Stratasys (NASDAQ:SSYS – Get Rating) had its price objective dropped by equities research analysts at Lake Street Capital from $28.00 to $26.00 in a research note issued on Thursday, The Fly reports. Lake Street Capital’s price objective would indicate a potential upside of 59.80% from the company’s previous close.

SSYS has been the subject of several other research reports. Credit Suisse Group started coverage on shares of Stratasys in a report on Tuesday, August 16th. They set an “outperform” rating and a $24.00 price objective for the company. TheStreet lowered shares of Stratasys from a “c-” rating to a “d+” rating in a report on Tuesday, July 5th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and three have assigned a buy rating to the company’s stock. According to MarketBeat.com, the stock has a consensus rating of “Hold” and an average price target of $29.67.

Stratasys Stock Up 0.2 %

NASDAQ:SSYS opened at $16.27 on Thursday. Stratasys has a 12-month low of $15.86 and a 12-month high of $42.83. The firm has a market capitalization of $921.21 million, a PE ratio of -15.64 and a beta of 1.32. The firm has a 50-day moving average price of $18.48 and a 200 day moving average price of $20.03.

Institutional Trading of Stratasys

A number of hedge funds and other institutional investors have recently modified their holdings of the stock. Axxcess Wealth Management LLC boosted its stake in Stratasys by 6.6% in the second quarter. Axxcess Wealth Management LLC now owns 13,500 shares of the technology company’s stock valued at $253,000 after acquiring an additional 830 shares during the last quarter. Values First Advisors Inc. boosted its stake in Stratasys by 9.6% in the first quarter. Values First Advisors Inc. now owns 12,382 shares of the technology company’s stock valued at $314,000 after acquiring an additional 1,083 shares during the last quarter. Bank of New York Mellon Corp boosted its stake in Stratasys by 8.8% in the first quarter. Bank of New York Mellon Corp now owns 15,979 shares of the technology company’s stock valued at $406,000 after acquiring an additional 1,298 shares during the last quarter. Envestnet Asset Management Inc. boosted its stake in Stratasys by 4.8% in the second quarter. Envestnet Asset Management Inc. now owns 31,292 shares of the technology company’s stock valued at $586,000 after acquiring an additional 1,431 shares during the last quarter. Finally, Banque Cantonale Vaudoise boosted its stake in Stratasys by 55.9% in the first quarter. Banque Cantonale Vaudoise now owns 4,185 shares of the technology company’s stock valued at $106,000 after acquiring an additional 1,500 shares during the last quarter.

Stratasys Company Profile

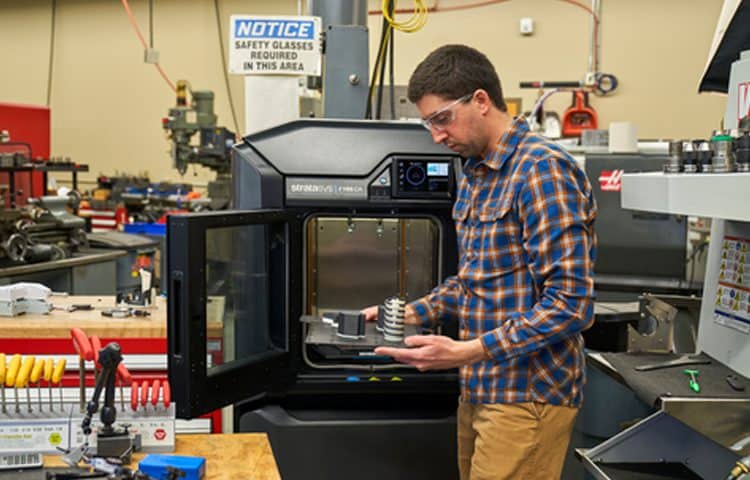

Stratasys Ltd. provides connected polymer-based 3D printing solutions. It offers 3D printing systems, such as polyjet printers, FDM printers, stereolithography printing systems, and programmable photo polymerization printers for rapid prototyping, such as design validation, visualization, and communication.