Werner Enterprises, Inc. (WERN Quick QuoteWERN – Free Report) shares gained 2.6% since its third-quarter 2023 earnings release on Nov 1. Quarterly earnings per share (EPS) of 42 cents lagged the Zacks Consensus Estimate of 48 cents and declined 53% on a year-over-year basis.

Total revenues of $817.74 million outperformed the Zacks Consensus Estimate of $802.4 million. The top line dipped 1% on a year-over-year basis due to a $49.7 million decrease in Truckload Transportation Services (TTS) revenues, partially offset by Logistics revenue growth of $43.1 million.

Operating income (adjusted) of $41.85 million fell 47% year over year. Adjusted operating margin contracted 450 basis points (bps) to 5.1%. Total operating expenses rose 3.7% to $779.84 million in the reported quarter.

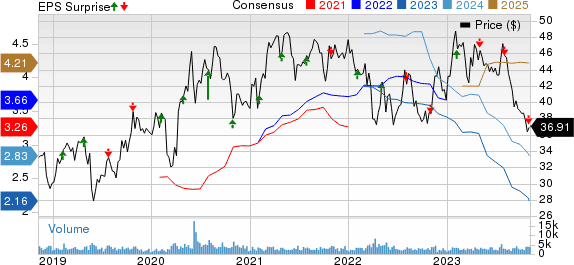

Werner Enterprises, Inc. Price, Consensus and EPS Surprise

Segmental Results

Revenues in the TTS segment tumbled 8% on a year-over-year basis to $572.19 million due to lower fuel surcharge revenues. Adjusted operating income decreased 45% to $41.64 million. Adjusted operating margin collapsed 500 bps to 7.3%. Adjusted operating ratio (operating expenses as a percentage of revenues) improved 500 bps to 92.7%.

Logistics’ revenues totaled $230.25 million, up 23% year over year. Adjusted operating income of $3.16 million declined 44% year over year. Adjusted operating margin fell 160 bps to 1.4%.

Liquidity

As of Sep 30, Werner had cash and cash equivalents of $42.75 million compared with $46.5 million at the prior-quarter end. Long-term debt (net of current portion) totaled $686.25 million at the end of the reported quarter compared with $636.25 million at the prior-quarter end.

The company generated $74.2 million of cash from operations in third-quarter 2023. Net capital expenditure amounted to $120 million.

In the quarter under review, Werner did not repurchase any shares. As of Sep 30, WERN had 2.3 million shares available under its share repurchase authorization.

Outlook

For 2023, Werner anticipates TTS truck growth to be between (5%) and (3%) (prior view: down 4-2%).

Net capital expenditure is estimated to be in the range of $425-$450 million (prior view: $400-$450 million). Under the TTS guidance, WERN projects dedicated revenues per truck per week growth to rise from breakeven to 3% in 2023.

One-way Truckload revenues per total mile are predicted to decline 9-7% (prior view: 4-7% down). Werner expects the average truck age to be 2.1 years for 2023, while the trailer age is forecasted to be five years.

However, the 2023 tax rate is anticipated to be in the range of 24-25%.

Presently, Werner carries a Zacks Rank #5 (Strong Sell).