realized inflation currently facing the U.S. is the perception that the balance of the real economy will remain resilient in perpetuity,” said Lyngen and Hartman.

While investors grapple with uncertainties surrounding rate cuts and inflation, U.S. stocks are still hovering in record territory, with the S&P 500 SPX soaring to its 16th record close of 2024 on Thursday — boosted by megacap tech stocks benefitting from increasing optimism on the health of the economy and surging demand for artificial-intelligence applications.

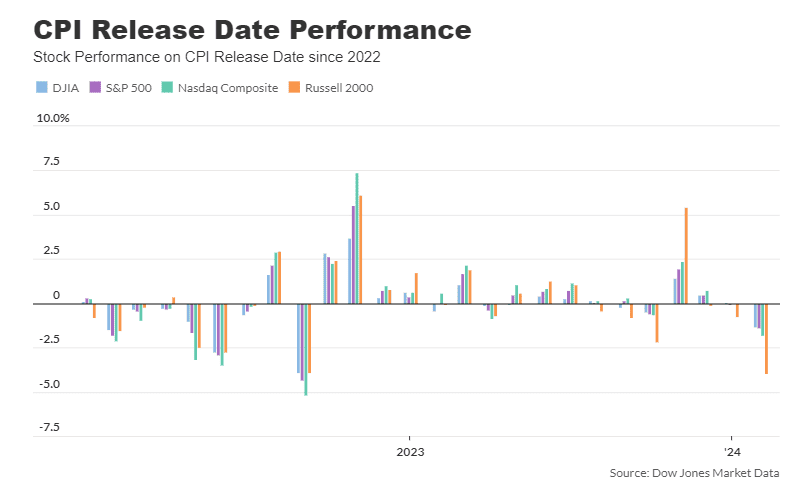

The CPI report has created a lot of market volatility before and after the data release as the stickiness of inflation has become one of the market’s chief concerns over the past two years. However, the stock market’s moves on CPI days were relatively muted in 2023, after the policymakers acknowledged they saw a consistent pattern of inflation falling over time.

But that volatility is again grasping the U.S. equities market this year. On the most recent CPI release date last month, the three major stock indexes had their worst CPI release-day performance since Sept. 13, 2022, while the small-cap Russell 2000 index RUT suffered its worst CPI release day since March 11, 2020, according to Dow Jones Market Data (see chart below).

That’s why stronger-than-expected February inflation data could reignite market concerns over persistently high inflation and a scenario in which the Fed continues to delay its rate cuts.

Fundstrat’s Tom Lee said he sees the CPI release as a “buy the dip” moment in the stock market, as the February inflation report is still likely to remain “hot” due to “residual seasonality” that should fade by March, while two biggest drivers of core CPI — shelter and auto insurance — will show improvements later in 2024.

In addition, Fed Chair Jerome Powell’s testimony to Congress last week, which showed his commitment to cutting rates, as well as Friday’s February jobs report, which showed the unemployment rate at a two-year high, bolstered the case for a rate cut by mid-year, Lee said in a client note viewed by MarketWatch on Monday.

U.S. stocks finished mostly lower on Monday afternoon, with the S&P 500 off 0.1%, the Dow Jones Industrial Average DJIA up 0.1% and the Nasdaq Composite COMP shedding 0.4%, according to FactSet data.