Dropbox (DBX Quick QuoteDBX – Free Report) is riding on an expanding artificial intelligence (AI) powered product portfolio, which is helping it win new customers and drive top-line growth. Its shares have returned 25.6% in the past six months, outperforming the Zacks Internet Services industry’s rise of 12.2% and the Zacks Computer and Technology sector’s return of 15.9%.

Dropbox’s bullish prospect is primarily backed by the company’s strategy of leveraging AI to develop products that organize all cloud content. Its Dropbox Dash (launched in June), a standalone universal search product that leverages AI and machine learning has been a noteworthy offering.

The company’s efforts to seamlessly integrate AI into the core File Sync and Share solution has been successful in improving customer experience and attracting new customers.

Dropbox exited third-quarter 2023 with 18.2 million paying users, marking a sequential addition of roughly 130,000 net new paying users. The average revenue per paying user was $138.71, up more than $4 year-over-year, driven by the Teams pricing increase, FormSwift (acquired in December 2022) as well as a shift to premium plans.

Expanding product capabilities and a strong partner base that includes the likes of NVIDIA (NVDA Quick QuoteNVDA – Free Report) is expected to help Dropbox, which currently sports a Zacks Rank #1 (Strong Buy), generate healthy returns. You can see the complete list of today’s Zacks #1 Rank stocks here.

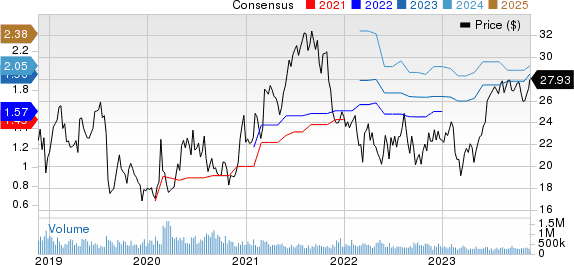

Dropbox, Inc. Price and Consensus

Enhanced Product Capabilities Aid Prospects

DBX announced enhancements to Dropbox Dash and Dropbox AI product offerings in October, along with a redesigned web experience, an all-in-one video tool called Dropbox Studio, and three new workflow plans.

Dropbox Dash allows users to quickly find everything in one place, including content that is pulled from Microsoft Outlook, Google Workspace or Asana.

Dash’s latest enhancements improve search functionality and help customers get answers much faster. The latest update made the solution capable of searching by keywords and semantic search, which provides more contextually relevant search results.

Dash, which is currently in open beta, is expected to become generally available in the early part of 2024.

Dropbox AI’s capabilities have also been enhanced as per the latest update. Customers can now ask questions and summarize content across their entire Dropbox account. Moreover, Dropbox AI is leveraging natural language to understand customer queries.

Dropbox Studio further strengthened the company’s offerings related to video content. The Studio solution is a video collaboration tool that enables customers to seamlessly create, edit, review, approve, and publish high-quality videos.

Strong Partner Base to Drive Growth

Dropbox is benefiting from a strong partner base that includes the likes of Google, Slack, Adobe, Atlassian, Zoom, Microsoft, BetterCloud, Salesforce and NVIDIA.

Dropbox recently announced a collaboration with NVIDIA that will expand the former’s extensive AI functionality with new uses for personalized generative AI. This will improve search accuracy, provide better organization, and simplify workflows for its customers across its cloud content.

The company will leverage NVIDIA’s AI foundry to enhance its latest AI-powered products, including Dropbox Dash and Dropbox AI.

Dropbox’s 2023 View Strong

For fourth-quarter 2023, Dropbox expects revenues between $629 million and $632 million. At constant currency (cc), revenues are expected between $631 million and $634 million.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $630.77 million, indicating year-over-year growth of 5.34%. The consensus mark for earnings is pegged at 48 cents per share over the past 30 days.

For 2023, Dropbox raised the midpoint of its reported revenue guidance range by roughly $5 million, from $2.496 billion to $2.499 billion. At cc, DBX raised the mid-point by roughly $7 million to a range of $2.536 billion to $2.539 billion. Dropbox expects FormSwift to contribute nearly 300 basis points of growth.

The Zacks Consensus Estimate for 2023 revenues is pegged at $2.50 billion, indicating year-over-year growth of 7.42%. The consensus mark for earnings is pegged at $1.96 per share, up 3.7% over the past 30 days.

The company raised its gross margin to 82%-82.5% from 82% for the year. Non-GAAP operating margin was 32.5%, up from the previous guidance of roughly 32%.