Stock Markets

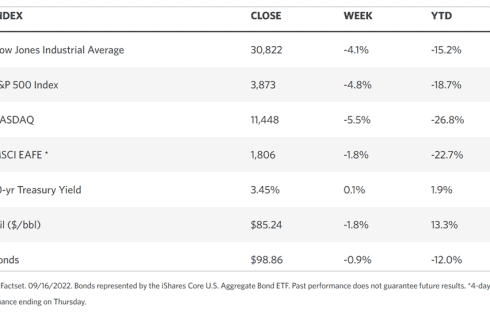

Stocks fell sharply this week, registering their largest weekly drop in three months. Inflation fears intensified with the announcement of a higher-than-expected consumer price index (CPI). Simultaneously, and for the same reason, short-term bond yields reached levels not seen since 2007, during the advent of the subprime financial crisis. The Dow Jones Industrial Average (DJIA) slumped by 4.13% from the previous week, while the total stock market index lost 4.80%. The S&P 500 Index dropped by 4.77% while the technology-heavy Nasdaq Stock Market Composite plunged by a hefty 5.48%. The NYSE Composite lost 4.06 % of its value.

Among the sectors, communication services underperformed the rest within the S&P 500 as a result of Google parent Alphabet and Facebook parent Meta Platforms sinking to new lows going back 52 weeks. There was also marked weakness in the industrials and materials shares. Despite the CBOE Volatility Index (VIX) rising 15.40%, it remained well below the levels seen at the beginning of the pandemic. On Tuesday, the S&P 500 suffered its worst drop in two years; on that day, however, trading volumes remained contained, with the number of shares traded coming in below the average for the year, suggesting the market may hold.

U.S. Economy

Tuesday’s CPI report appeared to have been the week’s prime mover. Consumer prices rose by 8.3% for the 12 months ended in August, which overshot consensus expectations for an increase of approximately 8.1%. The indicator was telling because it dimmed investors’ hopes that they had seen the worst of inflation and the economy was poised to recover. More worrisome was the core inflation (excluding food and energy) figure registering 6.3%, its highest level over the last six months and above the expected core inflation rate of 6.1%. The August housing cost increase of 7.0% was partly the cause of the higher-than-expected rise, but price increases in food and medical care also significantly contributed to the surge. On Wednesday, the core producer prices were released and offered some comfort to investors. Producers’ prices continued their year-on-year decline that commenced in April, registering 7.3% in August from 7.6% in July.

Regarding wage inflation, a key concern of policymakers, there were mixed messages over the past week. A large list of companies are planning layoffs, among which are Ford Motor and Microsoft, soon joined by Goldman Sachs. Weekly jobless claims released on Thursday suggested the opposite as they fell to 213,000, the lowest level since summer. Retail sales data released on the same day pointed to consumers’ reduced spending. The Labor Department reported a decline of 4.2% in spending at gas stations in August. There were, however, solid increases in spending on cars, restaurants and bars, and other stores. Some positive news in the form of falling gas prices helped to perk consumer sentiment. It slightly offset the gloomy outlook on the global economy reported by shipping giant FedEx. After Thursday’s market close, FedEx announced it was withdrawing its earnings guidance for fiscal year 2023 due to a foreseen “continued volatile operating environment” and that its CEO expected a global recession.

Overall, this week began with investors hopeful that inflation has rounded its peak and energy prices will continue their descent since August. This should have convinced the Federal Reserve to moderate its aggressive monetary tightening. The rise in food, shelter, and medical costs, however, offset gains made in decreasing gasoline prices, again raising fears of a further Fed rate hike.

Metals and Mining

The gold market is immersed in much doom and gloom as prices closed the week at their lowest levels since April 2020. Gold broke its support level at $1,700, but it still holds above its critical long-term support in the narrow range between $1,680 and $1,675 per ounce. There is hope that if the precious metal holds for some time within this range, it could build a solid base at a critical long-term level. Analysts are keen to observe that a strong break below the $1,675 level could mark the end of gold’s three-year bullish uptrend. There is a slight ray of hope, however. In the coming week, the central bank is expected to be fairly hawkish, but if Fed Chair Jerome Powell does not meet those elevated expectations, some profit-taking may take place in the U.S. dollar, and this development may drive gold prices higher.

This week, the spot prices of precious metals were mixed. Gold dropped -2.43% from the previous week’s close at $1,716.83 to its new close at $1,675.06 per troy ounce. Silver, on the other hand, gained 3.87% from its prior close at $18.86 to this week’s close at $19.59 per troy ounce. Platinum also rose 2.88% from its earlier price of $884.19 to the week’s ending price of $909.66 per troy ounce. Palladium lost some ground, beginning at $2,178.58 and ending at $2,138.16 per troy ounce for a loss of 1.86%. The 3-mo LME prices of base metals were mostly down. Copper, which closed the week earlier at $7,856.50, ended this week at $7,762.00 per metric tonne for a drop of 1.20%. Zinc dipped 0.44% week-on-week, from $3,167.50 to $3,153.50 per metric tonne. Aluminum, which a week ago traded at $2,286.00, closed this week at $2,277.00 per metric tonne for a price depreciation of 0.39%. Tin closed this week at $21,137.00 per metric tonne, down by 0.13% from its previous price of $21,165.00.

Energy and Oil

Fears of an economic downturn were signaled this week by a host of developments, including the largest single-day stock market crash in recent memory, U.S. yields breaching multi-year highs, and expectations of an impending global recession announced by the multinational shipping giant FedEx. There is widespread expectation that at next week’s Fed meeting, another aggressive rate hike will be announced. This will likely exacerbate a decidedly bearish sentiment in the oil market, with oil prices poised to record a decline for the third straight week. In the not-so-distant future, there remain plenty of catalysts to spur a bullish oil market, but none of them are likely to materialize soon enough to reverse the economic fears weighing heavily on this sector. Currently, investors can only sigh with relief for positive developments such as the aversion of an expected U.S. railroad strike that might have caused a major disruption to the country’s commodity markets and potentially derailed the energy sector.

Natural Gas

For the week beginning Wednesday, September 7, and ending Wednesday, September 14, the Henry Hub spot price rose by $0.56 from $8.13 per million British thermal units (MMBtu) to $8.69/MMBtu. Regarding the Henry Hub futures prices, the price of the October 2022 NYMEX contract increased by $1.272 from $7.842/MMBtu from the beginning of the week to $9.114/MMBtu by the week’s end. The price of the 12-month strip averaging October 2022 through September 2023 futures contracts increased by $0.898 to $7.424/MMBtu. Spot prices for natural gas increased at most locations this report week, while the international natural gas futures prices descended. The weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $2.88 to a weekly average of $53.19/MMBtu, and natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $5.68 to a weekly average of $60.81/MMBtu.

World Markets

European shares drew back due to signs of an impending economic slowdown. The pan-European STOXX Europe 600 Index closed 2,89% lower in local currency terms, Germany’s DAX Index fell by 2.65%, France’s CAC 40 Index declined by 2.17%, and the UK’s FTSE 100 Index dipped by 1.56%. Italy’s FTSE MIB Index remained roughly flat by the week’s end. The British pound weakened against the dollar, descending to levels not seen since 1885. Concerns of an impending recession accounted for the downward pressure on the markets. Further aggressive policy action is feared by investors, on the possibility that the Bank of England may hike interest rates by 0.5 percentage point (0.50%) at its next meeting, way smaller than an increase the U.S. Federal Reserve may announce that would further strengthen the dollar against the pound. In Germany, yields on the 10-year government debt rose due to hawkish comments from the European Central Bank policymakers that also boosted expectations of more substantial rate increases. Peripheral eurozone government bonds broadly tracked core markets. The British 10-year government bond yields climbed to their highest levels in more than a decade.

Japan’s stock market plunged in last week’s trading. The Nikkei 225 Index plummeted 2.29% of its value while the broader TOPIX Index lost 1.37%. The government announced the lifting of its COVID-related restrictions on individual tourists and removed its limit on daily international arrivals to the country. Trade data for August indicated that Japan’s exports grew by 22.1% from August 2021, further exceeding a 19% annual increase in July. This is largely accounted for by Japan’s top export market, the U.S. Exports may be further helped by the continued weakening of the Japanese currency against the dollar. The yen-to-dollar exchange rate finished at JPY 143, lower from the previous week’s level at JPY 142 versus the U.S. currency. Despite rumors that circulated midweek concerning a possible intervention by the Bank of Japan (BoJ), the central bank took no action and allowed the yen to further slide against the dollar. The yen’s decline was driven by the Fed’s rapid rate hikes whereas the BoJ has not made any such move to defend the yen. The 10-year Japanese government bond yield increased to 0.25% from 0.23% the week earlier. The BoJ began purchasing bonds at 0.25% which is the upper limit of the yield range for the 10-year note under the central bank’s yield curve control policy.

China’s stock markets fell due to currency weakness and lackluster property data overshadowing the unexpectedly strong factory output and retail sales indicators. The broad, capitalization-weighted Shanghai Composite Index sank by 4.2%, while the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, tumbled 3.9% in its largest weekly drop in two months. The People’s Bank of China (PBoC) siphoned off liquidity from the banking system for the second month in a row, but it maintained interest rates at their current levels in an attempt to ease selling pressure on the yuan due to a widening policy divergence with the Federal Reserve. China’s central bank has pegged a set of stronger-than-expected yuan fixings against the greenback while reducing banks’ foreign currency reserves requirement in an attempt to stabilize the currency. China’s surprise decision to lower key interest rates in August has accelerated the yuan’s slide amid the Fed’s hawkish tightening stance that has strengthened the dollar against emerging market currencies. Both the onshore and offshore yuan slumped to their lowest level since July 2020. The yield on the 10-year Chinese government bond rose to 2.692% from 2.663% one week earlier, ahead of another possible U.S. rate hike in the coming week.

The Week Ahead

Housing data and leading economic indicators are among the important economic data being released in the coming week. The next Federal Open Market Committee meeting will also take place during the week.

Key Topics to Watch

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Existing home sales (SAAR)

- Federal Reserve statement

- Fed Chair Jerome Powell’s news conference

- Initial jobless claims

- Continuing jobless claims

- Current account deficit (% of GDP)

- Leading economic indicators

- S&P U.S. manufacturing PMI (flash)

- S&P U.S. services PMI (flash)

Markets Index Wrap Up