Shares of DICK’S Sporting Goods, Inc. (DKS Quick QuoteDKS – Free Report) jumped more than 7%, following the third-quarter fiscal 2023 results, wherein the top and bottom lines beat the Zacks Consensus Estimate and improved year over year. Despite the challenging macro-economic environment, the company has been benefiting from the strong back-to-school season and continued market share gains. It is on track with business optimization to streamline the overall cost structure.

DKS shares have gained 6.8% in the past three months against the industry’s 5.3% decline.

Q3 in Detail

Adjusted earnings were $2.85 per share in the fiscal third quarter, up 10% from the prior-year figure of $2.60. Also, the metric beat the Zacks Consensus Estimate of $2.42 per share.

Net sales of $3,042 million improved 2.8% year over year and surpassed the Zacks Consensus Estimate of $2,956 million. The upside can be attributable to strong comparable store sales (comps) and healthy transaction growth.

Consolidated comps grew 1.7% year over year. However, the figure lagged our estimate of 2.1% growth. This was driven by higher transactions and average ticket.

Gross profit rose 4.8% year over year to $1,061 million and came ahead of our estimate of $1,048.2 million. Meanwhile, the margin expanded 67 basis points (bps) year over year to 34.9% in the fiscal third quarter.

In the fiscal third quarter, the SG&A expense rate of 25.5% expanded 254 bps year over year. SG&A expenses, in dollar terms, increased 14% to $776 million and beat our estimate of $763.9 million.

Financial Aspects

DICK’S Sporting ended the fiscal third quarter with cash and cash equivalents of $1,406.2 million, and no borrowings under the $1.6-billion revolving credit. Total inventory fell 2.3% year over year to $3,282.9 million as of Oct 29, 2023.

On Nov 20, 2023, the board authorized and declared a quarterly dividend of $1.00 per share on the company’s common stock and Class B common stock. The dividend is payable Dec 29, 2023, to stockholders of record at the close of business on Dec 15, 2023.

The company repurchased 3.5 million shares of its common stock for $388 million under its share repurchase program. As of Oct 28, 2023, it has $780 million remaining under its authorization.

As of Oct 28, 2023, net capital expenditure amounted to $409.5 million. DICK’S Sporting projects capital expenditure of $670-$720 million on a gross basis and $550-$600 million on a net basis for fiscal 2023.

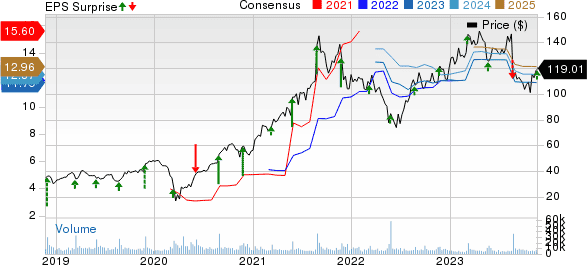

DICK’S Sporting Goods, Inc. Price, Consensus and EPS Surprise