Virgin Galactic (NYSE:SPCE – Get Free Report) will release its earnings data after the market closes on Tuesday, August 1st. Analysts expect Virgin Galactic to post earnings of ($0.51) per share for the quarter. Persons that wish to register for the company’s earnings conference call can do so using this link.

Virgin Galactic (NYSE:SPCE – Get Free Report) last posted its quarterly earnings results on Tuesday, May 9th. The company reported ($0.57) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.50) by ($0.07). Virgin Galactic had a negative return on equity of 107.33% and a negative net margin of 23,751.78%. The business had revenue of $0.39 million during the quarter, compared to the consensus estimate of $1.32 million. During the same quarter in the previous year, the business posted ($0.36) earnings per share. The company’s quarterly revenue was up 296.5% compared to the same quarter last year. On average, analysts expect Virgin Galactic to post $-2 EPS for the current fiscal year and $-2 EPS for the next fiscal year.

Virgin Galactic Stock Down 1.4 %

SPCE stock opened at $3.78 on Tuesday. The stock has a market cap of $1.07 billion, a PE ratio of -1.80 and a beta of 1.10. The company has a quick ratio of 4.70, a current ratio of 4.82 and a debt-to-equity ratio of 1.13. The firm’s 50-day simple moving average is $4.15 and its 200 day simple moving average is $4.42. Virgin Galactic has a fifty-two week low of $2.98 and a fifty-two week high of $8.56.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the company. Canada Pension Plan Investment Board boosted its holdings in shares of Virgin Galactic by 177.5% in the first quarter. Canada Pension Plan Investment Board now owns 2,586 shares of the company’s stock worth $25,000 after buying an additional 1,654 shares during the period. Federated Hermes Inc. boosted its holdings in shares of Virgin Galactic by 337.6% in the first quarter. Federated Hermes Inc. now owns 5,138 shares of the company’s stock worth $51,000 after buying an additional 3,964 shares during the period. Toroso Investments LLC acquired a new position in shares of Virgin Galactic in the first quarter worth about $99,000. Apollon Wealth Management LLC acquired a new position in shares of Virgin Galactic in the first quarter worth about $41,000. Finally, Steward Partners Investment Advisory LLC boosted its holdings in shares of Virgin Galactic by 531.0% in the first quarter. Steward Partners Investment Advisory LLC now owns 10,254 shares of the company’s stock worth $42,000 after buying an additional 8,629 shares during the period. 34.63% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities analysts have commented on the stock. Susquehanna raised their target price on shares of Virgin Galactic from $3.00 to $3.75 in a research note on Thursday, May 11th. Alembic Global Advisors upgraded shares of Virgin Galactic from an “underweight” rating to a “neutral” rating and set a $4.75 price objective for the company in a research report on Wednesday, June 14th. Four research analysts have rated the stock with a sell rating and five have assigned a hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of “Hold” and a consensus target price of $5.05.

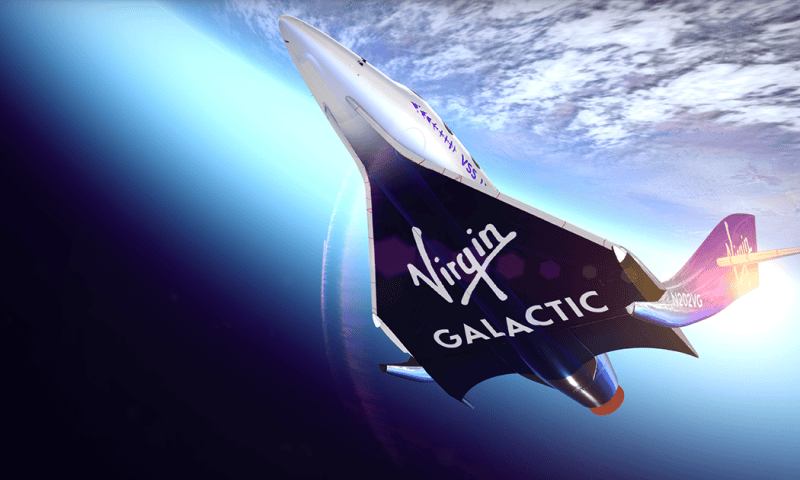

Virgin Galactic Company Profile

Virgin Galactic Holdings, Inc focuses on the development, manufacture, and operation of spaceships and related technologies for conducting commercial human spaceflight and flying commercial research and development payloads into space. It is also involved in the ground and flight testing, and post-flight maintenance of its spaceflight system vehicles.