Nvidia stock surged 14% on upbeat earnings

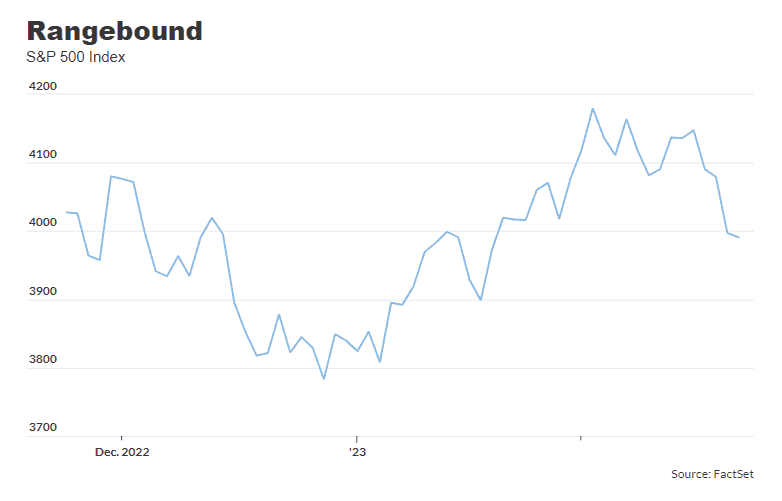

U.S. stocks ended a choppy session higher on Thursday, with the S&P 500 snapping its longest losing streak of the year as investors parsed data on the state of the economy and labor market and weighed the outlook for future rate increases by the Federal Reserve.

A big gain for shares of Nvidia Corp. helped buoy the Nasdaq Composite and S&P 500 after the chip maker reported upbeat earnings results.

How stocks traded

- The S&P 500 SPX, +0.53% rose 21.27 points, or 0.5%, to end at 4,012.32.

- The Dow Jones Industrial Average DJIA, +0.33% gained 108.82 points, or 0.3%, to finish at 33,153.91.

- The Nasdaq Composite COMP, +0.72% advanced 83.33 points, or 0.7%, ending at 11,590.40.

Stocks fell Wednesday as investors digested the minutes of the Fed’s latest policy meeting. The Nasdaq Composite is up 9.9% so far in 2023, but remains down 28.3% from its record high seen in November 2021.

What drove markets

U.S. stocks finished higher on Thursday after wavering for much of the session, with the technology sector paced by a 14% jump by shares of Nvidia Corp. NVDA, +14.02% following the graphics-chip specialist’s well-received results.

The moves came a day after the release of the minutes of the Fed’s previous meeting, which showed little sign the central bank’s determination was wavering.

David Russell, vice president of market intelligence at online brokerage TradeStation, said both the markets and the Fed are in a “wait and see period” until the release of a slew of February economic data, which is due out ahead of the Fed’s March 21-22 meeting, provides a more in-depth glimpse to the state of the economy.

“Nobody really knows if the Fed is nearing the end or needs to get more aggressive again,” said Russell. “I believe that we will have greater clarity on that in the next three to four weeks, because we’re going to have [Fed Chair] Jerome Powell in Congress on March 7. We’re going to have [February] nonfarm payrolls on the 10th, CPI on the 14th, and then, on March 22, we get the dot plot.”

The U.S. Senate’s banking committee will hold its semiannual hearing on the Federal Reserve’s monetary policy report on March 7, when Powell is expected to deliver a policy update to Congress.

Wall Street’s early 2023 rally has faded in recent sessions as investors become more concerned that robust economic data of late will encourage the Federal Reserve to keep interest rates higher for longer, as it tries to crush inflation that continues to run at three times its 2% target.

“While we are staring into the great unknown of the impacts of quantitative tightening and an aggressive Fed policy pace, we don’t think you need to go far out on the risk curve to do well and the odds are not in your favor based on past hiking cycles,” noted Alexandra Wilson-Elizondo, head of multiasset retail investing at Goldman Sachs Asset Management.

“In the next few months, we think U.S. equities will be trapped between strong but declining demand and a loosening but still tight labor market.”

However, 2-year U.S. government bond yields TMUBMUSD02Y, 4.699%, which are particularly sensitive to Fed policy, and which earlier this week flirted with their highest level since 2007, were a touch softer on Thursday.

U.S. economic updates released on Thursday included the weekly initial jobless claims report. The data showed the number of Americans applying for unemployment benefits fell by 3,000 to 192,000 in the week ending Feb. 18, according to Labor Department released Thursday. That’s the sixth straight week below 200,000, which is a signal of a strong labor market.

Meanwhile, the economy grew a touch slower at a 2.7% annual pace to finish off 2022, revised government figures show, largely because consumers cut back on spending.

On Friday, market attention will turn to the U.S. personal-consumption expenditures, or PCE, price index release, the Fed’s preferred measure of inflation, along with the University of Michigan’s final February read on consumer sentiment,

January’s headline PCE reading is expected to show a 4.9% rise from a year earlier, slowing from a 5% yearly increase in the previous month, according to a survey of economists by Dow Jones. The core price measure that strips out volatile food and fuel costs, is expected to rise 0.4% from December, or 4.3% year over year.

Michael J. Kramer, founder of Mott Capital Management, said if the month-over-month value comes in as expected, it would suggest that the 3-month annualized trend for PCE rose to 3.35% (Nov., Dec., Jan.) from an annualized 0.9% (Oct., Dec., Jan.). Meanwhile, it is running at a 3.3% annualized from July to January, up from 2.1% annualized over the same 6-month period.

“You can see that while the 3-month and 6-month year-over-year changes are down sharply from where they had been, they are still well above the Fed’s target of 2% and show a significant acceleration from the prior running trend,” Kramer said in a note.

“While one data point won’t panic the Fed, a hot reading in February could. So, if January comes as expected, it likely means that the Fed is taking a step back in achieving its goal.”

Companies in focus

- Shares of Alibaba Group Holding Ltd. BABA, -0.65% finished 0.7% lower after fiscal third-quarter earnings at the Chinese internet giant beat expectations.

- Etsy Inc. ETSY, +2.44% shares rose 2.4% after the online arts and crafts retailer’s sales outlook topped Wall Street estimates.

- Shares of Dollar General Corp. DG, -3.62% slumped 3.6% and headed to a nine-month low as the discount retailer cut its profit and sales outlook.

- Shares of Netflix, Inc. NFLX, -3.35% were down 3.4% after The Wall Street Journal reported that the company has reduced the cost of its service in more than three dozen countries in recent weeks, with some discounts being as much as half of the current monthly subscription.

- Domino’s Pizza, Inc. DPZ, -11.65% shares dropped 11.7% after the pizza chain after its fourth-quarter revenue missed Wall Street expectations as the pizza maker faced a drop in its delivery business.