LendingTree, Inc. (TREE Quick QuoteTREE – Free Report) shares have rallied 19.5% in response to better-than-expected third-quarter 2023 results. Adjusted net income per share of 61 cents beat the Zacks Consensus Estimate of 39 cents. The reported figure compares favorably with an adjusted net loss of 36 cents reported in the prior-year quarter.

The company’s results were aided by lower costs, while a decline in revenues was a spoilsport. Management reduced the guidance for 2023.

LendingTree reported a net loss of $148.5 million compared with a loss of $158.7 million in the year-ago quarter.

Revenues & Variable Marketing Margin Decline

Total revenues were down 34.7% year over year to $155.2 million in the third quarter. The downside stemmed from a decline in the Home, Consumer and Insurance segments’ revenues. Also, the reported figure missed the Zacks Consensus Estimate of $161.6 million.

The total cost of revenues was $7.6 million, down 46.3% from the prior-year quarter.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) totaled $21.8 million, up significantly year over year. The variable marketing margin was at $67.7 million, down 9.4%.

As of Sep 30, 2023, cash and cash equivalents were $175.6 million compared with $298.8 million as of 2022 end. Long-term debt was $625.7 million compared with $813.5 million as of 2022 end.

Outlook

For the fourth quarter of 2023, total revenues are estimated between $132 million and $142 million. Adjusted EBITDA and the variable marketing margin are anticipated to be $11-$17 million and $55-$65 million, respectively.

For 2023, total revenues are estimated between $670 million and $680 million. Adjusted EBITDA is anticipated to be $74-$80 million. The variable marketing margin is expected to be between $275 million and $285 million.

Conclusion

The company’s total revenues were affected mainly by the decline in Home, Consumer and Insurance segment revenues. Nonetheless, TREE has been focused on expense management. It also ensures maintaining the balance between its near-term profitability and aligning the same for long-term success.

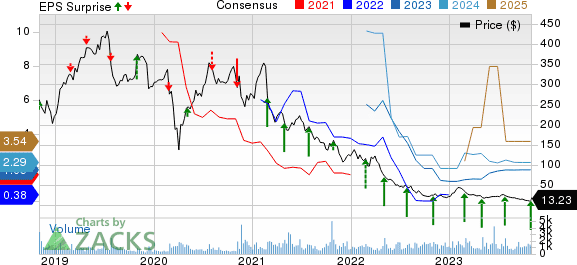

LendingTree, Inc. Price, Consensus and EPS Surprise