BankUnited, Inc. (BKU Quick QuoteBKU – Free Report) shares have lost 1.6% since its third-quarter 2023 results announced on Oct 19. Earnings per share of 63 cents missed the Zacks Consensus Estimate of 71 cents. The bottom line also declined 43.8% from the prior-year quarter.

Results were adversely impacted by an increase in non-interest expenses, lower deposit and loan balance and a decline in net interest income (NII). However, higher non-interest income acted as a tailwind.

Net income came in at $47 million, plunging 46.5% year over year. Our estimate for the metric was $50.9 million.

Revenues Fall & Expenses Rise

Net revenues were $242.6 million, declining 6.3% year over year. However, the top line surpassed the Zacks Consensus Estimate of $239 million.

NII was $214.8 million, decreasing 8.9% year over year. The decline was due to higher interest expenses. Net interest margin (NIM) shrunk 20 basis points (bps) year over year to 2.56%. Our estimates for NII and NIM were $220.4 million and 2.51%, respectively.

Non-interest income of $27.7 million was up 20.2%. The increase was mainly due to a rise in net gain on investment securities, lease financing and other non-interest income. We had projected non-interest income to be $18 million on the back of an uncertain operating backdrop. However, an improvement in the operating environment in the quarter seems to have helped the company report higher numbers.

Non-interest expenses grew 6.5% to $141.1 million. The increase was mainly due to the rise in employee compensation and benefits costs, deposit insurance expenses and other non-interest expenses. Our estimate for non-interest expenses was $145.2 million.

As of Sep 30, 2023, net loans were $24.2 billion compared with $24.7 billion as of Dec 31, 2022. Total deposits amounted to $26.1 billion, down from $27.5 billion at the end of December 2022. Our estimates for net loans and total deposits were $24.8 billion and $26.7 billion, respectively.

Credit Quality: A Mixed Bag

In the reported quarter, the company recorded a provision of credit losses worth $33 million, up significantly from $3.7 million in the prior-year quarter.

As of Sep 30, 2023, the ratio of net charge-offs to average loans was 0.07%, down 15 bps from the Dec 31, 2022 level.

Capital Ratios Improve & Profitability Ratios Deteriorate

As of Sep 30, 2023, the Tier 1 leverage ratio was 7.9%, up from 7.5% as of Dec 31, 2022. Common Equity Tier 1 risk-based capital ratio was 11.4%, up from 11%. The total risk-based capital ratio was 13.4%, up from 12.7% as of Dec 31, 2022.

At the end of the third quarter, the return on average assets was 0.52%, down from 0.96% in the year-earlier quarter. Return on average stockholders’ equity was 7.2%, down from 13.5%.

Share Repurchase Update

During the reported quarter, the company did not repurchase any shares.

Our View

BankUnited’s efforts to grow organically, driven by higher fee income, is expected to support financials. However, higher expenses and a fall in NII are major concerns. Further, any deterioration in the balance sheet might affect its financials.

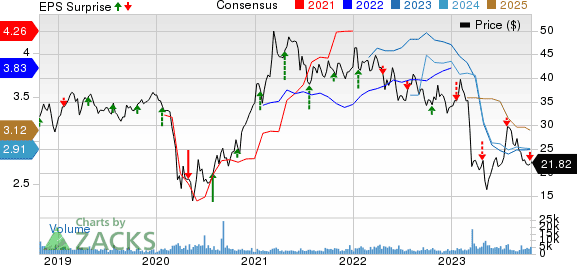

BankUnited, Inc. Price, Consensus and EPS Surprise

Texas Capital Bancshares, Inc. (TCBI Quick QuoteTCBI – Free Report) reported third-quarter 2023 earnings per share of $1.18, surpassing the Zacks Consensus Estimate of $1.03. Also, the bottom line reflects a rise of 59.5% from the prior-year quarter.

TCBI’s results were aided by a rise in non-interest income and lower expenses. Also, the NIM improved year over year on higher rates. However, a fall in NII and higher provisions hurt results to some extent. Further, the quarter witnessed a decline in loan balance.

East West Bancorp (EWBC Quick QuoteEWBC – Free Report) reported its third-quarter 2023 earnings per share of $2.02 surpassed the Zacks Consensus Estimate by a penny. However, the bottom line declined 2.9% from the prior-year quarter.

Results were primarily aided by higher NII and non-interest income. The company also witnessed a rise in loan balances in the quarter. However, an increase in expenses and higher provisions were the undermining factors for EWBC.