BILL (NYSE:BILL – Get Free Report)’s stock had its “buy” rating reiterated by analysts at Needham & Company LLC in a research note issued on Monday, Benzinga reports. They presently have a $200.00 target price on the stock. Needham & Company LLC’s target price suggests a potential upside of 84.21% from the stock’s previous close.

BILL has been the topic of several other research reports. Canaccord Genuity Group reaffirmed a “buy” rating and issued a $175.00 price target on shares of BILL in a research note on Friday, August 18th. Susquehanna upped their price target on BILL from $115.00 to $160.00 and gave the company a “positive” rating in a research note on Tuesday, July 18th. Citigroup upped their price target on BILL from $110.00 to $128.00 and gave the company a “buy” rating in a research note on Friday, August 25th. The Goldman Sachs Group increased their target price on BILL from $115.00 to $136.00 in a research note on Thursday, July 13th. Finally, Robert W. Baird decreased their target price on BILL from $140.00 to $120.00 in a research note on Friday, August 18th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and fifteen have given a buy rating to the company’s stock. According to data from MarketBeat, the stock has a consensus rating of “Moderate Buy” and an average price target of $135.50.

BILL Stock Up 4.1 %

Shares of BILL opened at $108.57 on Monday. The company has a debt-to-equity ratio of 0.42, a quick ratio of 1.78 and a current ratio of 1.78. BILL has a one year low of $68.30 and a one year high of $154.12. The stock has a market capitalization of $11.57 billion, a price-to-earnings ratio of -51.21 and a beta of 1.94. The stock has a 50 day moving average price of $111.08 and a 200 day moving average price of $101.89.

BILL (NYSE:BILL – Get Free Report) last released its quarterly earnings data on Thursday, August 17th. The company reported $0.10 earnings per share for the quarter, topping analysts’ consensus estimates of ($0.23) by $0.33. The company had revenue of $295.98 million for the quarter, compared to analyst estimates of $279.58 million. BILL had a negative return on equity of 3.08% and a negative net margin of 21.14%. Equities research analysts forecast that BILL will post -0.53 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other BILL news, CEO Rene A. Lacerte sold 39,235 shares of the stock in a transaction that occurred on Friday, September 1st. The stock was sold at an average price of $116.92, for a total transaction of $4,587,356.20. Following the completion of the sale, the chief executive officer now directly owns 76,414 shares of the company’s stock, valued at approximately $8,934,324.88. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, SVP Germaine Cota sold 890 shares of the firm’s stock in a transaction that occurred on Tuesday, August 29th. The stock was sold at an average price of $108.94, for a total value of $96,956.60. Following the completion of the transaction, the senior vice president now directly owns 3,647 shares of the company’s stock, valued at approximately $397,304.18. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Rene A. Lacerte sold 39,235 shares of the firm’s stock in a transaction on Friday, September 1st. The stock was sold at an average price of $116.92, for a total value of $4,587,356.20. Following the transaction, the chief executive officer now directly owns 76,414 shares of the company’s stock, valued at approximately $8,934,324.88. The disclosure for this sale can be found here. In the last ninety days, insiders sold 65,683 shares of company stock valued at $7,468,601. 5.00% of the stock is owned by company insiders.

Hedge Funds Weigh In On BILL

Hedge funds have recently bought and sold shares of the stock. Lindbrook Capital LLC grew its position in shares of BILL by 64.8% in the second quarter. Lindbrook Capital LLC now owns 234 shares of the company’s stock valued at $27,000 after purchasing an additional 92 shares during the period. Arcadia Investment Management Corp MI acquired a new position in BILL in the first quarter valued at $32,000. BI Asset Management Fondsmaeglerselskab A S boosted its holdings in BILL by 227.0% in the first quarter. BI Asset Management Fondsmaeglerselskab A S now owns 399 shares of the company’s stock valued at $32,000 after acquiring an additional 277 shares during the last quarter. Quarry LP boosted its holdings in BILL by 173.4% in the first quarter. Quarry LP now owns 391 shares of the company’s stock valued at $32,000 after acquiring an additional 248 shares during the last quarter. Finally, Brown Brothers Harriman & Co. acquired a new position in BILL in the first quarter valued at $38,000.

About BILL

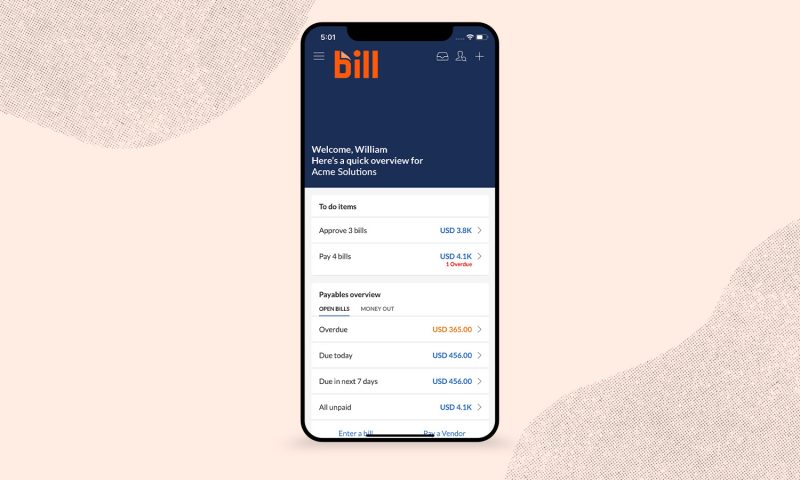

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.