Installed Building Products, Inc. (IBP Quick QuoteIBP – Free Report) reported mixed results in third-quarter 2023, with earnings surpassing the Zacks Consensus Estimate and increasing on a year-over-year basis. Net sales missed the consensus mark and declined from the prior-year quarter’s levels.

However, net sales declined due to softened single-family sales, partially offset by robust sales growth in its multi-family end market.

The company expects interest rate volatility to impact the housing industry’s cyclicality. However, the company foresees long-term opportunities in residential and commercial markets. The stable backlog supported its Multi-family revenues. The company’s emphasis on service value over volume helped it to achieve a record net profit margin and adjusted EBITDA margin in the quarter.

Installed Building’s shares dropped 1.6% on Nov 8 after the earnings release.

Inside the Headlines

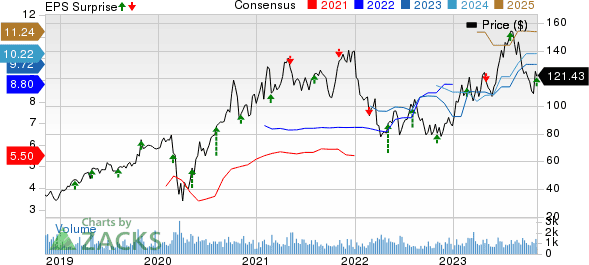

Installed Building reported adjusted earnings of $2.79 per share, which topped the Zacks Consensus Estimate of adjusted earnings of $2.42 per share by 15.3%. The metric also grew 11.2% year over year from $2.51 per share.

Installed Building Products, Inc. Price, Consensus and EPS Surprise

Net sales of $706.5 million missed the consensus mark of $718.2 million by 1.6% and declined 1.8% year over year.

Segmental Performance

The Installation segment’s net revenues came in at $661.2 million, down 1.7% year over year on 2.7% and 3.3% year over year decline in residential new construction and repair and remodel end markets, respectively. This was partially offset by a 3.7% year-over-year increase in the commercial end market. The segment’s gross profit margin improved year over year 350 bps to 36.6%.

Other revenues (including IBP’s manufacturing and distribution operations) dropped 1.9% year over year to $45.3 million. The segment’s gross profit margin improved 730 bps year over year to 28.4%.

Operating Highlights

Gross profit increased 9.4% year over year to $242.1 million. Gross profit margin expanded 350 basis points (bps) year over year to 34.3%.

Adjusted EBITDA improved 8.6% year over year to $130.5 million. Adjusted EBITDA margin expanded by 180 bps, from the year-ago figure.

Acquisition Update

During the reported quarter IBP completed two acquisitions including, Interior 2000 Products, LLC, based in Virginia and R-Pro Select, LLC, based in North Carolina.

In October 2023, IBP acquired North Dakota-based, Interstate Spray Foam, LLC.

Financials

As of Sep 30, 2023, Installed Building had cash and cash equivalents of $339.8 million compared with $229.6 million at 2022 end. Net cash provided by operations was $250.5 million in the first nine months of 2023 compared with $198.7 million in the year-ago period.

Long-term debt at the third-quarter end was $833.5 million, up from $830.2 million at 2022-end.

Zacks Rank & Recent Construction Releases

Installed Building sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Vulcan Materials Company (VMC Quick QuoteVMC – Free Report) reported stellar results in the third quarter of 2023, surpassing the Zacks Consensus Estimate for earnings and revenues.

VMC’s adjusted earnings per share (EPS) of $2.29 increased 28.7% from the year-ago level of $1.78. Total revenues of $2,185.8 million increased 4.7% year over year.

Otis Worldwide Corporation (OTIS Quick QuoteOTIS – Free Report) reported impressive results in third-quarter 2023. Its earnings and net sales surpassed the Zacks Consensus Estimate and rose on a year-over-year basis. Its quarterly results reflected 12 consecutive quarters of organic sales growth and solid operating margin expansion, contributing to high-teens adjusted EPS growth.

OTIS reported quarterly EPS of 95 cents, increasing 18.8% from the year-ago quarter’s figure of 80 cents. Net sales of $3.52 billion rose 5.4% on a year-over-year basis.

United Rentals, Inc.’s (URI Quick QuoteURI – Free Report) third-quarter 2023 earnings and revenues surpassed the Zacks Consensus Estimate. On a year-over-year basis, earnings and revenues increased on sustained growth across the business, profitability and returns, underpinned by broad-based activity.

URI’s adjusted EPS of $11.73 increased 26.5% from the prior-year figure of $9.27. Total revenues of $3.77 billion grew 23.4% year over year.