Stock Markets

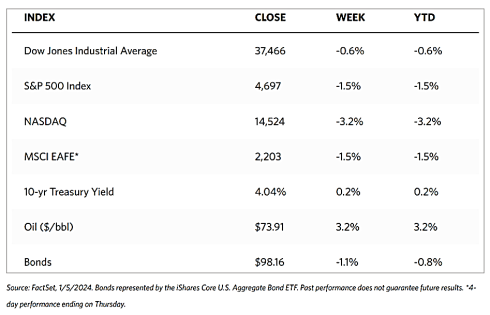

The major stock market indexes were generally down in the week just concluded, partly as a correction following the S&P’s nine-week winning streak, while interest rates moved higher. The WSJ Markets Report shows the Dow Jones Industrial Average (DJIA) slipped by 0.59% and the DJ Total Stock Market Index fell by 1.79%. The broad-based S&P 500 Index marginally dipped by 1.52% while the technology-tracking Nasdaq Stock Market Composite fell by more than twice as much at 3.25% down. The NYSE Composite is slightly lower than the week before by 0.56%, and the Russell Indexes indicate that the correction has affected both small and large-cap stocks. The CBOE Volatility Index (VIX), the investor risk perception indicator, rose by 7.23%.

The moderate sell-off can be attributed to some repositioning that was bound to happen at the start of a new trading year. After all, the markets rallied by 16% during the last two months of 2023 and some profit-taking can only be expected. The new year’s performance may be significantly affected by two primary forces: the interest-rate decisions that the Federal Reserve will be making and the economy’s glide path, both of which ought to be favorable this year. There is some vulnerability, however, in possible surprises on the downside compared to the rosy expectations (referred to as the Goldilocks outcomes, neither too hot nor too cold) for 2024, thus some volatility is likely.

U.S. Economy

Optimism about the economy generally hinges on the strength in the labor market which has proven to be resilient over the post-pandemic recovery period. The Goldilocks scenario is one in which the economy relies on growth in consumer spending and corporate profits to soften the prospects of a possible recession on the heels of the highest rate cuts to mitigate the highest inflation rates in recent history. The easing and possible reversal of the Fed’s rate hike policies should come about by a slowdown in the pace of consumer spending. The labor market is a key determinant of the path of household consumption.

The latest employment report shows that the jobs market retains its resilience, having created a better-than-expected total of 216,000 jobs in December, and the unemployment rate is holding steady at a healthy 3.7%. Despite the strong hiring trend of last month, it is more likely that the labor market will bend, but not break, as 2024 progresses. We may expect a slowdown in the pace of job gains and a moderate increase in the unemployment rate; these are healthy signs. Job openings last December remain robust as it continues to shrink. This development ought to prompt restraint in consumer spending compared to the last two years, without retreating into hibernation that may cause a full-blown recession.

Metals and Mining

Aluminum production was impacted by the power crunch in Europe and Mexico. As a result, prices were driven upward by more than 40% for a second straight year of gains. It, however, also affected the demand for iron ore as China, the world’s largest steel producer, cut output. Iron ore prices crashed in the second semester of 2023 after hitting record peaks in May, as China implemented strict output curbs. Moving forward, base metals are expected to outperform as energy transition will drive demand while supply chain bottlenecks may persist,

The spot price for precious metals came down over the recent week. Gold moderately fell by 0.85% from its previous week’s closing price of $2,062.98 to this week’s closing price of $2,045.45 per troy ounce. Silver slid by 2.56% from its week-ago close at $23.80 to its close this week at $23.19 per troy ounce. Platinum underwent a similar correction as that of silver, dropping by 2.79% from its week-ago close at $991.90 to finish at $964.18 per troy ounce this week. Palladium declined by 6.33% from its close last week at $1,100.24 to end this week at $1,030.56 per troy ounce. The three-month LME prices of base metals followed a similar trend as those of precious metals. Copper corrected by 1.12% from its close last week at $8,559.00 to its close this week at $8,463.00 per metric ton. Zinc fell by 3.59% from its ending price one week ago at $2,658.00 to its ending price this week at $2,562.50 per metric ton. Aluminum gave way by 4.64% from its close last week at $2,384.00 to this week’s close at $2,273.50 per metric ton. Tin lost 3.12% from its closing price one week ago of $25,415.00 to its closing price this week of $24,622.00.

Energy and Oil

Oil rose by 4% midweek due to Houthi militant action in the Red Sea despite U.S. warnings, as well as OPEC’s pledge to support prices. The price of oil will finish the week with a slight gain due to tensions in the Middle East accounting for recouping losses after US inventory data. A hefty 5.5 million crude stock draw, which was attributable to the typical year-end clearing of inventory to minimize ad valorem inventory taxes, caused an immediate market reaction in the form of a modest decline after both diesel and gasoline posted huge stock builds. Houthi attacks in the Red Sea persisted, however, as well as the worsening confrontation between Israel and Iran, which limited the pricing downside with Brent trading around $76 per barrel.

Natural Gas

The U.S. became the world’s leading liquefied natural gas exporter as the country’s LNG exports hit monthly and annual record highs in December. 8.6 million tons were shipped by the U.S. last month, bringing the annual total to 88.9 million tons, an increase of 15% from the previous year.

World Markets

The pan-European STOXX Europe 600 Index ended the week down 0.55% which ended seven consecutive weekly gains as the optimism for an early interest rate cut in the new year began to wane. Most of the major stock indexes fell, among which are France’s CAC 40 Index which lost by 1.62%, and Germany’s DAX which gave up 0.94%. Bucking the trend was Italy’s FTSE MIB which managed to squeeze out a 0.29% increase. Joining the losers was the UK’s FTSE 100 Index which slipped by 0.56%. As traders tempered their expectations for an aggressive rate cut, European government bonds fell sharply which sent yields higher. In Italy, the 10-year government bond yield closed the week above 3.8% while the yield on the benchmark 10-year German bund rose to more than 2.1%. The 10-year gilt in the UK ended with an almost 3.8% yield. The resumption in the acceleration of eurozone inflation in December appeared to dash hopes for early rate cuts by the European Central Bank.

Over a New Year’s holiday-shortened week where trading resumed only on Thursday, Japan’s stock markets ended mixed. The Nikkei 225 underperformed the broader TOPIX Index. Punctuating the lackluster market performance was the deadly earthquake on January 1 that ravaged Japan’s Noto Peninsula in the Hokuriku region which was followed by a series of aftershocks. The devastating human cost rose to over 90 fatalities with hundreds unaccounted for. Additionally, major damage to infrastructure threatened to disrupt manufacturing and other supply chains. Multiple semiconductor-related factories were located in the area hardest hit by the earthquake; others anticipate that the disaster may cause delays in the restart of nuclear power plants across Japan. Initial estimates indicate, however, that the macroeconomic impact of the earthquake is likely to be limited. Debate arose about whether the calamity might impact monetary policy decision-making. The yen dropped sharply in reaction to the event, falling to the low JPY 145 to the U.S. dollar from around JPY 141 at the end of the previous week. The yield on the 10-year Japanese government bond remained unchanged at 0.61% over the shortened week.

Stocks in China declined last week over prevailing economic concerns. The Shanghai Composite Index dropped by 1.54% and the blue-chip CSI 300 plunged by 2.97%. The Hong Kong benchmark Hang Seng Index gave up 3% of its value. December’s economic data continued to reflect the same concerning picture about China’s uncertain economy. For a third consecutive month, the official manufacturing Purchasing Managers’ Index (PMI) was firmly in contraction territory, falling to 49.0 in December. The figure, which is below consensus estimates, was due to accelerated declines in new orders and exports. The nonmanufacturing PMI, by comparison, rose to 50.4 in December from 50.2 in November, due to stronger construction activity offsetting weakness in other areas of the services sector. Readings higher than 50 signify expansionary growth from the preceding month. More evidence of China’s property slump highlighted worries about a key growth sector, new home sales by the top 100 developers in the country. This indicator fell by 34.6% in December from the prior-year period, up from the 29.6% drop in November. Failing home prices, construction delays, and guilder defaults weigh on consumer sentiment as the housing downturn continues to drag on China’s economy.

The Week Ahead

Consumer and producer price index inflation data are among the important economic data scheduled for release in the coming week.

Key Topics to Watch

- Consumer credit for November

- Trade deficit for November

- Wholesale inventories for November

- New York Fed President John Williams speaks

- Initial jobless claims for January 6

- Consumer price index (CPI) for December

- Core CPI for December

- CPI (year-over-year)

- Core CPI (year-over-year)

- Budget statement for December

- Producers price index (PPI) for December

- Core PPI (year-over-year)

Markets Index Wrap-Up\