Dow’s stock is technically the most overbought since its spinoff from DowDuPont, and dividend is less attractive, Fermium’s Frank Mitsch said

Shares of Dow Inc. fell for the first time in 2023, putting them on track to snap their record-tying win streak, after Fermium analyst Frank Mitsch backed away from his rare, but long-time bullish call on the materials science company.

The stock DOW, -2.18% dropped 1.9% in afternoon trading, after soaring 16.5% over the past nine days. The win streak had tied the nine-day stretch that ended April 21, 2022, which tied the record nine-day streak that ended June 13, 2019.

Fermium’s Mitsch downgraded Dow to hold, after being at buy for at least the past three years. Dow started regular trading as an independent company in April 2019, after being spun off from DowDuPont.

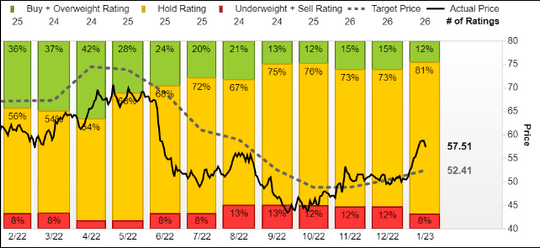

Before the downgrade, Mitsch was one of just four analysts, of the 26 surveyed by FactSet, that had been bullish on Dow. Now he’s one of 21 analysts who are neutral on the company. There are two bearish analysts.

Meanwhile, his stock price target of $60 implied 4.2% upside from current levels, and was 14.5% above the average analyst price target of $52.41.

But with the recent climb in the yield of the two-year U.S. Treasury note TMUBMUSD02Y, 4.181%, to 4.216% in recent trading, the so-called “risk-free” investment has “materially closed the gap” with Dow’s dividend yield.

Mitsch is also concerned about valuation, given the rally to start the year.

Over the past 18 months, Mitsch said the stock has reached technically overbought levels, based on the Relative Strength Index (RSI) momentum indicator. The RSI, which measures the magnitude of a stocks’ recent gains against the magnitude of recent declines, is used by Wall Street chart watchers aggressive buyers are sellers are acting relative to other periods of significant moves.

The latest RSI reading is at the “highest overbought level” since the spinoff from DowDuPont.

Mitsch said after the five previous overbought periods, Dow’s stock fell by an average of 5% over the following month, to underperform the S&P 500 over that time.

“Though we’re quite aware that the consensus rating on Dow has been hold since August of 2019, alas, we’re joining the gang,” Mitsch said.

The company is slated to report fourth-quarter results on Jan. 26, with the FactSet consensus for operating earnings per share expected to show a year-over-year decline of about 73% to 57 cents. Sales are expected to fall 16% to $12.05 billion.

Dow’s stock has run up 27.2% over the past three months, while the Dow Jones Industrial Average DJIA, -1.14% has climbed 12.6% and the S&P 500 has advanced 8.8%.