SYDNEY — Splitit Payments Ltd. shares rose 11% early Monday, after the buy-now-pay-later company said Chinese internet giant Alibaba Group Holding Ltd. will use its service on the AliExpress platform.

The Australia-listed tech stock was on course for its best day since Nov. 16, 2022 after Splitit said that Alibaba would offer its installment-payment service, initially in Germany, Spain and France.

Shares were last up 11% at 20 Australian cents (US$0.14).

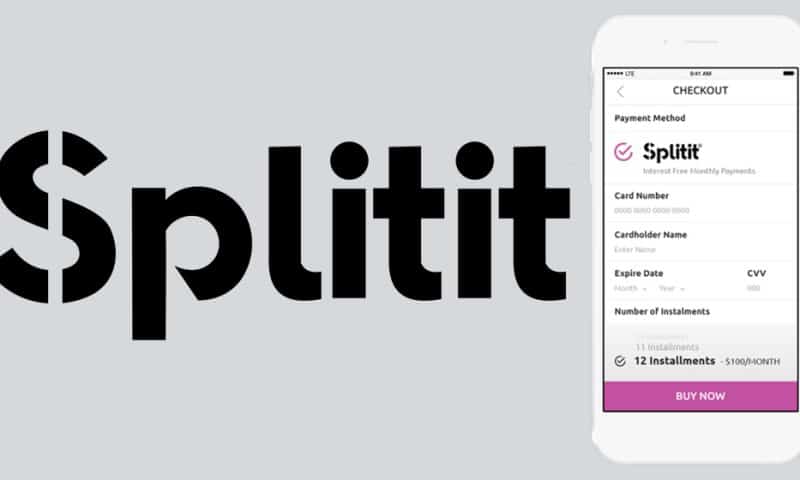

Splitit last year ditched its brand-based strategy and switched to a so-called white-label approach, allowing merchants to use its service at checkout under their own label. It uses untapped credit on customers’ existing credit-card accounts to offer interest-free installment plans.

“Splitit’s white-label approach allows us to easily customize and integrate the service into our platform while delivering a positive experience for sellers and shoppers,” said Topp Gary Paul, AliExpress’s European commercial director.

Splitit shares are up 25% for 2023, but still down 89% since August 2020.