TransMedics Group, Inc. (NASDAQ:TMDX – Get Rating) VP John F. Carey sold 3,000 shares of the company’s stock in a transaction dated Monday, October 3rd. The shares were sold at an average price of $42.09, for a total transaction of $126,270.00. Following the completion of the sale, the vice president now directly owns 771 shares in the company, valued at approximately $32,451.39. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link.

TransMedics Group Trading Up 6.2 %

NASDAQ:TMDX traded up $2.63 during trading hours on Tuesday, reaching $44.86. 477,872 shares of the company were exchanged, compared to its average volume of 321,089. The company has a debt-to-equity ratio of 0.70, a current ratio of 4.18 and a quick ratio of 3.41. The firm has a market cap of $1.26 billion, a price-to-earnings ratio of -26.08 and a beta of 1.54. TransMedics Group, Inc. has a 52-week low of $10.00 and a 52-week high of $56.41. The stock has a 50 day simple moving average of $46.80 and a 200 day simple moving average of $34.44.

TransMedics Group (NASDAQ:TMDX – Get Rating) last posted its quarterly earnings results on Monday, August 1st. The company reported ($0.41) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.32) by ($0.09). The company had revenue of $20.52 million for the quarter, compared to analysts’ expectations of $16.26 million. TransMedics Group had a negative return on equity of 74.20% and a negative net margin of 92.76%. During the same period in the prior year, the business earned ($0.39) EPS. As a group, analysts predict that TransMedics Group, Inc. will post -1.57 EPS for the current year.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on TMDX. Oppenheimer upped their price target on shares of TransMedics Group from $40.00 to $45.00 and gave the company an “outperform” rating in a report on Tuesday, August 2nd. JPMorgan Chase & Co. raised shares of TransMedics Group from a “neutral” rating to an “overweight” rating and upped their price objective for the company from $26.00 to $48.00 in a research note on Tuesday, August 2nd. Morgan Stanley upped their price objective on shares of TransMedics Group from $34.00 to $37.00 and gave the company an “equal weight” rating in a research note on Wednesday, August 3rd. Cowen upped their price objective on shares of TransMedics Group from $39.00 to $45.00 and gave the company an “outperform” rating in a research note on Tuesday, July 26th. Finally, Canaccord Genuity Group upped their price objective on shares of TransMedics Group from $46.00 to $58.00 in a research note on Thursday, August 4th. One analyst has rated the stock with a hold rating and six have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of “Moderate Buy” and an average price target of $46.00.

Institutional Investors Weigh In On TransMedics Group

Several large investors have recently made changes to their positions in the business. Nisa Investment Advisors LLC grew its holdings in TransMedics Group by 3.0% during the 2nd quarter. Nisa Investment Advisors LLC now owns 15,550 shares of the company’s stock valued at $489,000 after purchasing an additional 450 shares in the last quarter. Park Avenue Securities LLC grew its holdings in TransMedics Group by 3.3% during the 2nd quarter. Park Avenue Securities LLC now owns 17,505 shares of the company’s stock valued at $551,000 after purchasing an additional 560 shares in the last quarter. Legal & General Group Plc grew its holdings in TransMedics Group by 4.9% during the 2nd quarter. Legal & General Group Plc now owns 13,502 shares of the company’s stock valued at $425,000 after purchasing an additional 631 shares in the last quarter. Advisor Group Holdings Inc. grew its holdings in TransMedics Group by 7.8% during the 1st quarter. Advisor Group Holdings Inc. now owns 13,173 shares of the company’s stock valued at $354,000 after purchasing an additional 948 shares in the last quarter. Finally, FNY Investment Advisers LLC acquired a new stake in TransMedics Group during the 2nd quarter valued at $31,000. Institutional investors and hedge funds own 81.46% of the company’s stock.

About TransMedics Group

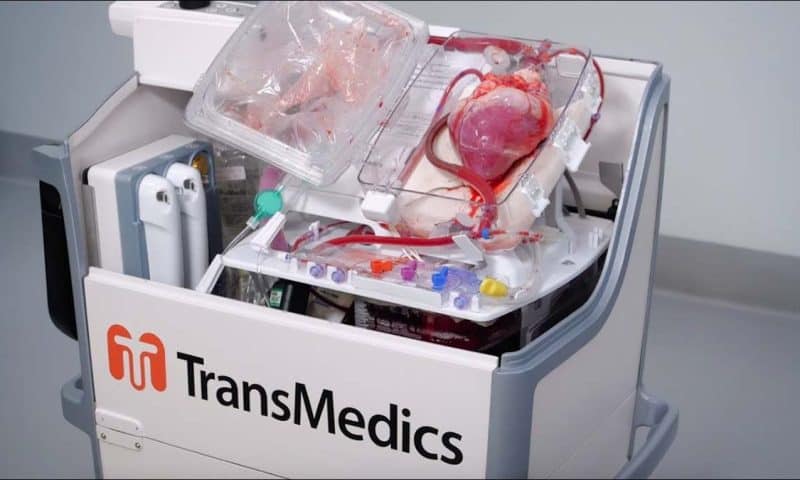

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.