SomaLogic (NASDAQ:SLGC – Get Rating) had its price target dropped by Cowen to $8.00 in a research report issued to clients and investors on Thursday, Stock Target Advisor reports. Cowen’s price objective would suggest a potential upside of 191.97% from the company’s previous close.

Separately, Cowen decreased their price target on shares of SomaLogic from $11.00 to $9.00 and set an “outperform” rating on the stock in a research note on Tuesday, August 16th. Five investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the company currently has a consensus rating of “Buy” and an average price target of $13.17.

SomaLogic Stock Up 1.9 %

Shares of SomaLogic stock traded up $0.05 during trading on Thursday, reaching $2.74. 31,554 shares of the stock were exchanged, compared to its average volume of 1,282,517. The stock’s fifty day moving average is $3.13 and its 200 day moving average is $4.31. The firm has a market cap of $502.65 million, a price-to-earnings ratio of -5.93 and a beta of 1.75. SomaLogic has a 1 year low of $2.63 and a 1 year high of $14.09.

SomaLogic (NASDAQ:SLGC – Get Rating) last issued its quarterly earnings data on Monday, August 15th. The company reported ($0.13) EPS for the quarter, topping the consensus estimate of ($0.19) by $0.06. SomaLogic had a negative net margin of 81.72% and a negative return on equity of 18.16%. The business had revenue of $14.14 million during the quarter, compared to analyst estimates of $25.55 million. Equities analysts forecast that SomaLogic will post -0.5 earnings per share for the current year.

Hedge Funds Weigh In On SomaLogic

Several institutional investors have recently bought and sold shares of SLGC. Vanguard Group Inc. increased its stake in SomaLogic by 158.1% in the 1st quarter. Vanguard Group Inc. now owns 6,473,890 shares of the company’s stock valued at $51,921,000 after buying an additional 3,965,138 shares during the period. Sumitomo Mitsui Trust Holdings Inc. grew its stake in shares of SomaLogic by 123.3% during the 3rd quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 4,408,343 shares of the company’s stock worth $12,784,000 after purchasing an additional 2,434,400 shares during the period. Goldman Sachs Group Inc. lifted its holdings in shares of SomaLogic by 2,913.7% during the 1st quarter. Goldman Sachs Group Inc. now owns 2,120,772 shares of the company’s stock worth $17,009,000 after acquiring an additional 2,050,401 shares during the period. State Street Corp grew its position in SomaLogic by 403.9% in the second quarter. State Street Corp now owns 2,510,507 shares of the company’s stock valued at $11,347,000 after acquiring an additional 2,012,256 shares in the last quarter. Finally, Northern Trust Corp grew its position in shares of SomaLogic by 441.8% during the second quarter. Northern Trust Corp now owns 1,324,293 shares of the company’s stock worth $5,986,000 after buying an additional 1,079,888 shares in the last quarter. 59.29% of the stock is owned by institutional investors and hedge funds.

About SomaLogic

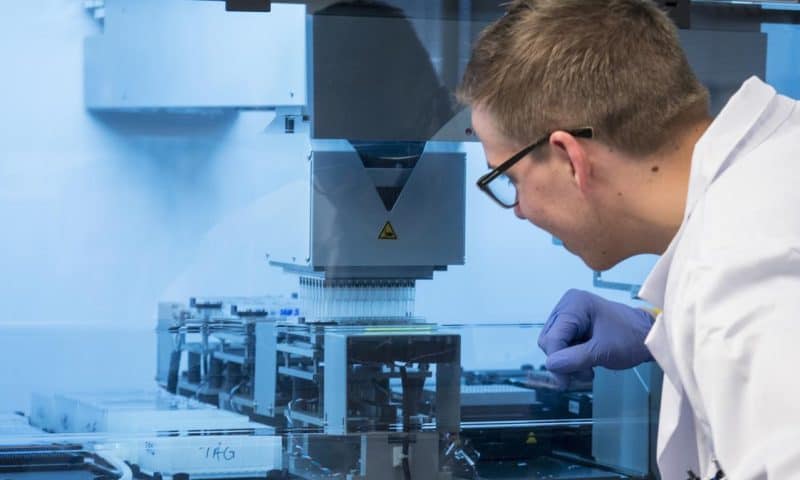

SomaLogic, Inc operates as a protein biomarker discovery and clinical diagnostics company in the United States. It develops slow off-rate modified aptamers (SOMAmers), which are modified nucleic acid-based protein binding reagents that are specific for their cognate protein; and offers proprietary SomaScan services, which provide multiplex protein detection and quantification of protein levels in complex biological samples.