Eli Lilly and Company (LLY Quick QuoteLLY – Free Report) boasts a solid portfolio of core drugs in diabetes, autoimmune diseases and cancer. Its revenue growth is being driven by higher demand for drugs like Jardiance, Verzenio, Taltz and others. Lilly has lately made rapid pipeline progress in areas like obesity, diabetes and Alzheimer’s, thus attracting investors to the stock.

Here, we discuss the factors that are driving Lilly’s stock higher and can keep the positive momentum alive in 2024.

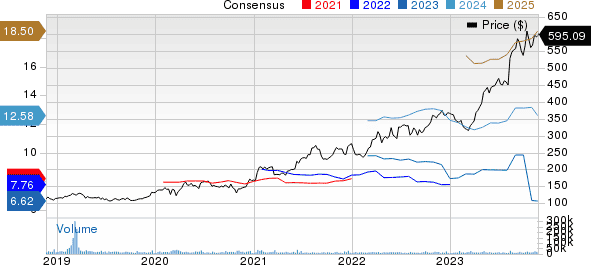

The stock has risen 62.0% so far this year compared with an increase of 4.5% for the industry.

Mounjaro Expected to Become Key Top-Line Driver

In May 2022, the FDA approved Lilly’s novel diabetes treatment, Mounjaro/tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA), which showed impressive blood sugar reductions and weight loss in type II diabetes patients in phase III studies. Mounjaro was approved in Europe and Japan in the third quarter of 2022.

Mounjaro is already generating impressive sales, benefiting from strong demand trends. Mounjaro sales totaled $2.96 billion in the first nine months of 2023. It is expected to be a key long-term top-line driver for Lilly as it has the potential to be approved for obesity and other diabetes-related diseases. Mounjaro showed superior weight-loss reduction in clinical studies for obesity indication. It was approved for the said indication in the United States in November, while its regulatory application is under review in the EU. Mounjaro will be marketed by the name of Zepbound for chronic weight management. Mounjaro and Zepbound are expected to be key top-line drivers for Lilly, with demand for weight loss drugs rising rapidly.

A phase III cardiovascular outcome study for tirzepatide is ongoing. Phase III studies are ongoing for obstructive sleep apnea and heart failure with preserved ejection fraction (HFpEF) and phase II in NASH.

New Drug Approvals and Launches

Lilly gained approvals for some key new drugs in 2023. Omvoh/mirikizumab was approved for its first inflammatory bowel disease (IBD) indication, ulcerative colitis in the United States, Europe and Japan in 2023. Omvoh is expected to be launched in the United States in a few weeks. Omvoh has already been launched in Japan and EU with planned additional launches in EU later this year. Jaypirca/pirtobrutinib was approved for mantle cell lymphoma in the United States in January 2023 while it is under review in Europe for the indication.

Lilly expects to file a regulatory application seeking approval of Omvoh/mirikizumab for its second IBD indication Crohn’s disease in 2024. The FDA’s decision on Jaypirca for the chronic lymphocytic leukemia indication is expected by end of 2023 while that for donanemab for early Alzheimer’s disease is expected in the first quarter of 2024. Lilly has also filed a regulatory application for donanemab for early Alzheimer’s disease in the EU.

All these potential new product launches are expected to drive growth of the company.

Conclusion

Lilly has its share of issues like generic competition for several drugs, rising pricing pressure and supply challenges in meeting strong demand for incretin-based products like Trulicity and Mounjaro. Lilly is investing in manufacturing capacity to increase the supply of incretin-based products to meet rising demand.

In addition, no COVID revenues in 2023 and the loss of exclusivity of key drug Alimta in the United States have been hurting the top line. However, continued strong sales of Mounjaro, Verzenio, Jardiance and Taltz, coupled with contributions from new products like Zepbound, are expected to drive top-line growth in 2024.

Zacks Rank & Stocks to Consider

Lilly currently has a Zacks Rank #3 (Hold).

Eli Lilly and Company Price and Consensus

Some better-ranked stocks in the drug/biotech sector are Novo Nordisk (NVO Quick QuoteNVO – Free Report) , Dynavax Technologies Corporation (DVAX Quick QuoteDVAX – Free Report) and Harpoon Therapeutics (HARP Quick QuoteHARP – Free Report) . While Novo Nordisk sports a Zacks Rank #1 (Strong Buy), Dynavax Technologies and Harpoon Therapeutics carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.57 to $2.62 over the past 30 days. Estimates for 2024 have jumped from $2.99 per share to $3.07 over the same timeframe. NVO’s stock has surged 51.7% year to date.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, missed in one and matched estimates in one, delivering an earnings surprise of 0.58% on average.

In the past 30 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 22 cents to 12 cents. During the same period, earnings per share estimates for 2024 have improved from 8 cents to 18 cents. Year to date, shares of DVAX have rallied 27.2%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 293.21%.

In the past 30 days, estimates for Harpoon Therapeutics’ 2023 loss per share have narrowed from $4.30 to $2.09. During the same period, loss per share estimates for 2024 have improved from $2.75 to $1.26. Year to date, shares of HARP have rallied 81.2%.

Harpoon Therapeutics’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 47.59%.