Shares of Corebridge Financial, Inc. (CRBG Quick QuoteCRBG – Free Report) declined 8% since it reported third-quarter 2023 results on Nov 3. Investors might be concerned about a declining premium and deposit level within the Group Retirement unit, reduced pension risk transfer transaction volume and escalating interest expense on financial debt.

However, the downside was partly offset by strong contributions from the Individual Retirement and Life Insurance segments, improved variable investment income and a decline in overall expense level.

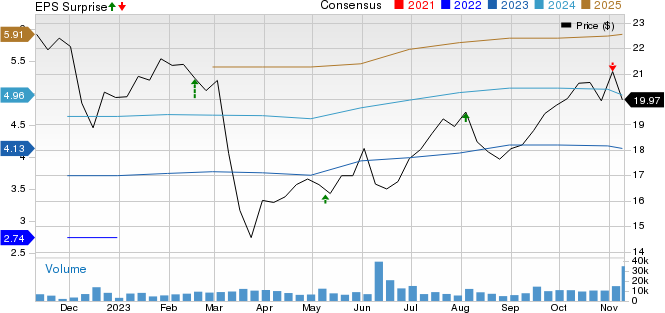

CRBG reported third-quarter 2023 adjusted operating earnings per share of $1.05, which missed the Zacks Consensus Estimate by a whisker. The bottom line advanced 28% year over year.

Adjusted revenues declined 8.1% year over year to $4.1 billion. The top line lagged the consensus mark by 23.6%.

Corebridge Financial, Inc. Price, Consensus and EPS Surprise

Quarterly Operational Update

Premiums and deposits of $9.1 billion improved 4% year over year in the quarter under review. Premiums and deposits, excluding transactional activity, rose 3% year over year on the back of growth in fixed index annuity and deposits.

Net investment income of Corebridge climbed 23% year over year to $2.7 billion, attributable to improved base portfolio income.

Total benefits, losses and expenses were $3.3 billion, which decreased 10.4% year over year in the third quarter due to lower policyholder benefits and general operating expenses.

CRBG reported an adjusted pre-tax operating income of $813 million, which rose 29% year over year. Adjusted return on average equity of 11.4% improved 230 basis points (bps) year over year.

Segmental Performance

Individual Retirement

Premiums and deposits amounted to $4 billion in the segment, which advanced 4% year over year on the back of expanding fixed index annuity and deposits. Fee income of $289 million fell 3.7% year over year in the third quarter.

Spread income surged 45.1% year over year. The unit reported an adjusted pre-tax operating income of $576 million, which climbed 54% year over year, thanks to improved base spread income, higher variable investment income and a decline in general operating expenses.

Group Retirement

The segment’s premiums and deposits fell 10% year over year to $1.8 billion in the quarter under review. The metric suffered due to reduced plan acquisitions and a decline in out-of-plan variable annuity deposits. Fee income of $180 million grew 2.9% year over year.

Spread income advanced 2% year over year. Adjusted pre-tax operating income inched up 1% year over year to $192 million, which resulted from growth in fee income.

Life Insurance

Premiums and deposits were recorded at $1.1 billion in the unit, which advanced 2.6% year over year. The segment reported an adjusted pre-tax operating income of $136 million in the third quarter, which improved 10% year over year on the back of expanding base portfolio income and reduced general operating expenses.

Institutional Markets

The segment reported premiums and deposits of $2.3 billion, which climbed 19% year over year resulting from increased guaranteed investment contracts issuance volumes. Fee income remained flat year over year at $16 million in the quarter under review.

Spread income advanced 6.1% year over year. However, the unit’s adjusted pre-tax operating income slipped 10% year over year to $75 million due to a decline in underwriting margin.

Corporate and Other

The unit incurred an adjusted pre-tax operating loss of $166 million in the third quarter, wider than the prior-year quarter’s loss of $142 million. The results were hurt due to elevated interest expense on financial debt.

Financial Position (as of Sep 30, 2023)

Corebridge exited the third quarter with a cash balance of $569 million, which rose 3.1% from the figure at 2022 end. Total investments of $216.9 billion dipped 1.5% from the 2022-end level.

Total assets of $355.6 billion declined 1.3% from the 2022-end figure.

Long-term debt amounted to $8.4 billion, up 6.4% from the figure as of Dec 31, 2022. Short-term debt totaled $1 billion at the third-quarter end.

Total equity of $9.3 billion fell 10.3% from the 2022-end level.

CRBG generated net cash from operations of $2.6 billion in the first nine months of 2023, which climbed 20.5% from the prior-year comparable period.

Adjusted book value per share was $38.23 in the quarter under review, which increased 4.5% year over year.

Share Repurchase & Dividend Update

Corebridge bought back around 2.5 million common shares worth roughly $46 million in the third quarter. A leftover capacity of around $754 million remained under its share repurchase authorization as of Sep 30, 2023.

It paid out cash dividends of $146 million in the quarter under review. Out of the net proceeds derived from the divestiture of Laya Healthcare in October 2023, management declared a special dividend of $1.16 per share of common stock, which will be paid out on Nov 22, 2023, to shareholders of record as of Nov 13, 2023.

2024 Target

CRBG remains on track to achieve a return on average equity in the range of 12-14% next year.