Clean Harbors, Inc. (CLH Quick QuoteCLH – Free Report) reported disappointing third-quarter 2023 results, wherein earnings and revenues missed the Zacks Consensus Estimate.

Investors, however, seem unaffected by the miss as the stock has risen 4.9% since the earnings release on Nov 1.

Adjusted earnings per share of $1.68 missed the Zacks Consensus Estimate by 18.8% and declined from the year-ago quarter’s figure by 30.9%. Total revenues of $1.37 billion missed the consensus estimate by 2.1% but grew slightly on a year-over-year basis.

Let’s check out the numbers in detail.

Revenues by Segment

Environmental Services’ (ES) revenues of $1.15 billion grew 5.5% year over year, surpassing our estimate of $1.11 billion. The uptick was backed by higher volumes of high-value waste streams, pricing initiatives and strength in its Industrial Services businesses.

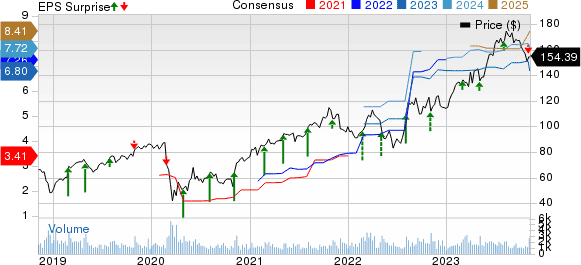

Clean Harbors, Inc. Price, Consensus and EPS Surprise

Safety-Kleen Sustainability Solutions’ (SKSS) revenues of $219.2 million declined 20.7% year over year, missing our estimate of $271.6 million.

Profitability Performance

Adjusted EBITDA of $255 million decreased 17.4% year over year and missed our estimate of $277.8 million. The adjusted EBITDA margin declined to 18.7% from 22.6% in the year-ago quarter.

Segment-wise, ES adjusted EBITDA was $288.98 million, up 10.9% year over year. SKSS adjusted EBITDA was $31.16 million, down 69.8% year over year.

Balance Sheet & Cash Flow

Clean Harbors exited third-quarter 2023 with cash and cash equivalents of $336 million compared with $238.8 million at the end of the prior quarter. Inventories and supplies were $311.5 million compared with $325.9 million in the prior quarter. Long-term debt was $2.29 billion, flat compared with the prior quarter’s figure.

CLH generated $220.12 million in net cash from operating activities in the reported quarter. Capital expenditure was $107.61 million. Adjusted free cash flow was $114.7 million.

Guidance

For 2023, adjusted EBITDA is anticipated to be between $1.01 billion and $1.03 billion.

Adjusted free cash flow for the current year is expected between $300 million and $330 million. Net cash from operating activities is projected in the range of $700-$750 million.