Critical information for the U.S. trading day

Wall Street looks ready to build on Monday’s gains, the first in five sessions for the S&P 500 and Nasdaq Composite . That’s as expectations build around Nvidia, which has had a lackluster August, to knock it out of the park with earnings on Wednesday.

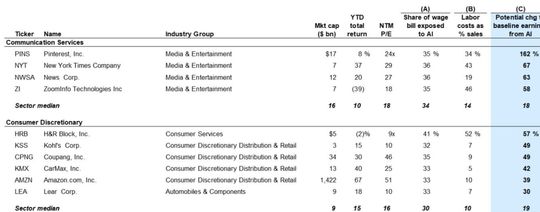

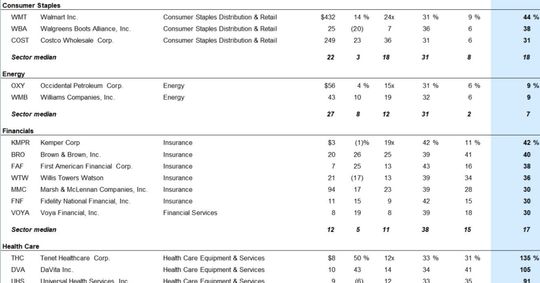

Investors have had months to focus on AI darlings such as Nvidia. In our call of the day, Goldman Sachs takes a look at stocks to trade after the big AI trade. A team led by strategists Ryan Hammond and David Kostin complied a basket of companies with the biggest potential long-term earnings per share boost from the impact of AI adoption on labor productivity.

Their analysis indicates that following widespread AI adoption, EPS for the median stock in that basket could be 72% higher than the baseline, versus 19% for the median Russell 1000 stock.

“We estimate the potential productivity-related EPS boost from increased revenues or increased margins, using a combination of company-level estimates of the share of the wage bill exposed to AI automation and the labor cost to revenue ratio,” said the Goldman team.

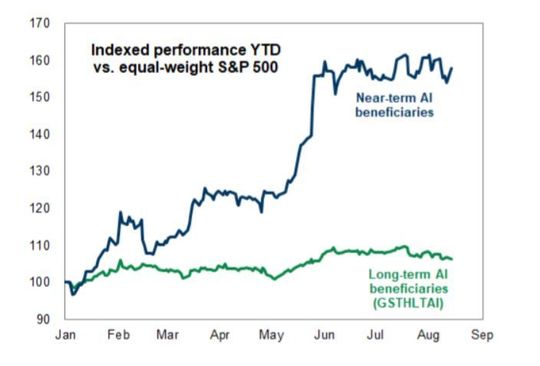

Since early 2023, when AI emerged as a theme for investors, they note their long-term basket of stocks has outperformed the equal-weight S&P 500 by just 6 percentage points, far less than near-term beneficiaries such as Nvidia NVDA, Microsoft MSFT or Meta META.

“The estimated AI-driven earnings boost is likely to occur over the next few years, but should be reflected in stock valuations sooner. However, the eventual share price impact will depend on the ability of companies to use AI to enhance earnings,” said Goldman.

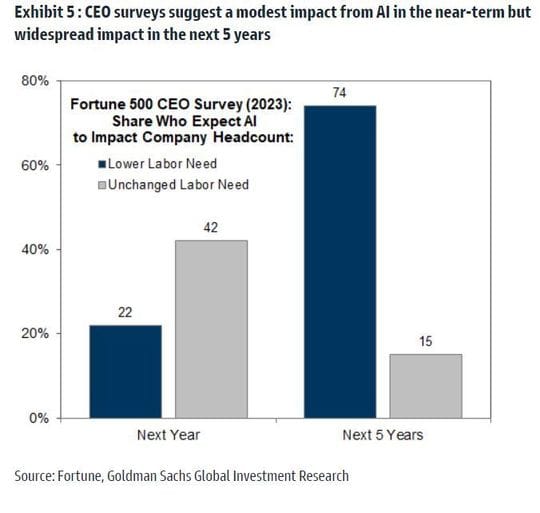

While unable to pin it exactly, Goldman expects AI adoption will start to a have a “meaningful macro impact” between 2025 and 2030, with regulatory constraints and data privacy concerns likely to slow widespread adoption. Nearly 75% of CEOs see AI take-up impacting companies or cutting labor needs within the next five years, even if they don’t right now.

Firms with the biggest workforce exposure to AI and larger and more innovative ones, will likely adopt generative AI earlier than others, say the strategists. They say to “expect valuation multiples for these companies to increase first as the adoption timeline crystallizes, even if actual adoption and the associated EPS boost is occur later.”

Goldman’s estimates on the potential earnings boost for those long-term AI beneficiaries consist of several factors: the share of each company’s wage bill exposed to AI automation, how much of a company’s wage bill is exposed to AI automation and labor cost as a share of revenue.

“For the typical Russell 1000 stock, 33% of the wage bill is potentially exposed to AI automation and labor costs currently represent 14% of total sales. The potential boost from higher sales would increase earnings by 11% and reduced labor costs would increase earnings by 26%, all else equal,” say the strategists.

Here is a taster of their long-term AI beneficiaries basket:

The markets

U.S. stocks are trading mixed. The yield on the 10-year Treasury is steady at 4.33%.

The buzz

Microsoft MSFT has proposed a Ubisoft license to win U.K. regulatory approval for its Activision Blizzard ATVI buyout. Activision shares and Ubisoft FR:UBI surged in Paris.

On the heels of a 7% surge, EV-maker Tesla TSLA is up 1.8%.

Lowe’s shares LOW are up after the DIY retailer’s earnings topped expectations, though it notes lower discretionary demand.

Among Monday’s late earnings news: Fabrinet FN is up 18% after the high-tech manufacturing services company upbeat forecast, with new AI products helping drive results. Videoconferencing group Zoom Video Communications ZM is up 4% after reporting an earnings jump and guidance.

The world’s biggest miner BHP BHP reported a 58% slump in annual profit amid tumbling commodity prices in part due to China’s economic troubles. U.S.-listed shares are up 4%.

Arm Holdings filed its long-awaited IPO, which could be the year’s biggest. The chip designer aims to raise up to $10 billion with a valuation of $60 billion to $70 billion.

Existing home sales for July are due at 10 a.m., with several Fed speakers throughout the day: Richmond Fed President Tom Barkin at 7:30 a.m. and Chicago Fed President Austan Goolsbee and Fed. Gov. Michelle Bowman both at 2:30 p.m.