Whirlpool Corporation (WHR Quick QuoteWHR – Free Report) posted third-quarter 2023 results, wherein sales and earnings beat the Zacks Consensus Estimate. The company’s top and bottom lines also improved year over year. Results were impacted by market share growth, strong replacement and builder demand in North America, and gains from cost takeout actions, offset by an unfavorable price/mix in some regions.

However, the company lowered its 2023 earnings view toward the low end of the prior guidance.

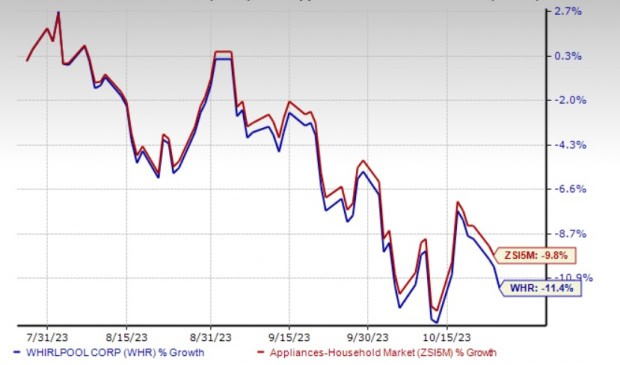

We note that shares of Whirlpool declined 5.3% in the after-hours trading session on Oct 25. This is likely to have resulted from the lowered earnings view for 2023. Shares of the Zacks Rank #4 (Sell) company have lost 11.4% in the past three months compared with the industry’s 9.8% decline.

Q3 Details

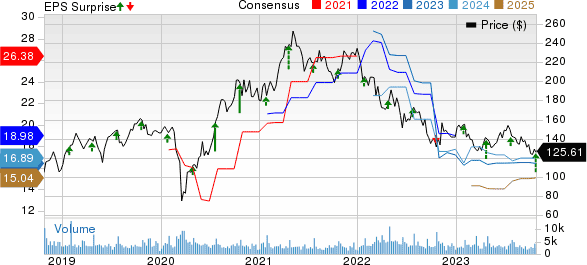

The appliance maker reported third-quarter adjusted earnings of $5.45 per share, surpassing the Zacks Consensus Estimate of $4.38 and up 21.4% from the year-ago quarter. Earnings per share also reflected sequential growth of 29.5%.

Net sales of $4,926 million beat the Zacks Consensus Estimate of $4,854 million and improved 3% from the year-ago quarter. Excluding the unfavorable impacts of foreign exchange, net sales were $4,844 million, up 1.3% year over year. Sales benefited from market share growth, and strong replacement and builder demand in North America. On a sequential basis, sales improved 2.8%.

The gross profit for third-quarter 2023 was $799 million, up 17.5% from the $680 million reported in the year-ago quarter. The gross margin improved 200 basis points (bps) year over year to 16.2%.

The ongoing EBIT of $322 million improved 21.5% from $265 million in the year-ago quarter. The ongoing EBIT margin of 6.5% expanded 100 bps year over year, backed by cost takeout endeavors. On a sequential basis, ongoing EBIT declined 8.5%.

In the quarter, the company’s cost takeout actions delivered a $300-million benefit on a year-over-year basis, driven by negating significant cost inflation from 2021 and 2022.

Whirlpool Corporation Price, Consensus and EPS Surprise

Regional Performances

Net sales for the North America segment rose 3.6% year over year and 5.4% sequentially to $2,977 million. Excluding currency, net sales improved 3.8% year over year, driven by market share gains and the integration of InSinkErator, offset by an adverse price/mix. The segment’s EBIT increased 5.7% year over year to $298 million, while the EBIT margin expanded 20 bps to 10% on gains from cost takeout initiatives and addition of InSinkErator, partially negated by an adverse price/mix. Sequentially, EBIT improved 2.8% due to favorable industry demand trends and cost takeout actions, offset by an adverse price/mix.

Net sales for the EMEA segment were down 4.4% year over year but up 1.1% sequentially to $863 million. Organic sales in the region dipped 11.1% year over year on persistent softness in demand trends in Europe, partly negated by a favorable price/mix. The segment’s EBIT of $1 million improved from the operating loss of $28 million reported in the year-ago quarter and declined 94.1% on a sequential basis. The EBIT margin was 0.1% against a negative 3.1% in the prior-year quarter, mainly benefiting from cost takeout actions and assets held for sale.

Net sales from Latin America rose 14.3% year over year and 4.6% sequentially to $857 million. Excluding currency, the segment’s sales rose 9.8% year over year due to market share gains, and industry recovery in Brazil and Mexico. The segment’s EBIT of $54 million advanced 35% year over year and 1.9% sequentially. The EBIT margin expanded 100 bps year over year to 6.3%, aided by cost takeout actions and increased volumes.

Net sales in Asia fell 11.2% year over year and 22.4% sequentially to $229 million. Excluding the currency impacts, sales for the region were down 8.4% due to negative consumer sentiment and soft demand trends. The segment’s EBIT of $5 million reflected a 58.3% plunge from the $12 million reported in the year-ago quarter. The segment’s EBIT margin of 2.2% contracted 250 bps from the prior-year quarter due to the adverse price/mix, partly negated by cost takeout actions. On a sequential basis, EBIT declined 54.5%.

Other Financial Details

As of Sep 30, 2023, Whirlpool used cash of $322 million from operating activities. It reported a free cash outflow of $660 million. WHR incurred a capital expenditure of $338 million in the same period.

The company returned $290 million in cash to shareholders as dividends in the first nine months of 2023.

Outlook

For 2023, Whirlpool reaffirmed its expectations for 2023 sales and revised its earnings per share guidance. It forecasts net sales of $19.4 billion for 2023, suggesting a 1-2% decline from the prior-year actual.

On a GAAP and ongoing basis, Whirlpool expects earnings per share of $9.00 and $16.00, respectively. Earlier, the company expected earnings per share, on a GAAP and ongoing basis, of $13.00-$15.00 and $16.00-$18.00, respectively.

Management anticipates a GAAP tax rate of 0-5% for 2023 compared with the 15-20% mentioned earlier. The adjusted tax rate is expected to be (5)-0% for 2023 compared with the 10-15% stated earlier.

For 2023, Whirlpool expects cash provided by operating activities of $1.1 billion and a free cash flow of $500 million.

Management is on track with its cost takeout actions and expects $800 million cost takeout related to gains from the ongoing measures and eased raw material inflation.