Ionis Pharmaceuticals (NASDAQ:IONS – Get Free Report) had its price objective upped by analysts at Morgan Stanley from $42.00 to $45.00 in a report issued on Wednesday, Benzinga reports. The firm currently has an “equal weight” rating on the stock. Morgan Stanley’s price target would indicate a potential downside of 4.86% from the stock’s previous close.

A number of other equities analysts have also commented on IONS. Needham & Company LLC reaffirmed a “buy” rating and issued a $60.00 price target on shares of Ionis Pharmaceuticals in a report on Wednesday. StockNews.com started coverage on Ionis Pharmaceuticals in a report on Thursday, August 17th. They set a “hold” rating for the company. Finally, Citigroup upgraded shares of Ionis Pharmaceuticals from a “neutral” rating to a “buy” rating and raised their price objective for the company from $36.00 to $60.00 in a research report on Monday, July 31st. One research analyst has rated the stock with a sell rating, four have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Ionis Pharmaceuticals presently has an average rating of “Hold” and a consensus target price of $48.10.

Ionis Pharmaceuticals Stock Performance

Shares of NASDAQ:IONS traded up $1.02 during midday trading on Wednesday, reaching $47.30. The company had a trading volume of 193,832 shares, compared to its average volume of 1,035,997. The stock has a market cap of $6.78 billion, a P/E ratio of -21.80 and a beta of 0.51. The company’s 50 day moving average price is $40.77 and its 200 day moving average price is $39.18. The company has a current ratio of 9.09, a quick ratio of 9.00 and a debt-to-equity ratio of 3.07. Ionis Pharmaceuticals has a 52-week low of $32.69 and a 52-week high of $47.74.

Ionis Pharmaceuticals (NASDAQ:IONS – Get Free Report) last released its earnings results on Wednesday, August 9th. The company reported $0.60 earnings per share for the quarter, beating analysts’ consensus estimates of ($0.94) by $1.54. Ionis Pharmaceuticals had a negative net margin of 48.81% and a negative return on equity of 59.17%. The firm had revenue of $188.00 million during the quarter, compared to the consensus estimate of $136.84 million. As a group, sell-side analysts anticipate that Ionis Pharmaceuticals will post -3.35 EPS for the current fiscal year.

Insider Activity at Ionis Pharmaceuticals

In other Ionis Pharmaceuticals news, CEO Brett P. Monia sold 18,650 shares of the stock in a transaction that occurred on Friday, July 7th. The shares were sold at an average price of $42.25, for a total transaction of $787,962.50. Following the transaction, the chief executive officer now directly owns 121,724 shares in the company, valued at $5,142,839. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, Director Joseph Klein III sold 3,555 shares of the firm’s stock in a transaction that occurred on Tuesday, July 18th. The stock was sold at an average price of $42.00, for a total transaction of $149,310.00. Following the transaction, the director now directly owns 20,346 shares in the company, valued at approximately $854,532. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, CEO Brett P. Monia sold 18,650 shares of the firm’s stock in a transaction that occurred on Friday, July 7th. The stock was sold at an average price of $42.25, for a total transaction of $787,962.50. Following the completion of the transaction, the chief executive officer now owns 121,724 shares in the company, valued at approximately $5,142,839. The disclosure for this sale can be found here. In the last three months, insiders have sold 22,862 shares of company stock valued at $964,242. Corporate insiders own 2.65% of the company’s stock.

Hedge Funds Weigh In On Ionis Pharmaceuticals

A number of hedge funds have recently modified their holdings of IONS. Whittier Trust Co. of Nevada Inc. increased its holdings in Ionis Pharmaceuticals by 173.9% during the 1st quarter. Whittier Trust Co. of Nevada Inc. now owns 934 shares of the company’s stock valued at $33,000 after purchasing an additional 593 shares during the period. Almanack Investment Partners LLC. purchased a new stake in Ionis Pharmaceuticals in the third quarter worth about $44,000. Quantbot Technologies LP bought a new stake in Ionis Pharmaceuticals during the 2nd quarter valued at approximately $44,000. Captrust Financial Advisors lifted its stake in shares of Ionis Pharmaceuticals by 21.1% in the 2nd quarter. Captrust Financial Advisors now owns 1,429 shares of the company’s stock valued at $53,000 after purchasing an additional 249 shares during the period. Finally, China Universal Asset Management Co. Ltd. boosted its position in shares of Ionis Pharmaceuticals by 34.2% during the first quarter. China Universal Asset Management Co. Ltd. now owns 1,937 shares of the company’s stock valued at $69,000 after purchasing an additional 494 shares in the last quarter. Hedge funds and other institutional investors own 93.86% of the company’s stock.

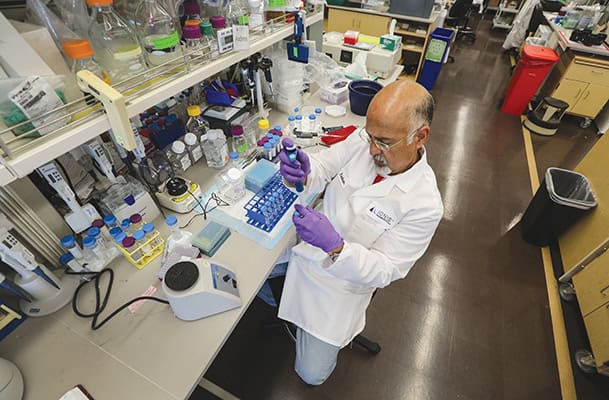

About Ionis Pharmaceuticals

Ionis Pharmaceuticals, Inc discovers and develops RNA-targeted therapeutics in the United States. The company offers SPINRAZA for spinal muscular atrophy (SMA) in pediatric and adult patients; TEGSEDI, an antisense injection for the treatment of polyneuropathy caused by hereditary transthyretin amyloidosis in adults; and WAYLIVRA, an antisense medicine for treatment for familial chylomicronemia syndrome (FCS) and familial partial lipodystrophy.