Critical information for the U.S. trading day

The reweighting of the Nasdaq 100 and the expiration of some $2 trillion worth of options is out of the way. Now it’s time for an onslaught of earnings, as well as rate decisions from the Fed, European Central Bank and Bank of Japan, before the summer really gets into sleepy territory.

It feels like every week there’s an apology of sorts from Morgan Stanley, whose analysts have been surprised by the stock market’s strength this year, which to date has sent the S&P 500 SPX, +0.40% up 18% and the Nasdaq Composite COMP, +0.19% soaring by 34%.

Chief cross-asset strategist Andrew Sheets points out that forward earnings estimates for both global equities, as measured by the MSCI All-County World Index, and the U.S., as measured by the S&P 500, haven’t risen all year. That means the entirety of gains have been driven by higher valuations. Over the last 25 years, he notes, only twice has there been stronger gains in multiples, and both those times, in 2009 and 2020, there were deep recessions met by enormous monetary easing, which supported the case that valuations should rise ahead of an eventual rebound.

Sheets also looked at 1998 and 2019, when multiples rose despite a shrinking Fed balance sheet and falling earnings per share. But core inflation then was about 2%. “Coincidentally, both 1998 and 2019 saw markets trade poorly in August-September, and multiple Fed rate cuts in the back half of the year,” he says.

But the really weird stuff is happening in capital structure, Sheets says, where there’s higher returns on senior debt structures than on the more junior exposures, what he calls unusually upside down.

For example, the yield on investment-grade corporate bonds, of 5.4%, is higher than the forward earnings yield for the Russell 1000, of 4.8% — it’s only been more extreme than that 2% of the time over the last 20 years. Similarly the yield on U.S. investment-grade real estate investment trusts, of 5.8%, is above the average U.S. commercial real estate cap rate, or the underlying real estate yield, of 5.4%. The difference between the yield on a collateralized loan obligation’s collateral and the weighted cost of its liabilities is in the 7th percentile of the last decade, in both the U.S. and Europe.

Sheets acknowledges there are different stories behind these inversions of sorts, and it makes sense for debt to be expensive to its underlying asset if growth is strong. “But this compression, and even flipping, of the capital structure suggests that growth expectations have now moved a long way since the start of the year. Across scenarios where growth stays solid, or slows, we think that debt generally offers better risk/reward, particularly when this capital structure compression provides increasing economic incentives to de-lever,” he says.

The markets

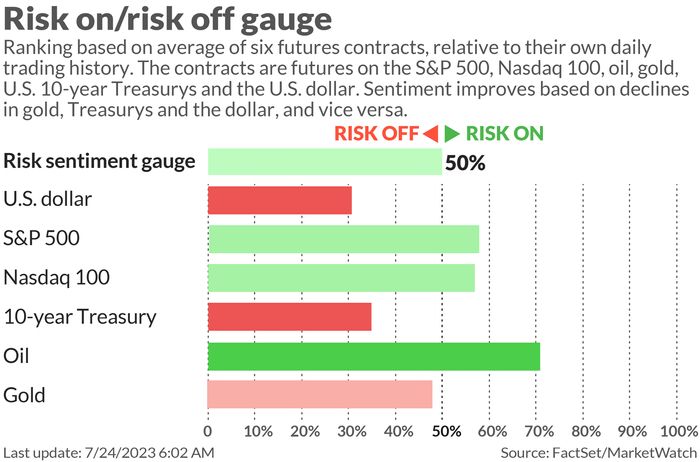

U.S. stock futures ES00, -0.05% NQ00, -0.04% edged higher. The dollar DXY, -0.03% was stronger in reaction to disappointing data out of Europe and the U.K.. Crude futures CL00, 0.20% were trading just under $78 per barrel.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

AMC Entertainment AMC, +32.95% submitted a revised proposal for its stock conversion plan after a judge rejected a settlement late on Friday, sending its stock up by some 60%.

Warner Bros. Discovery’s WBD, -2.47% “Barbie” saw $155 million in ticket sales from North American theaters, while Comcast’s CMCSA, +0.93% “Oppenheimer” registered $80.5 million — the strongest combination of movie openings on record.

Tesla TSLA, +3.48% was downgraded to neutral from buy at UBS, which says new launches won’t help the company’s results over the next 12 months.

Chevron CVX, +1.97% said its earnings were stronger than forecast as it said long-time CFO Pierre Breber was retiring, while waiving the retirement age for 62-year-old CEO Mike Wirth.

The flash readings of S&P’s manufacturing and services PMIs are due for release at 9:45 a.m. Eastern. The eurozone flash composite PMI fell to an eight-month low of 48.9.