U.S. stocks closed mostly lower Wednesday to start March, after the release of weak economic data, a further rise in bond yields, and remarks by several Federal Reserve officials reiterated the need for higher interest rates to combat inflation.

How stocks traded

- The Dow Jones Industrial Average DJIA, +0.02% rose 5.14 points, or less than 0.1%, to end at 32,661.84.

- The S&P 500 SPX, -0.47% declined 18.76 points, or 0.5%, closing at 3,951.39.

- The Nasdaq Composite COMP, -0.66% dropped 76.06 points, or 0.7%, finishing at 11,379.48.

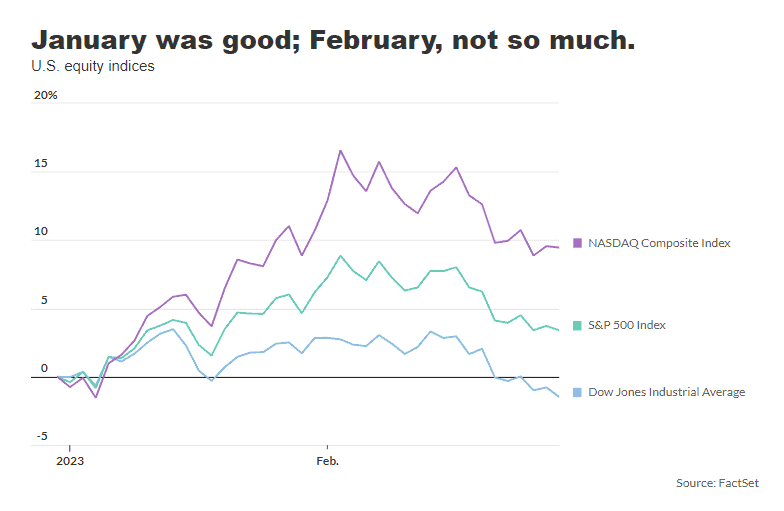

On Tuesday, stocks closed lower, adding to the Dow’s 4.2% decline in February and modest drop for 2023.

What drove markets

The S&P 500 and Nasdaq booked back-to-back losses on Wednesday following the release of weak economic data, a rise in bond yields, and several Federal Reserve officials reiterated the need for higher interest rates to combat inflation.

“The earnings season is almost over, and there’s not a whole lot of economic data this week,” said Randy Frederick, managing director of trading and derivatives at Schwab Center for Financial Research.

With the next Fed policy decision not until late March, he said investors will be left to fixate on every word from U.S. central bankers. “We know another rate hike isn’t for three weeks,” Frederick said. “The market is in a vacuum until then, and going to react to them a lot.”

Minneapolis Federal Reserve President Neel Kashkari said Wednesday that he hasn’t decided whether he will advocate for a 25-basis point or 50-basis point move at the central bank’s next interest-rate committee meeting later this month.

“I’m open minded at this point about whether its 25 basis points or 50 basis points,” Kashkari told business leaders in Sioux Falls, South Dakota.

Atlanta Fed President Raphael Bostic said the central bank needs to keep raising its policy interest rate until the target range is between 5% and 5.25%. The central bank’s target rate range is now between 4.5%-4.75%.

Economic data showed the Institute for Supply Management’s manufacturing survey edged up to 47.7% from 47.4% in prior month but numbers below 50% signal the manufacturing sector is contracting. The ISM report has been negative for the fourth month in a row, as manufacturers cut back on production to cope with a slower U.S. economy.

Meanwhile, the final number for S&P Global US Manufacturing PMI in February comes in at 47.3, compared with the preliminary number of 47.8.

The data arrived after a tough February for stock markets when worries that stubborn inflation would encourage central banks to keep raising interest rates pushed the S&P 500 down 2.6% and forced 2-year Treasury yields to their highest in more than 15 years.

“I believed since the start of this year that we were likely to see a fair amount of volatility and some retracing of gains, because there would be a lot of uncertainty around the Fed until it actually hits the pause button (for raising interest rates) and that’s what we’ve seen,” said Kristina Hooper, chief global market strategist at Invesco.

“Certainly January was a relatively good month, but at the start of February, we began getting data that made markets question the narrative they had bought into,” Hooper said in a call. “That narrative, of course, was that the Fed would very soon hit the pause button, because the economy was slowing, and inflation was continuing to moderate.”

The 10-year U.S. Treasury yield BX:TMUBMUSD10Y was at 3.994% as of 3 p.m. Eastern on Wednesday, the highest since Nov. 9, while the 2-year yield jumped to 4.887%, the highest since July 2007, according to Dow Jones Market Data.

Companies in focus

- 3M Co. MMM, +2.29% shares rose 2.3% Wednesday after it said the U.S. Dept. of Defense’s records show the “vast majority” of claimants in litigation over its Combat Arms earplugs have normal hearing under medically accepted standards.

- Kohl’s Corp. KSS, -1.89% stock fell 1.9% the retailer posted a loss and said it would fall short of analyst estimates for 2023 profit.

- Lowe’s Cos. LOW, -5.56% stock declined 5.6% after posting a mixed fiscal fourth-quarter earnings report Wednesday, beating profit expectations but failing to clear analysts’ bar for revenue.

- Novavax NVAX, -25.92% shares sank 25.9% after the vaccine maker said after the market closed on Tuesday there was “substantial doubt” about its ability to continue operations this the year. The company warned that it may not have enough cash flow to last more than a year.

- Rivian Automotive RIVN, -18.34% slumped 18.3% after the electric-vehicle maker narrowed its quarterly loss but missed revenue expectations and revealed struggles with parts shortages and other manufacturing hiccups as it tried to ramp up production.

- Reata Pharmaceuticals RETA, +198.91% stock shot up 198.9% on Wednesday morning after the Food and Drug Administration approved a drug treatment for a disease called Friedreich’s ataxia, a rare inherited disease that causes damage to the nervous system.