Jefferies sees 2 reasons why stock-market rally could broaden out

The U.S. stock market made an impressive surge last week as a potential debt-ceiling deal and a flurry of robust first-quarter corporate earnings drove the S&P 500 to briefly trade above 4,200, a level that has proved stubborn resistance to the benchmark.

Investor sentiment that remains weak — a potential contrarian signal — and upward S&P 500 earnings-per-share revisions by Wall Street analysts suggest that the large-cap index could still have a tailwind to move higher, said an analysts at Jefferies Group.

Andrew Greenebaum, senior vice president of equity research product management at Jefferies, thinks the current market sentiment remains “fairly poor” with the AAII Bull-Bear Spread, which measures what investors feel the stock market will be in the next six months, at negative 17 as of Monday, which also suggests there will be room for the sentiment to move higher.

The indicator has been trending “better” in 2023 compared with 2022, Greenebaum said, but it is still “plenty negative and well off the April high of negative-2 and year-to-date high of 13 in February,” wrote Greenebaum in a Saturday note.

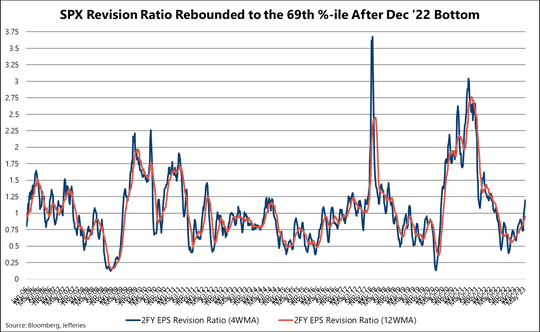

Meanwhile, revisions to the EPS of the S&P 500 show some cheerful signs as the EPS revision ratio for the large-cap index in the coming fiscal year is now over 1, which is a level that signifies upward revisions outnumber downward, said Greenebaum.

“The upshot is that in the wake of one of the most epic revisions ratio collapses observed in our data set, the SPX 2FY EPS revisions ratio marked a formal bottom in December 2022 and has been on the rise since,” said Greenebaum.

The EPS revision ratio crossing into “1” territory, as shown in the chart below, serves as another explanation for the recent rally in the S&P 500, and it could continue until market participants “get more cautious on [markets] fundamentals,” he said.

The S&P 500 index has traded near the 4,200 level many times since August 2022, but it never succeeded in holding above that critical turning point.

Contentious debt-ceiling talks and remarks by Fed officials robbed the index of a close above the 4,200-level on Friday, while on Monday it was standing just shy of 4,200 as President Joe Biden and House Speaker Kevin McCarthy were scheduled to meet in late afternoon to continue the debt-ceiling talks.

The week was off to a mixed start for equities on Monday, with the Dow Jones Industrial Average DJIA, -0.42% shedding 140 points, or 0.4%, to end at 33,286. The S&P 500 finished at 4,192, and the Nasdaq Composite COMP, +0.50% advanced 0.5%.