Hyatt Hotels Corporation (H Quick QuoteH – Free Report) delivered third-quarter 2023 results, wherein earnings surpassed the Zacks Consensus Estimate, while revenues missed the same. However, both metrics increased on a year-over-year basis.

Hyatt’s quarterly results reflected year-over-year growth in comparable system-wide revenue per available room (RevPAR), driven by an increase in occupancy and average daily rate (ADR). This uptrend is primarily driven by robust global travel demand, especially among leisure guests and group customers. Also, net rooms growth fueled solid fee generation, which the company expects to continue in the upcoming period, given the positive trends. However, increased costs and expenses, foreign currency risks and the ongoing macroeconomic uncertainties partially offset the aforementioned tailwinds.

Following the results, shares of this global hospitality company declined 1.9% in the pre-market trading session on Nov 2.

Q3 Earnings & Revenues

During the quarter under discussion, Hyatt reported adjusted earnings per share (EPS) of 70 cents, beating the Zacks Consensus Estimate of earnings of 60 cents per share by 16.7%. In the prior-year quarter, the company reported EPS of 64 cents.

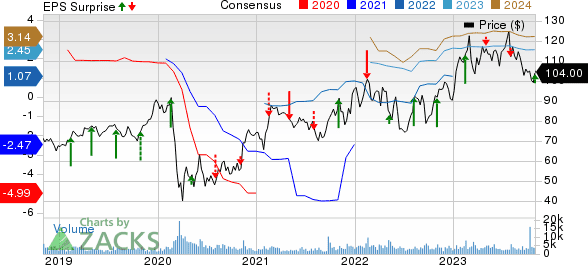

Hyatt Hotels Corporation Price, Consensus and EPS Surprise

Quarterly revenues of $1,622 million missed the consensus mark of $1,623 million by 0.1%. However, the top line climbed 5.3% on a year-over-year basis.

Operating Highlights

During the quarter, adjusted EBITDA was $247 million, down 1.7% year over year. Our model predicted the metric to be $250.2 million. Adjusted EBITDA margin decreased to 28.2% compared with 29.8% reported in the year-ago quarter.

Segmental Details

Hyatt manages business through five reportable segments, which are Owned and Leased Hotels; Americas Management and Franchising; Southeast Asia, Greater China, Australia, South Korea, Japan and Micronesia (ASPAC) Management and Franchising; Europe, Africa, Middle East and Southwest Asia (EAME/SW Asia) Management and Franchising; and Apple Leisure Group.

During the quarter under review, adjusted revenues in the Owned and Leased Hotels segment totaled $318 million, up 5.8% year over year. The segment benefited from growth in group travel and robust leisure demand. Our model estimated the revenues to be $321.8 million year over year.

Segmental RevPAR grew 6.3% from the prior-year quarter’s level. ADR was up 2.1% and occupancy rate expanded 2.9 percentage points from 2022 levels.

The segment’s adjusted EBITDA was $50 million compared with $51 million reported in the year-ago quarter.

Americas Management and Franchise segment’s total adjusted fee revenues amounted to $157 million, up 0.2% year over year. Our model estimated the metric to grow 3.7% year over year to $160.7 million.

RevPAR for comparable Americas hotels rose 2.9% from the prior-year quarter’s level. ADR improved 0.9% and occupancy rate moved up 1.4 percentage points from the prior-year quarter’s numbers.

Segmental adjusted EBITDA declined 0.2% year over year to $114 million.

In ASPAC Management and Franchising, RevPAR for comparable ASPAC hotels grew 41.6% from the year-earlier quarter’s figure. ADR grew 17% and occupancy rate improved 12.6 percentage points from the year-ago quarter’s levels. The uptrend was backed by major events, including the G20 Summit, Women’s FIFA World Cup and Asian Games.

Adjusted EBITDA was $28 million compared with $18 million in the prior-year quarter.

In EAME/SW Asia Management and Franchising, comparable EAME/SW Asia hotels’ RevPAR increased 5.2% from the year-ago quarter’s levels. ADR increased 1.2% and occupancy rate rose 2.7 percentage points from the year-ago quarter’s numbers. This was driven by Western Europe, strong international inbound seasonal demand and increased airlift into the region.

Adjusted EBITDA totaled $16 million compared with $18 million in the year-ago quarter.

In the Apple Leisure Group segment, adjusted revenues declined 2.4% year over year to $329 million. Our model hinted at an increase of 4.6% year over year.

Adjusted EBITDA was $50 million compared with $78 million reported in the year-ago quarter.

Balance Sheet

As of Sep 30, 2023, Hyatt reported cash and cash equivalents of $727 million compared with $906 million reported in the previous quarter. Total debt as of Sep 30, 2023, was $3,055 million compared with $3,102 million as of Mar 31, 2023.

Other Business Updates

Coming to hotel openings, 20 new hotels (or 3,262 rooms) joined Hyatt’s system in the third quarter of 2023. As of Sep 30, 2023, Hyatt executed management or franchise contracts for approximately 600 hotels (or 123,000 rooms).

Revised 2023 Outlook

For 2023, the company now expects adjusted selling, general and administrative expenses to be between $480 million and $490 million compared with the prior estimate of $485 million and $495 million. Capital expenditures are projected to be approximately $190 million compared with the prior expectation of approximately $200 million. Net rooms growth in 2023 is anticipated to be approximately 6% year over year.

Management anticipates 2023 system-wide RevPAR to rise 15-16% (earlier guidance: 14-16%) from 2022 levels. Adjusted EBITDA is estimated in the $1,005 – $1,025 million band, down from $1,020-$1,070 million expected earlier.