WealthPLAN Partners LLC lifted its position in shares of Ball Co. (NYSE:BALL – Free Report) by 26.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 15,228 shares of the company’s stock after purchasing an additional 3,139 shares during the period. WealthPLAN Partners LLC’s holdings in Ball were worth $839,000 at the end of the most recent quarter.

A number of other large investors also recently made changes to their positions in the company. Kentucky Retirement Systems Insurance Trust Fund bought a new position in shares of Ball during the first quarter valued at about $616,000. Pictet Asset Management SA lifted its position in shares of Ball by 0.6% during the first quarter. Pictet Asset Management SA now owns 145,373 shares of the company’s stock valued at $8,012,000 after purchasing an additional 867 shares in the last quarter. Tredje AP fonden lifted its position in shares of Ball by 4.8% during the first quarter. Tredje AP fonden now owns 66,566 shares of the company’s stock valued at $3,668,000 after purchasing an additional 3,027 shares in the last quarter. Palisade Asset Management LLC lifted its position in shares of Ball by 2.7% during the first quarter. Palisade Asset Management LLC now owns 157,607 shares of the company’s stock valued at $8,686,000 after purchasing an additional 4,125 shares in the last quarter. Finally, Mitsubishi UFJ Trust & Banking Corp raised its position in Ball by 4.6% in the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 210,763 shares of the company’s stock worth $11,615,000 after acquiring an additional 9,351 shares during the period. 86.04% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several analysts have commented on the stock. Wells Fargo & Company raised shares of Ball from an “underweight” rating to an “equal weight” rating and lifted their price objective for the stock from $52.00 to $55.00 in a research report on Tuesday, June 20th. Jefferies Financial Group lifted their price objective on shares of Ball from $59.00 to $61.00 in a research report on Tuesday, July 18th. Mizuho lifted their price objective on shares of Ball from $58.00 to $59.00 in a research report on Tuesday, April 18th. JPMorgan Chase & Co. lowered their price objective on shares of Ball from $57.00 to $56.00 and set a “neutral” rating on the stock in a research report on Thursday, August 10th. Finally, Citigroup lifted their target price on shares of Ball from $60.00 to $63.00 and gave the stock a “neutral” rating in a research note on Friday, August 4th. Ten investment analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to MarketBeat, Ball presently has a consensus rating of “Hold” and a consensus price target of $57.60.

Ball Price Performance

BALL stock traded up $0.21 during midday trading on Wednesday, reaching $55.72. The company had a trading volume of 68,014 shares, compared to its average volume of 1,755,721. The company has a debt-to-equity ratio of 1.92, a current ratio of 0.78 and a quick ratio of 0.50. Ball Co. has a 1 year low of $46.00 and a 1 year high of $62.16. The company has a market capitalization of $17.56 billion, a P/E ratio of 22.03, a P/E/G ratio of 3.75 and a beta of 0.80. The firm has a 50-day moving average price of $56.68 and a 200-day moving average price of $55.31.

Ball (NYSE:BALL – Get Free Report) last released its quarterly earnings results on Thursday, August 3rd. The company reported $0.61 EPS for the quarter, topping analysts’ consensus estimates of $0.59 by $0.02. Ball had a net margin of 5.48% and a return on equity of 21.43%. The business had revenue of $3.57 billion during the quarter, compared to analysts’ expectations of $3.84 billion. During the same quarter in the previous year, the company earned $0.82 EPS. The business’s quarterly revenue was down 13.7% compared to the same quarter last year. On average, research analysts anticipate that Ball Co. will post 3.02 earnings per share for the current fiscal year.

Ball Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, September 15th. Stockholders of record on Friday, September 1st will be issued a $0.20 dividend. The ex-dividend date of this dividend is Thursday, August 31st. This represents a $0.80 dividend on an annualized basis and a dividend yield of 1.44%. Ball’s payout ratio is 31.75%.

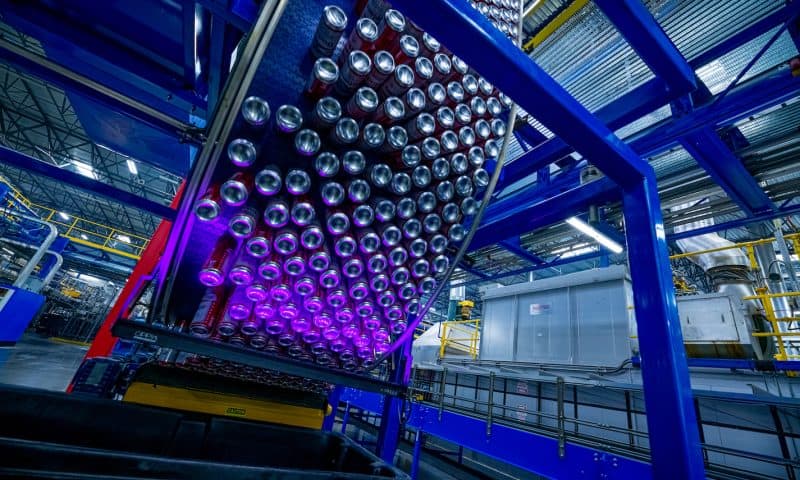

Ball Profile

Ball Corp. provides metal packaging for beverages, foods, and household products. It operates through the following business segments: Beverage Packaging North and Central America, Beverage Packaging South America, Beverage Packaging Europe, Middle East and Africa (EMEA), and Aerospace. The Beverage Packaging North and Central America segment includes multi-year supply contracts to fillers of carbonated soft drinks, beer, energy drinks, and other beverages.