Preview: Holiday earnings will have to greatly exceed expectations for Amazon to reach an annual profit for the year

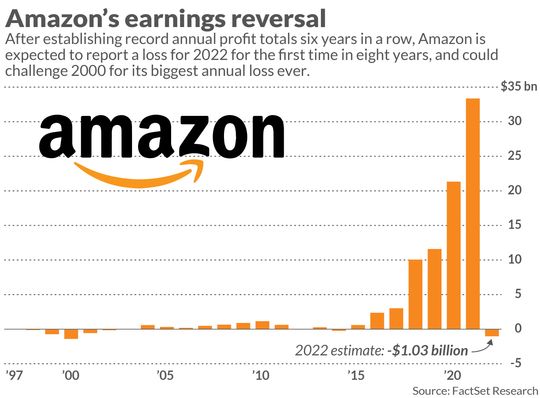

Amazon.com Inc. is expected to reveal this week its first unprofitable year since 2014 and the worst year for its bottom line since 2000 — and expectations for this year aren’t headed in a positive direction.

Amazon AMZN, +2.57% reported roughly $3 billion in total losses through the first nine months of the year, and Wall Street analysts on average are projecting about $2 billion in net income in the holiday season, according to FactSet. Beyond being its first annual loss since 2014, a loss of $1 billion or more would challenge for the biggest annual loss on Amazon’s books — the only time it has lost more than $1 billion in a year was a $1.4 billion loss in 2000, when Amazon had less than $3 billion in annual revenue.

Amazon’s losses are driven by Rivian Automotive Inc. RIVN, +7.54%, which Amazon invested in and contracted with for delivery vehicles; the electric-vehicle maker’s stock plunged in 2022 after a successful initial public offering at the end of 2021. Amazon is unlikely to face those paper losses again in future years, and Wall Street projects that Amazon will storm back to more than $17 billion in profit in 2023 by cutting costs and shedding employees it brought on to deal with spiking demand in the first two years of the COVID-19 pandemic.

That forecast may be too bright, though, amid growing doubt about Amazon’s most profitable business, Amazon Web Services. While Amazon is not expected to produce a net income this year, its operating income will be in the black solely because of an expected $23 billion profit from AWS, countering an $11 billion loss from the rest of the business.

Cloud-computing growth is slowing, however, as large corporate customers look to cut back on their spending. Last week, Microsoft Corp. MSFT, +2.10% executives revealed that an Azure slowdown that spooked investors in October had gotten worse in December, and that they expected it to continue to get worse this quarter. AWS revenue growth has already decelerated, and many analysts rushed to adjust their projections for Amazon revenue and profit forecasts ahead of Thursday’s guidance from executives.

“Our lower AWS margin forecasts further drag down our Amazon [operating income] estimates and pose some risk to the outlook,” UBS analysts wrote last week in a report that predicted just 15% revenue growth this year for AWS, a slowdown for a business that has more than doubled sales since the end of 2019 to an expected $80 billion this year.

All of this explains the recent corporate cuts at Amazon, which more than doubled its workforce to become the second-largest private U.S. employer during the pandemic. No amount of cutting is expected to return Amazon to the heights it enjoyed in 2020 and 2021 — when the e-commerce and cloud-computing giant produced more than $54 billion in profit collectively, more than in its entire existence to that point — but now those cuts may be the only way to come close to expectations this year.

“A weaker outlook at AWS puts even more pressure on cost cuts at the retail segment to drive the margin story,” UBS analysts bluntly stated, while maintaining a buy rating but cutting their price target to $118 from $121.

It’s still possible for Amazon to exceed expectations, maybe by enough to reach break-even for the year — holiday earnings have beaten estimates at least five years running, according to FactSet records that date to 2017, including a huge beat last year thanks to the Rivian IPO. The direction of the stock likely depends on the forecast, though, and what it says about the direction of profit, and AWS, in 2023.