Stock Markets

The major stock indexes closed the week mixed with investors trying to balance healthy growth and profit signals with concerns that inflation may once more spiral out of control. The Dow Jones Industrial Average (DJIA) dipped by 0.13% although its sectors were generally up and the total stock market index remained unchanged. The S&P 500 Index also slightly fell by 0.28% and the technology tracker Nasdaq Stock Market Composite inched upward by 0.59% led by the Biotech sector which nudged up by 0.64%. The NYSE Composite index slid by 0.44%. Investors’ risk perception was mitigated as shown by a 2.48% drop in the CBOE Volatility index.

Investors feared that the Federal Reserve may be forced to again raise short-term interest rates by more than earlier anticipated. This caused U.S. Treasury yields to increase and cause a strengthening of the U.S. dollar, while a particularly large toll was taken on oil prices and energy stocks since oil is priced in U.S. dollars on international markets and oil demand increases when the dollar appreciates. Trading volumes were quiet early in the week after the Super Bowl celebrations last Sunday and markets were scheduled to remain closed the next Monday, February 20, in observance of the Presidents’ Day holiday.

U.S. Economy

The monthly inflation report came in higher than expected although the longer-term trends remain intact. A mixed picture was painted by the week’s highly anticipated inflation data. The Labor Department reported on Tuesday that, consistent with expectations, consumer prices rose by 0.5% in January compared to a 0.1% increase in December. Nearly half of the gain was accounted for by a “sticky” increase in shelter prices, which compensated for another sharp drop in used car prices. The inflation rate came in at 6.4% year-over-year, which is higher than consensus estimates, but still the slowest pace since October 2021. The annual core inflation figure, which excluded food and energy costs, was 5.6%, also modestly above expectations, but its slowest pace since December 2021.

Producer prices surprised on the upside on Thursday, causing stocks to react with a sell-down. In January, the producer price index climbed by 0.7%, its biggest gain since June. Meanwhile, core producer prices rose by 0.5%, the most since May. Overall, however, producer prices continued their steep and steady decline that began in June on a year-over-year basis – falling almost in half, from 11.2% to 6.0% during that interval.

Another key report released last week was the U.S. retail sales figures, which were the highest in almost two years. January sales surged by 3% from the previous month, well above the 2% increase expectation, and more than offsetting the decline in December. The advance was accounted for by an increase in auto sales, as well as strong spending at restaurants and furniture outlets. Gains were nevertheless broad across different categories, which hints that consumers were playing catch-up and were willing to spend this quarter after pulling back during last year’s fourth quarter.

Metals and Mining

In the gold market, headwinds continued to strengthen in tandem with the increase in bond yields. Investors appear to anticipate that the Federal Reserve will continue to pursue its aggressive monetary policy. This creates a challenging environment for gold at present even as prices have some leeway to move lower. Many analysts have observed, however, that there have been no developments to shift the long-term bullish potential of the yellow metal. The movements in the bond market, as short-term bonds offer investors positive returns, making them more attractive safe-haven assets once more. But there is where the trouble lies. Some economists have stated that it is not a matter of whether a recession will hit, but when.

In the past week, the spot prices of precious metals have retracted. Gold, which has a week-ago price of $1,865.57, ended this week at $1,842.36 per troy ounce for a loss of 1.24%. Silver slid from its closing price last week at $22.00 to this week’s close at $21.73 per troy ounce, a drop of 1.23%. Platinum lost 2.98% from its previous close at $949.55 to this week’s price of $921.21 per troy ounce. Palladium closed this week at $1,502.59 per troy ounce, lower by 2.79% from the earlier week’s close of $1,545.67. The three-month LME prices of base metals were mixed for the week. Copper came from $8,857.50 the previous week to close this week at $8,987.50 per metric tonne for a gain of 1.47%. Zinc closed one week ago at $3,042.50 and this past week at $3,058.00 per metric tonne for a gain of 0.51%. Aluminum closed the prior week at $2,440.50 and this past week at $2,387.50 per metric tonne, dropping by 2.17%. Tin closed at $27,349.00 one week ago and this week at $25,856.00 per metric tonne for a loss of 5.46%.

Energy and Oil

The gap between WTI and other global crude benchmarks appears to be widening as climbing crude inventories and another SPR release push the U.S. benchmark lower. Furthermore, the release of strong economic data in the U.S. this past week and evidence that the labor market is tightening further have exerted some macro pressure on oil prices. The result is heightened fears that the Federal Reserve’s rate hikes may be further extended. These bearish indicators moved the WTI back below $76 per barrel on Friday morning. On the other hand, analysts estimate that China’s crude imports will rise by 0.5 to 1.0 million barrels per day (b/d) this year to as high as 11.8 million b/d, a new all-time high. This may reverse the year-on-year decline in 2022 and fire up domestic refining that has languished through the years China pursued the zero-Covid policy.

Natural Gas

In January 2023 compared to December 2022, the natural gas price at the U.S. benchmark Henry Hub declined by 41%, or $2.26 per million British thermal units (MMBtu). The decline in price was attributable to warmer-than-average temperatures across the United States in January, driving down the consumption of natural gas for space heating and increased natural gas production.

For this report week covering Wednesday, February 8, to Wednesday, February 15, 2023, the Henry Hub spot price rose by $0.02 from $2.42/MMBtu at the start of the week to $2.44/MMBtu at the end of the week. The price of the March 2023 NYMEX contract increased by $0.075 from $2.396/MMBtu on February 8 to $2.471/MMBtu on February 15. The price of the 12-month strip-averaging March 2023 through February 2024 futures contracts climbed $0.033 to $3.228/MMBtu. International gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased $0.039 to a weekly average of $17.91/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.15 to a weekly average of $16.68/MMBtu. In the corresponding week last year (the week ending February 16, 2022), the price in East Asia was $24.43/MMBtu, and the price at TTF was $24.87/MMBtu.

World Markets

Better-than-expected corporate results raised optimism among investors, allaying fears about additional interest rate hikes and causing European shares to rebound. The pan-European STOXX Europe 600 Index closed the week 1.40% higher. France’s CAC 40, which reached a record level earlier in the week, surged by 3.06%. Italy’s FTSE MIB Index likewise advanced significantly, by 1.77%, while Germany’s DAX Index also jumped by 1.14%. The UK FTSE 100 hit an all-time high when it rose by 1.55% this week. Helping to support the UK index was a weaker British pound as against the U.S. dollar, as many listed companies in the UK bourse are multinationals with overseas revenues. The European government bond yields are about to reach multiyear highs partly due to hawkish comments by European Central Bank (ECB) policymakers. Yields on benchmark 10-year German government debt rose, as well as bond yields in Switzerland and France when ECB President Christine Lagarde reiterated that to control inflation, interest rates need to be increased further.

For the week, returns were mixed in Japanese equity markets. The Nikkei 225 Index descended 0.57% while the broader TOPIX Index registered a 0.25% increase. The positive U.S. economic data elicited hawkish comments from U.S. Federal Reserve (Fed) officials, weighing on risk assets. Investor sentiment was somewhat dampened by the fact that the Japanese economy rebounded less than anticipated over the fourth quarter of last year. Further speculation about the future trajectory of the central bank’s monetary policy was further prompted by the nomination during the week of Kazuo0 Ueda as the next Bank of Japan (BoJ) governor. The yield on the 10-year Japanese government bond (JGB) hovered about the 0.50% level at which the BoJ intends to cap JGB yields. The yen weakened somewhat to around JPY 134.2 versus the greenback, from about JPY 131.3 at the end of the previous week. The movement was mainly due to expectations that there would be no change to BoJ’s monetary policy in the short term.

Chinese equities plunged for the third straight week in light of concerns over escalating geopolitical tensions with the U.S. which are creating barriers to prospects of faster economic growth. The Shanghai Stock Exchange Index retreated 1.12$ and the blue-chip CSI 300 eased by 1.75%. In Hong Kong, the benchmark Hang Seng Index slid by 2.22%. The prices for new homes in China were relatively steady in January, halting a 16-month decline, as demand was boosted when the government lifted its zero-Covid regime. During the past few months, the government has rolled out several measures in support of the beleaguered sector as part of the effort to restore Chinese economic growth. According to economists, the government will be announcing additional policies during or after the much anticipated annual Parliament meeting, which starts in early March. On the other hand, Chinese foreign ministry spokesman Wang Wenbin announced that Beijing will be enacting countermeasures against the U.S. after it shot down a suspected Chinese spy balloon in U.S. territory the previous week, raising fears of intensifying geopolitical risks. The warning was issued after the U.S. included Chinese firms on an export blacklist amid alleged links to a military-backed global balloon espionage program.

The Week Ahead

Among the important economic data scheduled to come out this week are the Markit PMI index, the personal consumption index, and the gross domestic product.

Key Topics to Watch

- S&P flash U.S. services PMI

- S&P flash U.S. manufacturing PMI

- Existing home sales

- FOMC minutes of Feb1 meeting

- Initial jobless claims

- Gross Domestic Product

- Atlanta Fed President Bostic speaks

- Consumer spending (nominal)

- Personal income (nominal)

- PCE index

- Core PCE index

- Core PCE (year-over-year)

- New home sales

- Consumer sentiment (final)

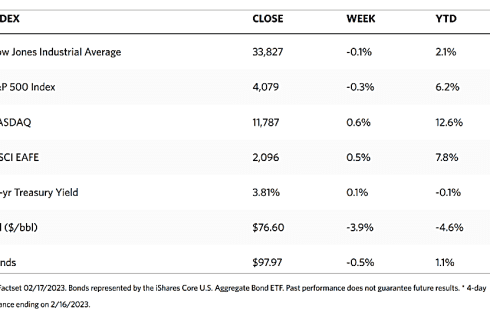

Markets Index Wrap Up