Chesapeake Utilities Co. (NYSE:CPK – Get Free Report) was the recipient of a large growth in short interest during the month of December. As of December 15th, there was short interest totalling 301,200 shares, a growth of 48.4% from the November 30th total of 203,000 shares. Based on an average daily trading volume, of 223,600 shares, the days-to-cover ratio is currently 1.3 days.

Chesapeake Utilities Trading Down 0.5 %

NYSE CPK traded down $0.56 on Monday, reaching $105.63. The company had a trading volume of 158,000 shares, compared to its average volume of 114,587. The stock’s 50 day moving average is $96.22 and its 200-day moving average is $105.94. The stock has a market cap of $1.88 billion, a price-to-earnings ratio of 21.38 and a beta of 0.63. The company has a quick ratio of 0.39, a current ratio of 0.48 and a debt-to-equity ratio of 0.74. Chesapeake Utilities has a 52 week low of $83.79 and a 52 week high of $132.91.

Chesapeake Utilities (NYSE:CPK – Get Free Report) last posted its earnings results on Thursday, November 2nd. The utilities provider reported $0.69 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.60 by $0.09. Chesapeake Utilities had a return on equity of 10.62% and a net margin of 13.09%. The firm had revenue of $131.55 million during the quarter, compared to analysts’ expectations of $128.10 million. Equities analysts predict that Chesapeake Utilities will post 5.16 earnings per share for the current year.

Chesapeake Utilities Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 5th. Shareholders of record on Friday, December 15th will be paid a $0.59 dividend. The ex-dividend date of this dividend is Thursday, December 14th. This represents a $2.36 dividend on an annualized basis and a yield of 2.23%. Chesapeake Utilities’s payout ratio is 47.77%.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Raymond James & Associates boosted its position in shares of Chesapeake Utilities by 2.1% during the first quarter. Raymond James & Associates now owns 3,965 shares of the utilities provider’s stock worth $546,000 after buying an additional 83 shares during the period. Tower Research Capital LLC TRC boosted its position in shares of Chesapeake Utilities by 9.5% during the first quarter. Tower Research Capital LLC TRC now owns 982 shares of the utilities provider’s stock worth $126,000 after buying an additional 85 shares during the period. Tradewinds Capital Management LLC boosted its position in shares of Chesapeake Utilities by 11.4% during the second quarter. Tradewinds Capital Management LLC now owns 1,025 shares of the utilities provider’s stock worth $122,000 after buying an additional 105 shares during the period. Magellan Asset Management Ltd boosted its position in shares of Chesapeake Utilities by 1.4% during the third quarter. Magellan Asset Management Ltd now owns 10,415 shares of the utilities provider’s stock worth $1,018,000 after buying an additional 144 shares during the period. Finally, Quadrant Capital Group LLC boosted its position in shares of Chesapeake Utilities by 132.8% during the second quarter. Quadrant Capital Group LLC now owns 270 shares of the utilities provider’s stock worth $32,000 after buying an additional 154 shares during the period. 74.80% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on CPK. StockNews.com lowered Chesapeake Utilities from a “hold” rating to a “sell” rating in a report on Friday. Wells Fargo & Company raised Chesapeake Utilities from an “underweight” rating to an “equal weight” rating and decreased their price objective for the stock from $115.00 to $100.00 in a report on Monday, October 16th. LADENBURG THALM/SH SH started coverage on Chesapeake Utilities in a report on Thursday, October 12th. They set a “buy” rating and a $100.00 price objective on the stock. TheStreet lowered Chesapeake Utilities from a “b-” rating to a “c+” rating in a research note on Friday, October 6th. Finally, Guggenheim decreased their price target on Chesapeake Utilities from $112.00 to $99.00 in a research note on Monday, October 9th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating and one has issued a buy rating to the company’s stock. Based on data from MarketBeat, the company presently has a consensus rating of “Hold” and an average price target of $104.00.

About Chesapeake Utilities

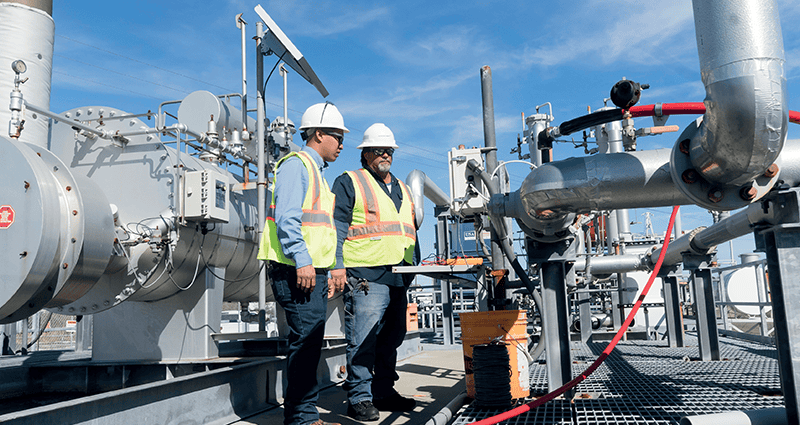

Chesapeake Utilities Corporation operates as an energy delivery company. The company operates through two segments, Regulated Energy and Unregulated Energy. The Regulated Energy segment natural gas distribution operations in central and southern Delaware, Maryland’s eastern shore, and Florida; regulated natural gas transmission in the Delmarva Peninsula, Ohio, and Florida; and regulated electric distribution in northeast and northwest Florida.