One of Wall Street’s biggest bears believes U.S. stocks are poised for their next leg lower as the January effect and other factors that had supported markets in the early weeks of the New Year have started to fade.

In a note to clients dated Monday, Mike Wilson, chief U.S. equity strategist and chief investment officer at Morgan Stanely, said “the door is still very much open” for U.S. stocks to fall as investors grappled with an earnings outlook that has substantially weakened during the month of January.

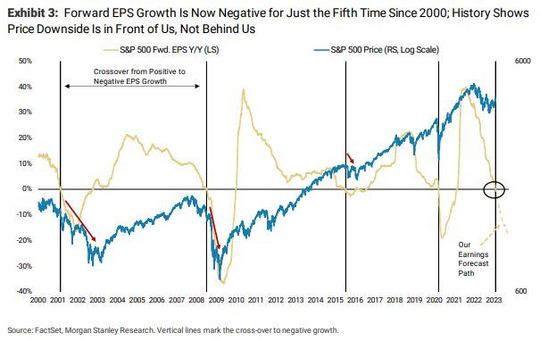

Expectations for corporate profits in 2023 have continued to deteriorate since the start of the year. In fact, as of the end of last month, expectations for S&P 500 earnings-per-share growth for 2023 turned negative for the first time since 2020, and only the fifth time since 2000.

Previous instances occurred in 2001, 2008, 2015 and 2020. And each time, it preceded further downside in the S&P 500, as Wilson and his team illustrated.

According to data from FactSet, the calendar-year EPS expectations for 2023 fell by 2.5% during the first quarter to $224.88. At this level, corporate earnings would be contracting, not growing.

“What makes this analysis more powerful is that, historically, the majority of the

price downside in equities comes after forward EPS growth goes negative. In other words, this earnings recession is not priced, in our view,” Wilson said.

Expectations for corporate earnings growth have deteriorated by 2.5% since the start of January, according to FactSet data. That’s the largest such decline to kick off a year since January 2016.

This dimming has occurred as companies have reported their quarterly results for the fourth quarter of 2023. So far, America’s largest publicly traded companies are on track to see profits shrink by 5.3% compared with the same period in 2021. Barring a sudden turnaround, this will be the first such decline since the third quarter of 2020, according to FactSet.

But while other periods of deterioration coincided with a Federal Reserve that was cutting interest rates to protect the economy, Wilson said that this time around, the Fed is still hiking interest rates, with no plans to start cutting until 2024 according to the central bank’s official projections.

“In other words, this earnings recession is not priced,” he said.

To be sure, Wilson says there are other reasons to be bearish on U.S. stocks besides the fundamental earnings picture.

In his note, he also pointed to positioning, as institutional investors have already rebuilt their stockholdings, which could constrain further gains. Wilson also sees the recent underperformance of the Dow Jones Industrial Average DJIA, -0.10% as a sign that stocks could be ready to sour once again.

Heading into the new year, Wilson had expected the S&P 500 SPX, -0.61% to reach a new cycle low closer to 3,000 before the end of the first quarter. Now, he expects this decline will arrive eventually, although they could take longer to play out.

The S&P 500 and Nasdaq Composite COMP, -1.00% are on track to finish in the red for a second day in a row on Friday. The large-cap index was down 0.4% in recent trade at 4,121, but it has still risen more than 7% since the start of the year. The Nasdaq was off 0.6% at 11,937, but is still up more than 14% for the year.

The Dow was marginally higher Monday afternoon, but is up roughly 2.5% for the year so far.

Wilson is Morgan Stanley’s top U.S. equity strategist. He earned plaudits for correctly anticipating the selloff in stocks and bonds in 2022, which saw the S&P 500 fall 19.4% for the worst calendar-year decline since 2008.