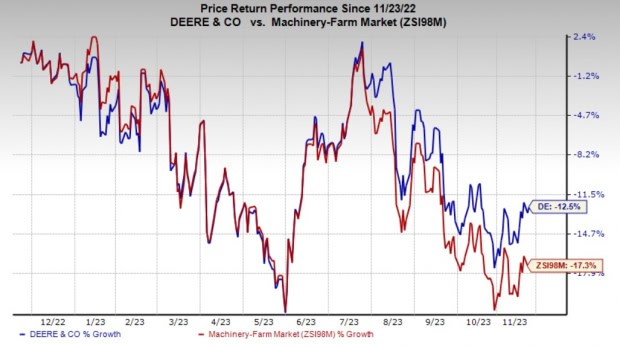

Deere & Company (DE Quick QuoteDE – Free Report) reported fourth-quarter fiscal 2023 (ended Oct 29) earnings of $8.26 per share, beating the Zacks Consensus Estimate of earnings of $7.49 per share. The bottom line increased 11% from the prior-year quarter’s levels, backed by favorable market conditions and price realization.

Despite the outperformance, DE shares dipped 5.3% in pre-market trading as the company’s fiscal 2024 guidance indicates a decline in sales in all its segments along with lower net income. The midpoint of the company’s provided range for net income indicates a year-over-year slump of 21%, thus reflecting the company’s expectations of weak demand.

Net sales of equipment operations (comprising Agriculture and Turf, Construction and Forestry) were $13,801 million, down 4% year over year. Revenues topped the Zacks Consensus Estimate of $13,628 million. Total net sales (including financial services and others) were $15,412 million, down 1% year over year.

Deere & Company Price, Consensus and EPS Surprise

Operational Update

The cost of sales in the reported quarter went down 7.7% year over year to $9,427 million. Total gross profit increased 5.7% year over year to $4,374 million. Selling, administrative and general expenses (SA&G) rose 1% to $1,203 million from the year-ago quarter levels.

Total operating profit (including financial services) was up 2% year over year to $3,025 million in the fiscal fourth quarter.

Segment Performance

The Production & Precision Agriculture segment’s sales declined 6% year over year to $6,965 million. The figure was higher than our model’s estimated revenues of $6,567 million for the quarter. Gains from price realization were offset by low volumes.

Operating profit increased 6% year over year to $1,836 million mainly due to price realization. Lower shipment volumes/sales mix, higher SA&G and research and development (R&D) expenses offset some of the gains. Our estimate for the segment’s operating profit was $1,677 million.

Small Agriculture & Turf sales were down 13% year over year at $3,739 million on low volumes, somewhat offset by price realization. Our projection for the segment’s sales was $3,175 million. Operating profit declined 12% year over year to $444 million. Lower sales, as well as elevated SA&G and R&D expenses, led to the decline. The figure was lower than our estimate of operating profit of $483 million for the segment.

Construction & Forestry sales were $3,742 million, up 11% year over year, backed by higher shipment volumes and price realization. The figure was lower than our projection of $3,772 million. Operating profit increased 25% year over year to $516 million. Gains from higher sales were partially offset by increased production costs, unfavorable impact of foreign currency exchange, less favorable sales mix and a loss on the sale of the Russian roadbuilding business. Our estimate for the segment’s operating profit was $678 million.

Revenues in Deere’s Financial Services division were $1,347 million in the reported quarter, up 36% year over year. The figure was higher than our estimate of $1,049 million. The segment’s operating income was $229 million in the quarter under review, down compared with $297 million in the last fiscal year’s comparable quarter. Our projection was $276 million for the quarter.

Net income for Financial services declined 18% year over year to $190 million in the fourth quarter of fiscal 2023.

Financial Update

Deere reported cash and cash equivalents of $7.46 billion at the end of fiscal 2023 compared with $4.77 billion recorded at fiscal 2022 end. Cash flow from operating activities was $8.6 billion in fiscal 2023 compared with $4.7 billion in the prior fiscal.

At the end of fiscal 2023, DE’s long-term borrowing was nearly $38.5 billion compared with $33.6 billion at fiscal 2022 end.

Fiscal 2023 Performance

The company reported earnings per share of $34.63 in fiscal 2023, which came in 49% higher than the earnings per share of $23.28 in fiscal 2022. It also surpassed the Zacks Consensus Estimate of earnings of $33.89 per share.

Net sales of equipment operations (comprising Agriculture and Turf, Construction and Forestry) rose 16% year over year to $55.6 billion, which beat the consensus estimate of $55.4 billion. Total net sales (including financial services and others) were $61.3 million, up 16.5% year over year.

Guidance

Deere expects net income for fiscal 2024 to be between $7.75 billion and $8.25 billion stating that it expects volumes to return to mid-cycle levels. The stated range is much lower than net income attributable of $10.2 billion in fiscal 2023.

Net sales for Production & Precision Agriculture are expected to be down 15-20% year over year in fiscal 2024. Sales of Small Agriculture & Turf are expected to decline in the range of 10% to 15%. Sales of Construction & Forestry are projected to be down 10%. The Financial Services segment’s net income is expected to be around $770 million.

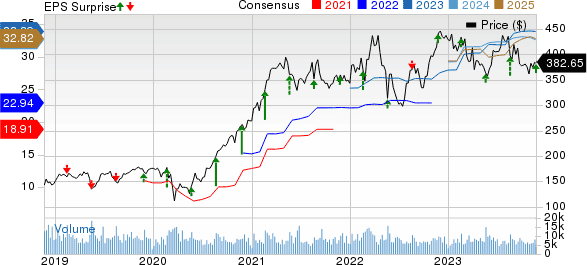

Price Performance

Deere’s shares have fallen 12.5% in the past year compared with the industry’s 17.3% decline.