Lovesac (NASDAQ:LOVE – Get Free Report)’s stock had its “buy” rating reaffirmed by stock analysts at Roth Mkm in a note issued to investors on Friday, Benzinga reports. They currently have a $37.00 target price on the stock. Roth Mkm’s target price would indicate a potential upside of 45.44% from the stock’s current price.

Lovesac Stock Up 11.0 %

Shares of Lovesac stock traded up $2.52 during trading on Friday, reaching $25.44. The company’s stock had a trading volume of 517,457 shares, compared to its average volume of 428,212. Lovesac has a 52 week low of $17.60 and a 52 week high of $30.93. The firm has a market cap of $387.20 million, a PE ratio of 18.71, a P/E/G ratio of 0.34 and a beta of 2.46. The business’s 50-day moving average price is $26.21 and its 200-day moving average price is $25.96.

Lovesac (NASDAQ:LOVE – Get Free Report) last issued its quarterly earnings results on Wednesday, June 7th. The company reported ($0.28) earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of ($0.39) by $0.11. The business had revenue of $141.20 million for the quarter, compared to the consensus estimate of $133.73 million. Lovesac had a return on equity of 12.52% and a net margin of 3.33%. The firm’s quarterly revenue was up 9.1% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.12 earnings per share. Equities analysts predict that Lovesac will post 1.88 earnings per share for the current year.

Institutional Trading of Lovesac

A number of institutional investors and hedge funds have recently made changes to their positions in LOVE. Premier Fund Managers Ltd raised its position in Lovesac by 86.1% during the fourth quarter. Premier Fund Managers Ltd now owns 108,500 shares of the company’s stock valued at $7,703,000 after purchasing an additional 50,202 shares in the last quarter. Kornitzer Capital Management Inc. KS raised its holdings in shares of Lovesac by 3.2% during the 1st quarter. Kornitzer Capital Management Inc. KS now owns 281,799 shares of the company’s stock worth $8,144,000 after buying an additional 8,627 shares in the last quarter. Jump Financial LLC bought a new stake in shares of Lovesac during the 1st quarter worth $2,028,000. Merit Financial Group LLC acquired a new stake in Lovesac in the first quarter valued at about $257,000. Finally, Avantax Planning Partners Inc. bought a new position in Lovesac in the first quarter valued at about $211,000.

About Lovesac

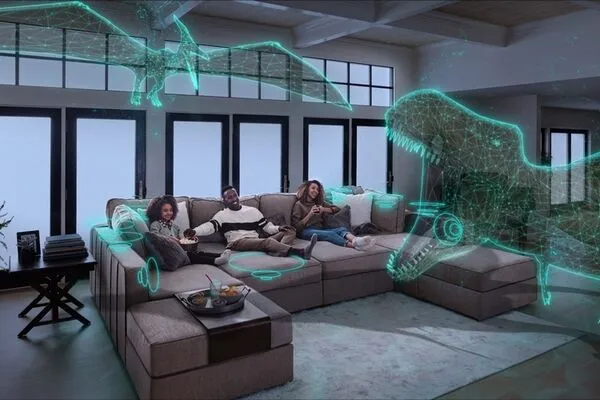

The Lovesac Company designs, manufactures, and sells furniture. It offers sactionals, such as seats and sides; sacs, including foam beanbag chairs; and other products comprising drink holders, footsac blankets, decorative pillows, fitted seat tables, and ottomans. The company markets its products primarily through lovesac.com website, as well as showrooms at top tier malls, lifestyle centers, mobile concierges, kiosks, and street locations in 40 states of the United States; and in store pop-up- shops and shop-in-shops.