Kimbal Musk acquired shares through options and then sold them at much higher prices than what he paid

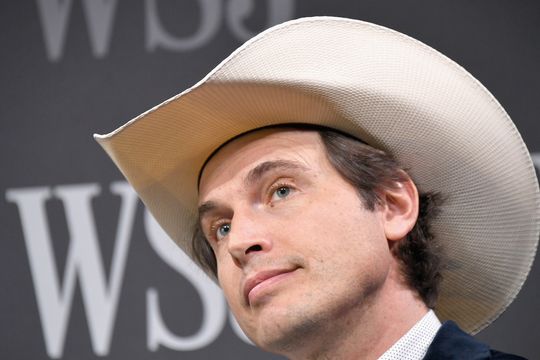

Kimbal Musk, a Tesla Inc. board member and the brother of Elon Musk, netted more than $17 million this week by exercising options and selling the shares for prices far higher than what he paid for them.

Musk acquired 100,000 shares through options for $24.73 apiece Monday, according to a filing with the Securities and Exchange Commission released late Wednesday. He then sold 100,000 shares of Tesla TSLA, -0.25% for average prices spanning from $192.280 to $202.520.

He paid $2.47 million to acquire the shares through options. Musk sold the 100,000 shares for $19.57 million in aggregate, bringing his net profit from the transactions to $17.1 million.

Musk arranged for these transactions Dec. 8 through a 10b5-1 trading plan, which lets company insiders like board members and executives arrange for stock sales, purchases, and other transactions to be executed under certain future conditions. The plans allow insiders to transact shares while avoiding the appearance that they’re trading based on current business information about the company.

Musk, who owns more than 1.6 million shares of Tesla, has exercised options and then sold the associated shares at numerous points in the past. Among other episodes, he pocketed $7.2 million doing so in April 2021 and followed that up with a series of November 2021 transactions that netted upward of $100 million.

Tesla shares have gained 51% so far this year, though they’re down 47% over a 12-month span, as the S&P 500 index SPX, +0.36% has declined 8.7%. The stock was inching 0.3% higher as of Thursday’s midday action.