Critical information for the U.S. trading day

The new quarter kicked off with a fresh shock for investors after several major oil producers decided to cut more than 1 million barrels of oil per day from circulation starting next month.

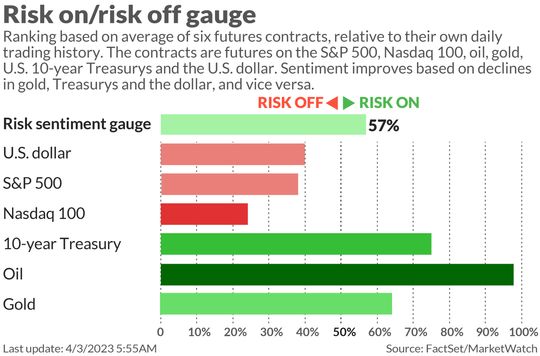

Unsurprisingly, crude prices are surging early Monday, simultaneously giving central bankers another hurdle in trying to keep a lid on inflation. What that means for risky assets remains to be seen, but Wall Street was already pretty cautious on prospects for stock returns this year.

Among the extra wary out there is JPMorgan, who in our call of the day says the risk of holding stocks, particularly in the U.S. where they advise an underweight, is no longer worth it.

“The main disconnect that the market will need to grapple with revolves around the hopes of a soft landing, without much pain to profits, labor or credit, but at the same time the expectation that inflation will come down quickly,” a team of strategists led by Mislav Matejka, head of global and European equity strategy at JP Morgan, tell clients in a Monday note.

They say it’s unclear whether the consensus view on the worst of pressures being behind the markets will be proved right. They note that impact of monetary tightening has historically worked with a lag, and a sustained rally has never been seen before the Fed has stopped hiking.

“Finally, to be positive on equities at this stage, one has to have a very bullish set of assumptions on growth/rates/China/politics etc, as there is an alternative, the main

risk-free rate is offering 5%, duration risk free,” they said.

The three-month U.S. Treasury bill BX:TMUBMUSD03M is currently yielding 4.747%, but was right at that 5% mark last month.

“All these are likely to contribute to our view that stocks are set to weaken for the

remainder of the year. We were bullish equities in [the fourth quarter], and we expected positive trading to spill over into [the first quarter] , but we believe one should be [underweight] stocks from here.” said Matejka.

The strategists don’t think the early-year activity upswing, fueled by Europe’s falling natural-gas prices and China’s reopening, will continue feeding gains.

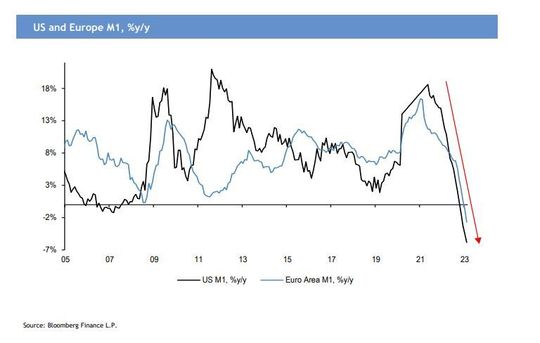

The most liquid money supply in an economy — M1 — is dropping in both Europe and the U.S., notes JPMorgan. BLOOMBERG/JPMORGAN

“Apart from potential renewed deterioration in fundamentals in [the second half], the curveballs could come from U.S. politics, U.S.-China relations and geopolitics,” they said.

profit margins will start to get stretched, with “pricing power likely to weaken from here. We think the mix will start to deteriorate, as inventories spike, and the operating leverage is set to turn negative, along with rising financial costs.”

Their preference is for international equities over the U.S. owing to a “significant valuation discount” and other key drivers, and despite a rush into tech lately, the sector won’t lead from here. They advised investors to close out shorts in tech last October.

Also there’s a sentiment issue, as they say from a very downbeat view six months ago, “investors are now net long the market, and the sentiment is near complacent.”

They are overweight the U.K, to take advantage of a “prolonged poor run” for stocks there, and Japan and like the eurozone due to attractive valuations. Also overall, they see defensives trading better from here.

The markets

Stocks have opened mixed, with the S&P 500 SPX and Nasdaq Composite COMP down, but Dow industrials DJIA up. U.S. crude CL is up over 5% at $79.91 a barrel, with a similar gain for Brent crude BRN00, which is trading above $84 a barrel. Gold prices GC00 are higher as the dollar DXY reversed directions. Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y are rising on inflation worries.

The buzz

Major oil companies — Exxon Mobil XOM, Chevron CVX, ConocoPhilips COP, BP BP and Shell SHEL — are climbing after those surprise production cuts from several members of the Organization of the Petroleum Exporting Countries and allies. The trigger for that was reportedly Saudi Arabia getting irked after a U.S. energy official ruled out replenishing the Strategic Petroleum Reserve last month.

Tesla TSLA shares are down 2% after the electric-vehicle maker said it delivered 422,875 vehicles in the first quarter, which was shy of the 432,000 analysts had predicted.

It’s a deals galore Monday. Extra Space Storage EXR has agreed to merge with Life Storage LSI in an all-stock deal with a total enterprise value of about $47 billion. Life Storage shares are up 4%, Extra Space stock is down 2%.

UFC parent company Endeavor Group EDR has agreed to combine with World Wrestling Entertainment WWE in a $21.4 billion deal. WWE shares are down over 4%, Endeavor shares are up 6%.

Heska HSKA stock is up 20% after Mars Inc. said it will buy the Loveland, Colo.-based veterinary diagnostics and technology company for $120 per share, or a premium of about 23% over Heska’s March 31 closing price.

UBS UBS CH:UBSG reportedly plans to cut 36,000 workers in the wake of its planned takeover for Credit Suisse. Separately, the Swiss public prosecutors office has opened a probe into the tie-up.

McDonald’s MCD will temporarily close corporate offices through Wednesday ahead of planned layoffs that are expected to arrive via email this week.

A busy week for economic data ends with the March jobs report, though markets will close for Good Friday. For Monday, the ISM manufacturing index and construction spending are due at 10 a.m., sandwiched by a couple of Fed speakers — St. Louis Fed President Bullard at 8:30 a.m. and Fed. Gov. Cook at 4:15 p.m.

A private gauge of China’s factory activity fell from an eight-month high, signaling moderation for the sector.