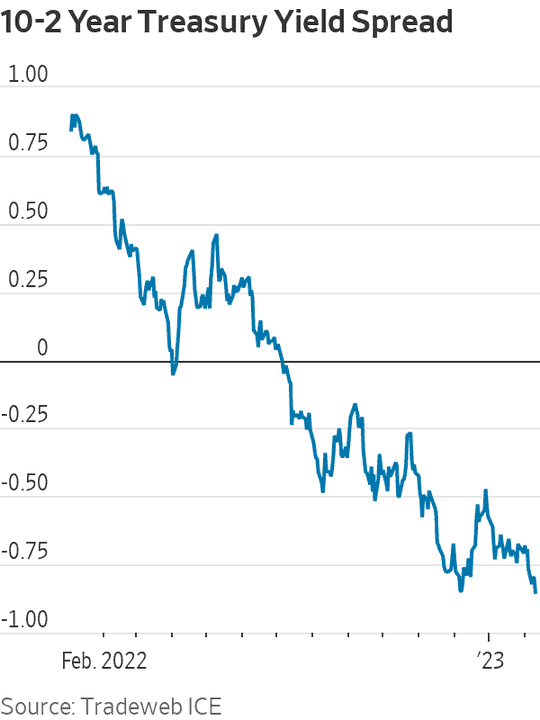

‘Our call for 2s/10s to reach -100 bp is back on the table,’ say BMO Capital Markets strategists

A bond-market gauge of impending U.S. recessions fell just shy of reaching its most negative reading since October 1981, when interest rates were 19% under Paul Volcker’s Federal Reserve.

That gauge, which measures the spread between 2- TMUBMUSD02Y, 4.489% and 10-year Treasury yields TMUBMUSD10Y, 3.676%, finished the New York session on Thursday at minus 82.5 basis points. In other words, the 10-year yield was trading 82.5 basis points below the 2-year yield.

Over much of the day, the spread appeared to be on track to surpass its Dec. 7 low of minus 84.9 basis points and seemed headed for the most negative level since Oct. 2, 1981, when it reached minus 96.8 basis points, according to Dow Jones Market Data. Instead, it fell just shy of December’s mark.

The continued inversion comes at a time when investors and policy makers are bracing for additional Federal Reserve rate hikes and a period of disinflation, or a slowing pace of inflation, that could take some time to work its way through. One possible silver lining behind Thursday’s bond-market moves is that many investors appear to believe the Federal Reserve will stick by its inflation-fighting campaign — and ultimately win it.

Stocks initially rallied on Thursday, but gave up gains around midday. All three major stock indexes finished down for the day, with the Dow Jones Industrial Average DJIA, -0.73% off by 0.7%, the S&P 500 SPX, -0.88% falling 0.9%, and the Nasdaq Composite lower by 1%.

“Our call for 2s/10s to reach -100 bp is back on the table after appearing less realistic” at the end of last year, when the spread closed around minus 55 basis points, BMO Capital Markets strategists Ian Lyngen and Ben Jeffery said in a note Thursday.

For much of Thursday, the 2s/10s spread seemed poised to go more deeply negative than any time since October 1981, when the annual headline inflation rate from the consumer-price index was above 10%, the fed-funds rate was around 19% under Volcker, and the U.S. economy was in the midst of one of its worst downturns since the Great Depression.

But after a weak 30-year bond auction in the U.S. afternoon, the 10-year rate bounced back along with just about every other yield across the curve as investors sold off Treasurys.

A negative 2s/10s spread simply means that the 2-year Treasury rate is trading far above its 10-year counterpart, as bond investors and traders factor in near-term Fed rate hikes along with lower inflation and/or a poor economic outlook over the long term.

Ordinarily, Treasury spreads should be sloping upward when the outlook is bright; it slopes downward and goes negative when there’s greater pessimism. The more negative the spread, the more negative the message is from the bond market, the thinking goes — although strategists at Goldman Sachs and yield-curve research pioneer Campbell Harvey have cautioned against linking inversions to recessions.

Traders, strategists and investors have been toggling between two narratives on the most likely path for inflation. One is that the U.S. could be heading into a period of “transitory disinflation,” in which any cooling price gains turn out to be fleeting. The other is that there could be a swift and surprising drop in inflation, with the annual headline rate on the consumer-price index heading toward 2% in a matter of months, on the view that the U.S. economy won’t be able to avoid a recession.

Villanova University business professor Peter Zaleski sees the two narratives as essentially one and the same, with the only difference being one’s views on the strength of the U.S. economy — a key factor in determining how fast inflation can drop.

In other bond-market moves on Thursday, a second recession indicator — the spread between rates on 3-month T-bills TMUBMUSD03M, 4.742% and the 10-year Treasury yield — went to minus 105.7 basis points, versus a record low of minus 127.73 basis points set on Jan. 18.